The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

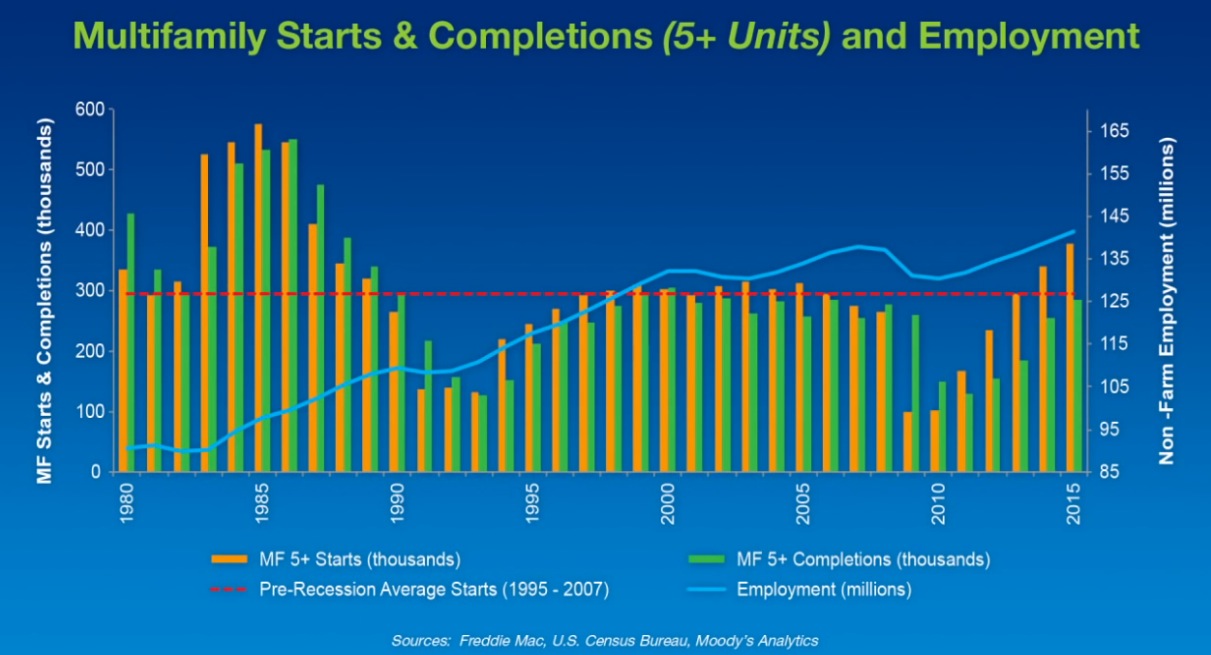

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

Apartments | Aug 22, 2023

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Adaptive Reuse | Aug 16, 2023

One of New York’s largest office-to-residential conversions kicks off soon

One of New York City’s largest office-to-residential conversions will soon be underway in lower Manhattan. 55 Broad Street, which served as the headquarters for Goldman Sachs from 1967 until 1983, will be reborn as a residence with 571 market rate apartments. The 30-story building will offer a wealth of amenities including a private club, wellness and fitness activities.

Sustainability | Aug 15, 2023

Carbon management platform offers free carbon emissions assessment for NYC buildings

nZero, developer of a real-time carbon accounting and management platform, is offering free carbon emissions assessments for buildings in New York City. The offer is intended to help building owners prepare for the city’s upcoming Local Law 97 reporting requirements and compliance. This law will soon assess monetary fines for buildings with emissions that are in non-compliance.

Sponsored | Multifamily Housing | Aug 15, 2023

Embracing Integrations: When Access Control Becomes Greater Than the Sum of Its Parts

Multifamily Housing | Aug 11, 2023

Hotels extend market reach with branded multifamily residences

The line separating hospitality and residential living keeps getting thinner. Multifamily developers are attracting renters and owners to their properties with hotel-like amenities and services. Post-COVID, more business travelers are building in extra days to their trips for leisure. Buildings that mix hotel rooms with for-sale or rental apartments are increasingly common.

MFPRO+ New Projects | Aug 10, 2023

Atlanta’s Old Fourth Ward gets a 21-story, 162-unit multifamily residential building

East of downtown Atlanta, a new residential building called Signal House will provide the city with 162 units ranging from one to three bedrooms. Located on the Atlanta BeltLine, a former railway corridor, the 21-story building is part of the latest phase of Ponce City Market, a onetime Sears building and now a mixed-use complex.

Senior Living Design | Aug 7, 2023

Putting 9 senior living market trends into perspective

Brad Perkins, FAIA, a veteran of more than four decades in the planning and design of senior living communities, looks at where the market is heading in the immediate future.

Multifamily Housing | Jul 31, 2023

6 multifamily housing projects win 2023 LEED Homes Awards

The 2023 LEED Homes Awards winners in the multifamily space represent green, LEED-certified buildings designed to provide clean indoor air and reduced energy consumption.

MFPRO+ New Projects | Jul 27, 2023

OMA, Beyer Blinder Belle design a pair of sculptural residential towers in Brooklyn

Eagle + West, composed of two sculptural residential towers with complementary shapes, have added 745 rental units to a post-industrial waterfront in Brooklyn, N.Y. Rising from a mixed-use podium on an expansive site, the towers include luxury penthouses on the top floors, numerous market rate rental units, and 30% of units designated for affordable housing.

Affordable Housing | Jul 27, 2023

Houston to soon have 50 new residential units for youth leaving foster care

Houston will soon have 50 new residential units for youth leaving the foster care system and entering adulthood. The Houston Alumni and Youth (HAY) Center has broken ground on its 59,000-sf campus, with completion expected by July 2024. The HAY Center is a nonprofit program of Harris County Resources for Children and Adults and for foster youth ages 14-25 transitioning to adulthood in the Houston community.