The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

Chart: FMI

Chart: FMI

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

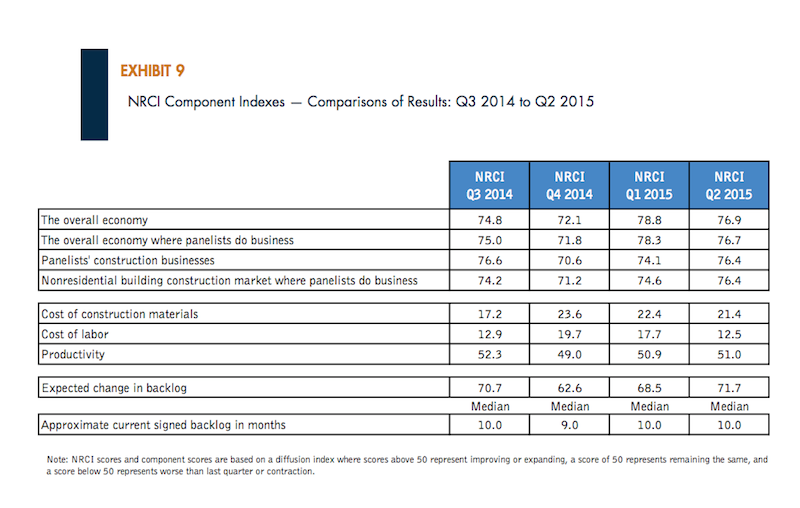

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

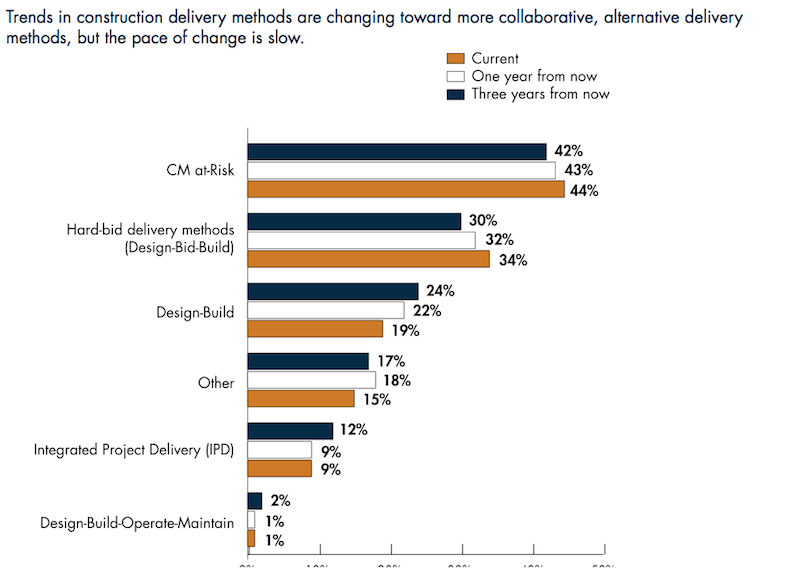

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

Architects | Jan 23, 2023

PSMJ report: The fed’s wrecking ball is hitting the private construction sector

Inflation may be starting to show some signs of cooling, but the Fed isn’t backing down anytime soon and the impact is becoming more noticeable in the architecture, engineering, and construction (A/E/C) space. The overall A/E/C outlook continues a downward trend and this is driven largely by the freefall happening in key private-sector markets.

Multifamily Housing | Jan 23, 2023

Long Beach, Calif., office tower converted to market rate multifamily housing

A project to convert an underperforming mid-century office tower in Long Beach, Calif., created badly needed market rate housing with a significantly lowered carbon footprint. The adaptive reuse project, composed of 203,177 sf including parking, created 106 apartment units out of a Class B office building that had been vacant for about 10 years.

Hotel Facilities | Jan 23, 2023

U.S. hotel construction pipeline up 14% to close out 2022

At the end of 2022’s fourth quarter, the U.S. construction pipeline was up 14% by projects and 12% by rooms year-over-year, according to Lodging Econometrics.

Standards | Jan 19, 2023

Fenestration Alliance updates liquid applied flashing standard

The Fenestration and Glazing Industry Alliance (FGIA) published an update to its Liquid Applied Flashing Standard. The document contains minimum performance requirements for liquid applied flashing used to provide water-resistive seals around exterior wall openings in buildings.

AEC Tech | Jan 19, 2023

Data-informed design, with Josh Fritz of LEO A DALY

Joshua Fritz, Leo A Daly's first Data Scientist, discusses how information analysis can improve building project outcomes.

Multifamily Housing | Jan 19, 2023

Chicago multifamily high-rise inspired by industrial infrastructure and L tracks

The recently unveiled design of The Row Fulton Market, a new Chicago high-rise residential building, draws inspiration from industrial infrastructure and L tracks in the historic Fulton Market District neighborhood. The 43-story, 300-unit rental property is in the city’s former meatpacking district, and its glass-and-steel façade reflects the arched support beams of the L tracks.

Products and Materials | Jan 18, 2023

Is inflation easing? Construction input prices drop 2.7% in December 2022

Softwood lumber and steel mill products saw the biggest decline among building construction materials, according to the latest U.S. Bureau of Labor Statistics’ Producer Price Index.

ProConnect Events | Jan 17, 2023

3 ProConnect Single Family events for Home Builders and Product Manufacturers set for 2023

SGC Horizon, parent company of ProBuilder, will present 3 ProConnect Single Family Events this year. At ProConnect Single Family, Home Builders meet in confidential 20-minute sessions with Building Product Manufacturers to discuss upcoming projects, learn about new products, and discover practical solutions to technical problems.

University Buildings | Jan 17, 2023

Texas Christian University breaks ground on medical school for Dallas-Fort Worth region

Texas Christian University (TCU) has broken ground on the Anne Burnett Marion School of Medicine, which aims to help meet the expanding medical needs of the growing Dallas-Fort Worth region.

Green | Jan 17, 2023

Top 10 U.S. states for green building in 2022

The U.S. Green Building Council (USGBC) released its annual ranking of U.S. states leading the way on green building, with Massachusetts topping the list. The USGBC ranking is based on LEED-certified gross square footage per capita over the past year.