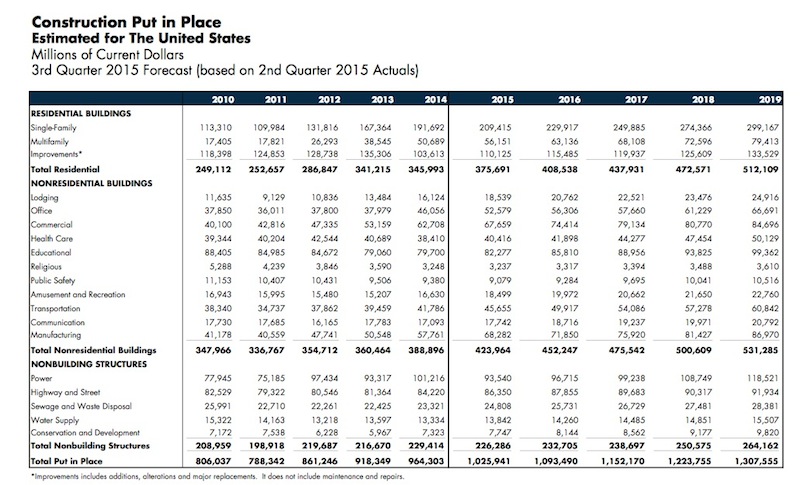

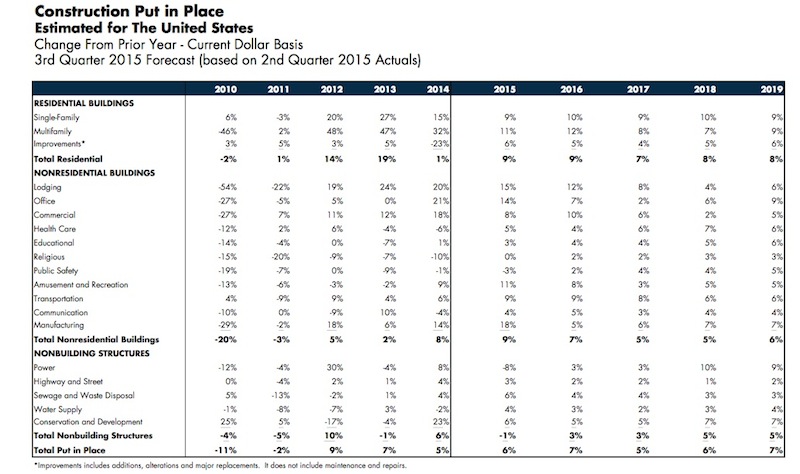

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Nov 16, 2010

Brazil Olympics spurring green construction

Brazil's green building industry will expand in the coming years, spurred by construction of low-impact venues being built for the 2016 Olympics. The International Olympic Committee requires arenas built for the 2016 games in Rio de Janeiro meet international standards for low-carbon emissions and energy efficiency. This has boosted local interest in developing real estate with lower environmental impact than existing buildings. The timing couldn’t be better: the Brazilian government is just beginning its long-term infrastructure expansion program.

| Nov 16, 2010

Green building market grows 50% in two years; Green Outlook 2011 report

The U.S. green building market is up 50% from 2008 to 2010—from $42 billion to $55 billion-$71 billion, according to McGraw-Hill Construction's Green Outlook 2011: Green Trends Driving Growth report. Today, a third of all new nonresidential construction is green; in five years, nonresidential green building activity is expected to triple, representing $120 billion to $145 billion in new construction.

| Nov 16, 2010

Calculating office building performance? Yep, there’s an app for that

123 Zero build is a free tool for calculating the performance of a market-ready carbon-neutral office building design. The app estimates the discounted payback for constructing a zero emissions office building in any U.S. location, including the investment needed for photovoltaics to offset annual carbon emissions, payback calculations, estimated first costs for a highly energy efficient building, photovoltaic costs, discount rates, and user-specified fuel escalation rates.

| Nov 16, 2010

CityCenter’s new Harmon Hotel targeted for demolition

MGM Resorts officials want to demolish the unopened 27-story Harmon Hotel—one of the main components of its brand new $8.5 billion CityCenter development in Las Vegas. In 2008, inspectors found structural work on the Harmon didn’t match building plans submitted to the county, with construction issues focused on improperly placed steel reinforcing bar. In January 2009, MGM scrapped the building’s 200 condo units on the upper floors and stopped the tower at 27 stories, focusing on the Harmon having just 400 hotel rooms. With the Lord Norman Foster-designed building mired in litigation, construction has since been halted on the interior, and the blue-glass tower is essentially a 27-story empty shell.

| Nov 16, 2010

Where can your firm beat the recession? Try any of these 10 places

Wondering where condos and rental apartments will be needed? Where companies are looking to rent office space? Where people will need hotel rooms, retail stores, and restaurants? Newsweek compiled a list of the 10 American cities best situated for economic recovery. The cities fall into three basic groups: Texas, the New Silicon Valleys, and the Heartland Honeys. Welcome to the recovery.

| Nov 16, 2010

Landscape architecture challenges Andrés Duany’s Congress for New Urbanism

Andrés Duany, founder of the Congress for the New Urbanism, adopted the ideas, vision, and values of the early 20th Century landscape architects/planners John Nolen and Frederick Law Olmsted, Jr., to launch a movement that led to more than 300 new towns, regional plans, and community revitalization project commissions for his firm. However, now that there’s a societal buyer’s remorse about New Urbanism, Duany is coming up against a movement that sees landscape architecture—not architecture—as the design medium more capable of organizing the city and enhancing the urban experience.

| Nov 16, 2010

NFRC approves technical procedures for attachment product ratings

The NFRC Board of Directors has approved technical procedures for the development of U-factor, solar heat gain coefficient (SHGC), and visible transmittance (VT) ratings for co-planar interior and exterior attachment products. The new procedures, approved by unanimous voice vote last week at NFRC’s Fall Membership Meeting in San Francisco, will add co-planar attachments such as blinds and shades to the group’s existing portfolio of windows, doors, skylights, curtain walls, and window film.

| Nov 15, 2010

Gilbane to acquire W.G. Mills, Inc.

Rhode Island-based Gilbane Building Company announced plans to acquire W.G. Mills, Inc., a construction management firm with operations based in Florida. The acquisition will dramatically strengthen Gilbane’s position in Florida’s growing market and complement its already established presence in the southeast.