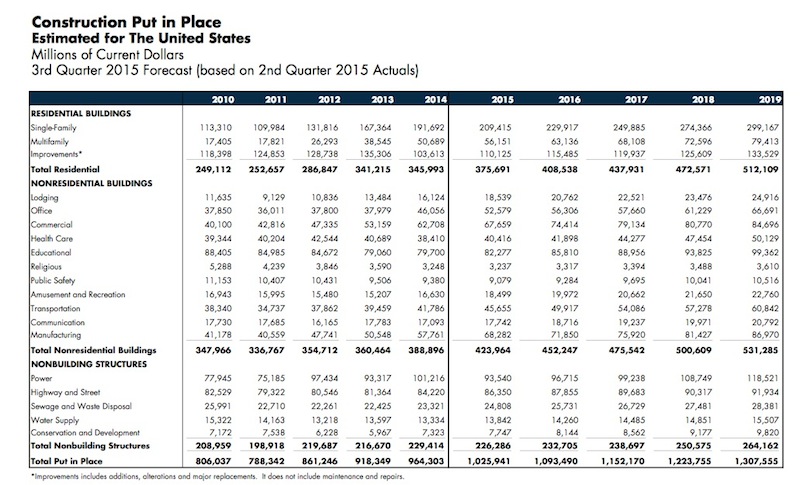

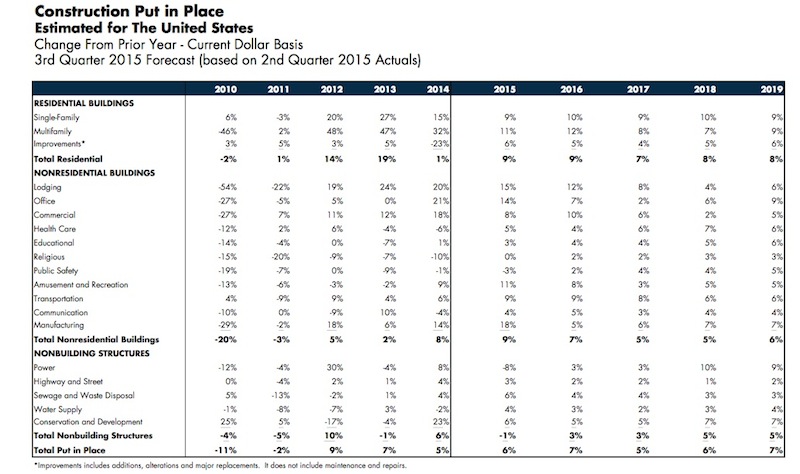

Manufacturing and lodging continue to lead the charge in the construction sector, which is expected to grow by 6% in 2015, according to the latest forecasts by FMI, the investment consulting and banking firm. That’s a percentage point higher than the growth FMI projected three months ago.

FMI also expects construction activity to increase by 7% in 2016, and reach $1.09 trillion, the highest level since 2008. Nonresidential construction in place should hit $423.96 billion this year, representing a 9% gain, and keep growing by 7% to $452.25 billion in 2016. For the most part, the biggest sectors of nonresidential construction are expected to thrive through next year.

Here are some of the report’s highlights:

• Manufacturing has been the “rock star” of nonresidential building, says FMI. Construction activity in this sector should be up 18% to $68.2 billion this year. “Manufacturing capacity utilization rates [were] at 77.7% of capacity in July 2015, which is near the historical average.” However, FMI expects this sector to slow next year, when construction growth is projected to increase by just 5% to $71.9 billion. “One concern, like much of the construction industry, is the lack of trained personnel needed to keep up with growing backlogs.”

