The overall economy, as well as the economy in which they do business, might be down, but contractor panelists who provided these insights still see nonresidential construction on the upswing, according to FMI’s Second Quarter Nonresidential Construction Index (NRCI) Report.

Raleigh, N.C.-based FMI provides management consulting, investment banking, and people development services. Its quarterly index is based on voluntary responses from panelists to a 10-minute survey. The respondents represent a fairly wide cross-section of trades, company sizes, and markets. About 15% of the respondents are national contractors, 56% are Commercial General Building Contractors, and 39% operate businesses that generate between $51 million and $200 million in annual revenue. FMI declined to provide the number of panelists surveyed.

Chart: FMI

Chart: FMI

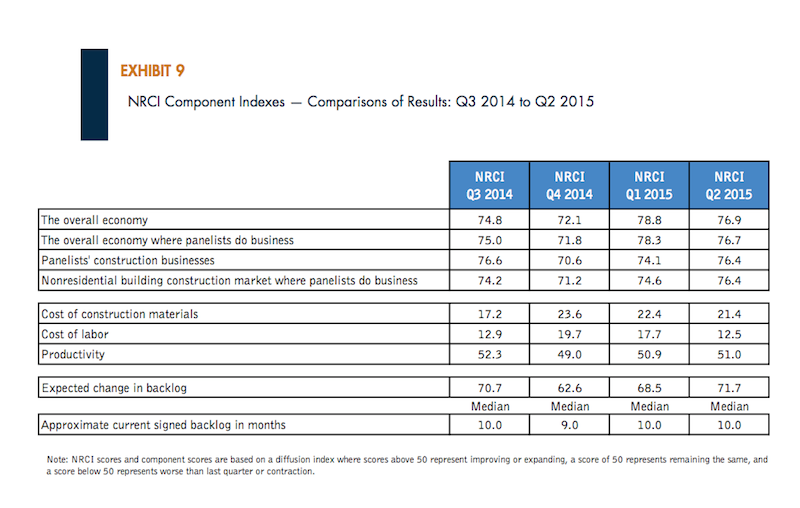

The NRCI for the second quarter was 64.9, virtually unchanged from the first quarter but improved from the 62.8 Index in the second quarter of 2014. FMI states that scores above 50 indicate expansion.

The panelists’ business outlook for specific nonresidential sectors is more ambivalent, however. Indices for healthcare and office construction are up, compared to a year ago, but down (albeit still on the growth side) for education, lodging, and manufacturing.

These scores might reflect the panelists’ perceptions of a still-volatile overall economy, whose second-quarter Index of 76.9 is down from the 78.8 Index in the first quarter. The panelists report that their own markets’ economies are off, too.

On the other hand, the panelists report improving productivity and steady backlogs. Half of the panelists said that their second-quarter backlogs grew faster than the previous quarter.

The indices for costs of materials and labor are down from the previous quarterly and yearly measurements, meaning those costs are rising. The NRCI Index for Construction Materials stood at 21.4, and 58.1% of the panelists said their materials costs increased from the first quarter. The Labor Cost Index was at 12.5, with 75% of the panelists reporting that their labor costs were higher in the second quarter than the first.

Chart: FMI

Chart: FMI

The survey also found that:

• Green construction made up only 28.6 percent of the panelists’ second-quarter backlogs, on average. FMI concludes from this finding that contractors no longer see green as anything special because it has become engrained into the mainstream of their businesses.

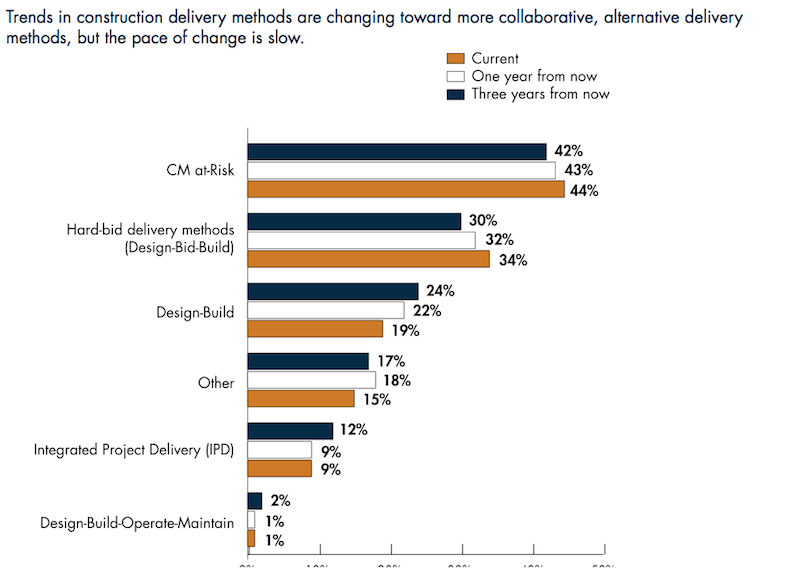

• The expediency of certain delivery methods during the recession is slowly yielding to more collaborative approaches among Building Teams and owners. “CM at-Risk is now allowed by most states, but those building CM at-Risk projects won’t quickly move to IPD [integrated project delivery].” FMI writes. “Design-build and IPD are expected to be growth areas for delivery methods; but IPD in particular, even though it offers many benefits to all parties, is not for everyone at this time. IPD, and even what has been called IPDish, requires more sophisticated owners, designers and contractors in order to realize the full benefits of this delivery approach.”

• Based on the panelists’ responses, FMI notes that other trends in construction—such as prefabrication, modularization, use of robotics, and 3D printing—are also likely to take a longer time to become mainstream like green construction has. “But the ongoing shortages of skilled labor will certainly hasten their coming.”

Related Stories

| Oct 11, 2011

Onex completes investment in JELD-WEN

With the completion of the JELD-WEN investment, Onex Partners III is approximately 40% invested.

| Oct 7, 2011

GREENBUILD 2011: Demand response partnership program announced at Greenbuild 2011

Program will use USGBC’s newly revised LEED Demand Response credit as an implementation guideline and leverage its relationships with the building community to foster adoption and participation in existing utility and solution provider demand response offerings.

| Oct 7, 2011

GREENBUILD 2011: Otis Elevator announces new contracts for sustainable building projects

Wins reinforce Otis’ position as leader in energy-efficient products.

| Oct 7, 2011

GREENBUILD 2011: UL Environment releases industry-wide sustainability requirements for doors

ASSA ABLOY Trio-E door is the first to be certified to these sustainability requirements.

| Oct 7, 2011

GREENBUILD 2011: Otis Elevator introduces energy-efficient escalator

The energy-efficient NCE escalator from Otis offers customers substantial “green” benefits.

| Oct 7, 2011

GREENBUILD 2011: Schools program receives grant to track student conservation results

To track results, schools will use the newly developed Sustainability Dashboard, a unique web-based service that makes tracking sustainability initiatives affordable and easy.

| Oct 7, 2011

GREENBUILD 2011: Transparent concrete makes its North American debut at Greenbuild

The panels allow interior lights to filter through, from inside.

| Oct 6, 2011

GREENBUILD 2011: Growing green building market supports 661,000 green jobs in the U.S.

Green jobs are already an important part of the construction labor workforce, and signs are that they will become industry standard.

| Oct 6, 2011

GREENBUILD 2011: NEXT Living EcoSuite showcased

Tridel teams up with Cisco and Control4 to unveil the future of green condo living in Canada.

| Oct 6, 2011

GREENBUILD 2011: Kingspan Insulated Panels spotlights first-of-its-kind Environmental Product Declaration

Updates to Path to NetZero.