The market outlook for Multifamily “continues to be positive,” and is expected to remain strong “for several more years,” according to Freddie Mac’s latest projections.

The multifamily rental market is in its sixth year of robust growth. And there are several reasons for optimism about the sector’s near-term future, says Steve Guggenmos, an economist and Senior Director of Multifamily Investments and Research with Freddie Mac. For one thing, “growing demand continues to put pressure on multifamily occupancy rates and rent growth.” Occupancy rate in the second quarter of this year, at 4.2%, fell to a 14-year low. Meanwhile, rent growth expanded by 3.7%.

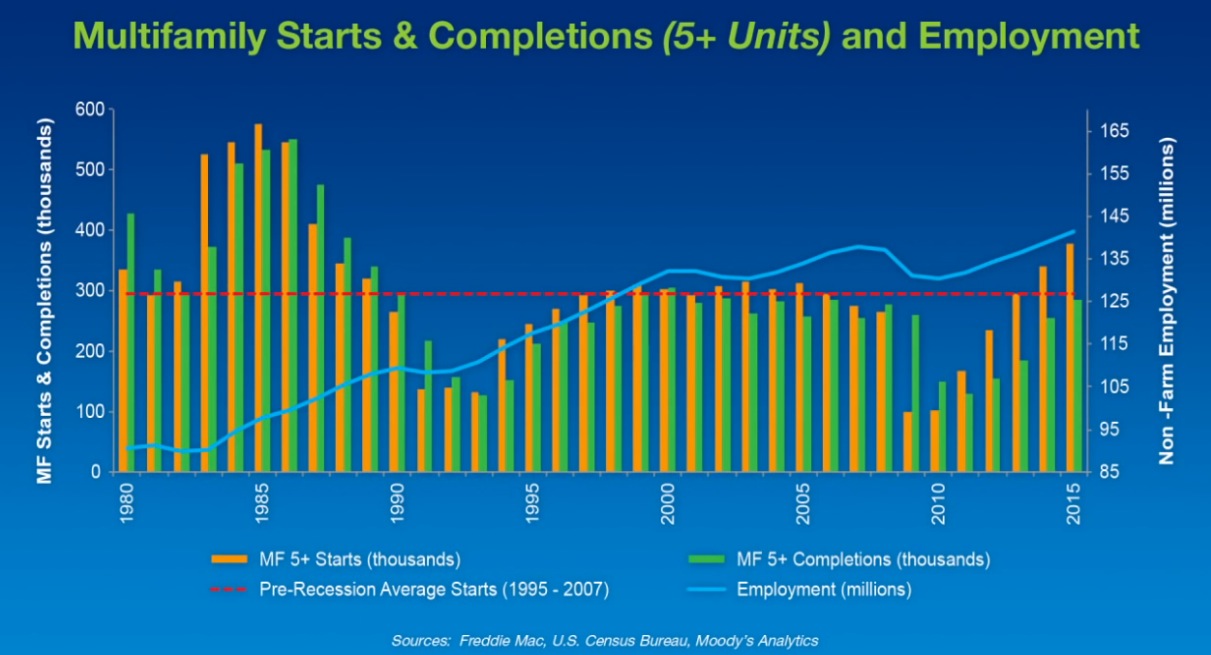

The supply side “is just starting to catch up” with demand, and in the second quarter hit the highest level of completions—an annualized 285,000—since the 1980s. Newsday reported last week that demand for multifamily housing on Long Island, N.Y., pushed the number of local construction jobs—80,500 in August—to its highest level in at least a quarter century.

While completions nationwide could remain elevated over the next few years, demand should be able to absorb most of that supply, keeping vacancy rates down.

The multifamily sector is definitely benefiting from an improving economy that has released pent-up demand, says Guggenmos. Labor markets are growing (the unemployment rate stood at 5.1% in September, according to the Bureau of Labor Statistics). And Freddie expects the country to add more than 2.5 million new jobs in 2015. However, full employment “remains elusive,” and the one negative has been wage growth, which only now is starting to pick up but still lags rent growth.

Since the end of 2014, household formations have continued to rise, and the majority of those formations chose rental housing. Freddie expects that pattern to continue, for three reasons: the economy will get even better, Millennials are moving into adulthood, and positive net migration.

Guggenmos also cites the “strong appetite” among investors for multifamily properties, “especially in major markets.” And he expects origination volumes to remain on the upswing into 2016 because of favorable loan rates, property cash flows, evaluations, and increasing loan maturities.

Freddie foresees rent growth moderating to 2.9% in 2015, and to keep retreating to 2.4% in 2016, as vacancies (which it forecasts to inch up nationally to 4.9% in 2016) and rents converge to “a historic norm.” Freddie sees only three metros—Washington D.C., Austin, and Norfolk, Va.—where vacancy rates might be “meaningfully” higher than the long-run average in 2016. Conversely, Freddie sees Houston’s multifamily market is among those that are at the greatest risk of economic impact from low oil prices.

Related Stories

| Oct 14, 2014

Richard Meier unveils design for his first tower in Taiwan

Taiwan will soon have its first Richard Meier building, a 535-foot apartment tower in Taichung City, the country’s third-largest city.

| Oct 12, 2014

AIA 2030 commitment: Five years on, are we any closer to net-zero?

This year marks the fifth anniversary of the American Institute of Architects’ effort to have architecture firms voluntarily pledge net-zero energy design for all their buildings by 2030.

| Oct 7, 2014

Analysis: Student loans will cost housing industry $83 billion in 2014

More than 410,000 single- and multifamily home sales will be lost in 2014 due to student loan debt, according to analysis by John Burns Real Estate Consulting.

| Oct 7, 2014

Economic gains are rallying rents in Raleigh, N.C.

The greater Raleigh, N.C., market appears to be getting back on its feet again, which is good news for rental property owners.

| Oct 3, 2014

Herzog & de Meuron unveil design for Manhattan hotel-condo tower [slideshow]

Herzog & de Meuron will partner with interior designer John Pawson to design a 28-story tower for Manhattan's Bowery district. The majority of the building will house a 370-room hotel, with 11 luxury residences on its top.

| Sep 25, 2014

Look to history warily when gauging where the construction industry may be headed

Precedents and patterns may not tell you all that much about future spending or demand.

| Sep 24, 2014

Architecture billings see continued strength, led by institutional sector

On the heels of recording its strongest pace of growth since 2007, there continues to be an increasing level of demand for design services signaled in the latest Architecture Billings Index.

| Sep 22, 2014

4 keys to effective post-occupancy evaluations

Perkins+Will's Janice Barnes covers the four steps that designers should take to create POEs that provide design direction and measure design effectiveness.

| Sep 22, 2014

Sound selections: 12 great choices for ceilings and acoustical walls

From metal mesh panels to concealed-suspension ceilings, here's our roundup of the latest acoustical ceiling and wall products.

| Sep 15, 2014

Ranked: Top international AEC firms [2014 Giants 300 Report]

Parsons Brinckerhoff, Gensler, and Jacobs top BD+C's rankings of U.S.-based design and construction firms with the most revenue from international projects, as reported in the 2014 Giants 300 Report.