• Lodging construction continues to be strong. FMI forecasts 15% growth this year to $18.5 billion, and 12% in 2016 to $20.8 billion. To bolster its predictions, FMI quotes a May 2015 report from Lodging Econometrics that estimates 3,885 projects and 488,230 rooms currently under construction. “The greatest amount of growth will continue to be upscale properties and event locations,” FMI states;

• Office construction has slowed a bit from its gains in 2014. But FMI still expects office construction to be up by 14% to $52.6 billion this year, and by 7% to $56.3 billion in 2016. The National Association of Realtors predicts that office vacancies would drop below 15% by year’s end. And JLI noted recently that more than 40% of all office leases 20,000 sf or larger are exhibiting growth;

• Healthcare construction is on a path to return to “historical growth rates” over the next four years. That would mean a 5% increase to $40.4 billion this year, and a 10% gain to $41.9 billion next year. FMI points out, though, that “the changing nature of health care and insurance” continues to make investors nervous. Renovation and expansion will account for the lion’s share of construction projects going forward;

• The Educational sector “is growing again,” albeit modestly, says FMI. Construction in place should increase by 3% to $82.3 billion this year, and then bump up by 10% to $85.8 billion in 2016. FMI notes that K-12 construction is getting less funding from states, even as enrollment is expected to expand by 2.5 million over the next four years.

• Commercial construction—which is essentially the retail and food segments—should be up 8% to $67.7 billion in 2015, and grow by another 10% to $74.4 billion, next year. FMI quotes Commerce Department estimates that food services and drinking places were up in July by 9% over the same month in 2014, and non-store retail rose by 5.2%.

• Amusements and recreation-related construction was up 9% last year, and is expected to increase to 11% to $18.5 billion in 2015, and by 8% next year, when it should hit nearly $20 billion. FMI anticipates ongoing municipal demand for sports venues, which are seen as “job creators.”

• The slowdown of multifamily construction may have to wait another year. FMI expects construction of buildings with five or more residential units to increase by 11% in 2015, and by 12% next year to $63.1 billion.

Related Stories

| Sep 28, 2011

Opus Group awarded contract for new Church & Dwight Co. headquarters

The campus will include two 125,000-sf Class A, energy-efficient office buildings that will be designed and constructed with sustainable practices and elements.

| Sep 27, 2011

FDI hires Allen to round out project team

Allen's experience includes managing several multi-million dollar facilities projects for Stanford University.

| Sep 19, 2011

Portland team hired as LEED and commissioning consultants for $5.5B downtown sustainable project in Qatar

The $5.5 billion sustainable downtown regeneration project underway by Msheireb Properties will transform a 76 acres site at the centre of Doha, Qatar’s capital city, recreating a way of living that is rooted in Qatari culture, attracting residents back to the city center and reversing the trend for decentralization.

| Sep 14, 2011

USGBC L.A. Chapter's Green Gala features Jason McLennan as keynote speaker

The Los Angeles Chapter of the nonprofit USGBC will launch its Sustainable Innovation Awards this year during the chapter's 7th Annual Green Gala on Thursday, November 3.

| Sep 14, 2011

Lend Lease’s role in 9/11 Memorial & Museum

Lend Lease is honored to be the general contractor for the National September 11 Memorial & Museum project at the World Trade Center site in New York City.

| Sep 14, 2011

Thornton Tomasetti’s Poon named to the Council on Tall Buildings and Urban Habitat’s Board of Trustees

During his 30-plus years of experience, Poon has been responsible for the design and construction of super high-rise structures, mixed-used buildings, hotels, airports, arenas and residential buildings worldwide.

| Sep 12, 2011

LACCD’s $6 billion BIM connection

The Los Angeles Community College District requires every design-build team in its massive modernization program to use BIM, but what they do with their 3D data after construction is completed may be the most important change to business as usual.

| Sep 12, 2011

PVs play new roles as a teaching tool

Solar installations are helping K-12 schools around the country save money and teach students the intricacies of renewable energy sources.

| Sep 12, 2011

Living Buildings: Are AEC Firms up to the Challenge?

Modular Architecture > You’ve done a LEED Gold or two, maybe even a LEED Platinum. But are you and your firm ready to take on the Living Building Challenge? Think twice before you say yes.

| Sep 9, 2011

Hardinger joins Ryan Companies as vice president, mission critical

He will lead the Ryan team responsible for building and developing data centers and other mission-critical projects, and will oversee business development, client relationships, executive level communications and overall marketing strategies for the division.