The enthusiasm that surged through the U.S. engineering industry following the election of Donald Trump has moderated, according the latest survey of engineering firm leaders by the American Council of Engineering Companies (ACEC).

The first quarter 2017 (Q1/17) of ACEC’s Engineering Business Index (EBI) dipped slightly (0.5 points) to 66.0. The decline is minimal and the score remains decidedly positive, but is in contrast to the 4th quarter 2016 EBI in which, fueled by Trump’s promises of lower taxes, infrastructure investment, and regulatory reform, the score jumped 5.1 points—the largest quarterly increase in the survey’s three-year history.

Now however, with the Administration slow to implement any of these polices, engineering firm leader confidence seems to have plateaued.

The EBI is a leading indicator of America’s economic health based on the business performance and projections of U.S. engineering firms that develop the nation’s transportation, water, energy and industrial infrastructure. The EBI is a diffusion index. The index mean is 50, with scores above 50 indicating business expansion, and scores below 50 indicating contraction. The Q1/17 survey was conducted March 23 to April 24 of 378 U.S. engineering firm leaders.

When comparing today’s market conditions to six months ago, the EBI score climbed 3.2 point to 66.8; while current backlog compared to six months ago was up a strong 5.1 points to 67.1. Additionally, short-term (six-month) expectations for profitability increased 3.5 points to 72.5 points.

Other EBI results however, clearly reflect engineering leader marketplace ambiguity. Market expectations for one year from today fell 2.6 points to 69.5; profitability expectations for the same period were flat (72.9); but looking out three years, expectations fell 2.4 points, and anticipated backlog fell 1.1 points to 70.4.

Concerns about long-term marketplace health resulted in significant declines in nine of the 12 primary public and private sector engineering markets.

For more information about the Q1/17 EBI, go to www.acec.org.

Related Stories

Office Buildings | Oct 19, 2023

Proportion of workforce based at home drops to lowest level since pandemic began

The proportion of the U.S. workforce working remotely has dropped considerably since the start of the Covid 19 pandemic, but office vacancy rates continue to rise. Fewer than 26% of households have someone who worked remotely at least one day a week, down sharply from 39% in early 2021, according to the latest Census Bureau Household Pulse Surveys.

Giants 400 | Oct 17, 2023

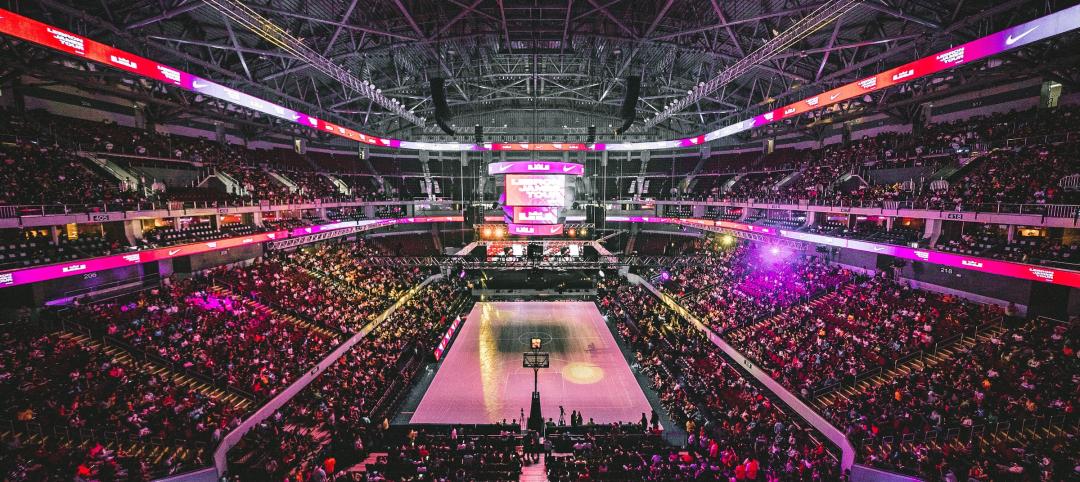

Top 70 Sports Facility Engineering Firms for 2023

Alfa Tech Consulting Engineers, ME Engineers, AECOM, and Henderson Engineers top BD+C's ranking of the nation's largest sports facility engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Engineers | Oct 12, 2023

Building science: Considering steel sheet piles for semi-permanent or permanent subsurface water control for below-grade building spaces

For projects that do not include moisture-sensitive below-grade spaces, project teams sometimes rely on sheet piles alone for reduction of subsurface water. Experts from Simpson Gumpertz & Heger explore this sheet pile “water management wall” approach.

Giants 400 | Oct 11, 2023

Top 90 Industrial Sector Engineering Firms for 2023

Jacobs, IPS, CRB Group, and Burns & McDonnell head the ranking of the nation's largest industrial facility sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report.

Products and Materials | Oct 10, 2023

‘Works with WELL’ product licensing program launched by International WELL Building Institute

The International WELL Building Institute (IWBI) recently launched the Works with WELL product licensing program. Works with Well certification allows manufacturers to demonstrate that their products align with WELL strategies.

Mass Timber | Oct 10, 2023

New York City launches Mass Timber Studio to spur more wood construction

New York City Economic Development Corporation (NYCEDC) recently launched New York City Mass Timber Studio, “a technical assistance program to support active mass timber development projects in the early phases of project planning and design.”

Government Buildings | Oct 10, 2023

GSA names Elliot Doomes Public Buildings Service Commissioner

The U.S. General Services Administration (GSA) announced that the agency’s Public Buildings Service Commissioner Nina Albert will depart on Oct. 13 and that Elliot Doomes will succeed her.

Higher Education | Oct 10, 2023

Tracking the carbon footprint of higher education campuses in the era of online learning

With more effective use of their facilities, streamlining of administration, and thoughtful adoption of high-quality online learning, colleges and universities can raise enrollment by at least 30%, reducing their carbon footprint per student by 11% and lowering their cost per student by 15% with the same level of instruction and better student support.

MFPRO+ News | Oct 6, 2023

Announcing MultifamilyPro+

BD+C has served the multifamily design and construction sector for more than 60 years, and now we're introducing a central hub within BDCnetwork.com for all things multifamily.

Giants 400 | Oct 5, 2023

Top 90 Healthcare Engineering Firms for 2023

Jacobs, WSP, IMEG, BR+A, and Affiliated Engineers head BD+C's ranking of the nation's largest healthcare sector engineering and engineering/architecture (EA) firms for 2023, as reported in Building Design+Construction's 2023 Giants 400 Report. Note: This ranking includes revenue related to all healthcare buildings work, including hospitals, medical office buildings, and outpatient facilities.