The recession is weighing heavily on architects, engineers, and contractors, if the results of an exclusive BD+C survey of 504 AEC professionals are any measure of the commercial construction industry’s outlook on business prospects for 2012.

More than three-fourths of respondents (78.4%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in the next year, followed by competition from other firms (40.1%) and lack of capital funding for their projects (34.5%).

Nearly three in four (74.8%) described the current business situation for their firms as “very” to “intensely” competitive—a strong verification of the dog-eat-dog climate that many in the AEC industry have reported anecdotally in the last couple of years.

On the brighter side, nearly half of respondents (49.7%) said their firms were in at least “good” financial health, and four-fifths (80.2%) said their companies would at least hold steady in revenue in 2012.

Layoffs over the last two years were reported by 44.8% of respondents, with another 37.3% saying that hours had been reduced, while more than half (51.0%) said their firms had eliminated or cut back on bonuses.

Looking toward 2012, nearly half of respondents (46.8%) said they thought their companies would be beefing up PR and marketing initiatives to revive their businesses.

More than a third (35.7%) said their firms would be pumping dollars into technology. However, more than one in five (20.6%) said their firms were not using building information modeling; of those who said BIM was used in their shops, a clear majority (58.4%) said BIM figured in less than 25% of projects, while only slightly more than one-fourth (26.8%) said BIM was being used most of the time (i.e., 50% or more of projects, based on dollar value).

Healthcare remains strongest sector

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- Healthcare was the most highly rated sector, with a strong majority of respondents (54.6%) giving it a “good” to “excellent” rating.

- Data centers and mission-critical facilities were also given good marks, with 45.2% of respondents in the good/excellent category.

- Government and military work was rated good to excellent by more than two-fifths of respondents (41.1%).

- Senior and assisted-living facilities drew a fairly strong 37.8% of respondents in the good to excellent category.

- University/college facilities were rated good to excellent by nearly a third of respondents (32.3%).

Other sectors had much less optimistic support from respondents. Only one in nine (11.1%) said they thought retail commercial construction would have a good to excellent year. Less than 1% thought cultural/performing arts centers had a chance to have even a good year, and only 1.5% were sanguine about industrial and warehouse facilities.

The prospects for office buildings were bleak as well, with only 9.4% saying that market would be good to excellent—and nearly two-thirds (67.3%) predicting office buildings would be “weak” or “very weak.” However, office interiors and fitouts fared better, with 28.0% saying that sector would be good to excellent.

“Good to excellent” prospects for other sectors were mixed: 23.2% for K-12 schools and 24.0% for multifamily projects (condos and apartments, but most likely the latter).

In sum, hardly the cheeriest of prognostications for the 2012 commercial design and construction industry, according to respondents to our exclusive survey.

Note: Of the 494 who gave their professional description, 41.3% are architects; 19.0%, engineers; 18.8%, contractors; 10.7% building owners, developers, or facility/property managers; and 10.2%, consultants or “other.”

For more information visit www.BDCnetwork.com/forecast/2012. BD+C

Related Stories

| Nov 3, 2010

Virginia biofuel research center moving along

The Sustainable Energy Technology Center has broken ground in October on the Danville, Va., campus of the Institute for Advanced Learning and Research. The 25,000-sf facility will be used to develop enhanced bio-based fuels, and will house research laboratories, support labs, graduate student research space, and faculty offices. Rainwater harvesting, a vegetated roof, low-VOC and recycled materials, photovoltaic panels, high-efficiency plumbing fixtures and water-saving systems, and LED light fixtures will be deployed. Dewberry served as lead architect, with Lord Aeck & Sargent serving as laboratory designer and sustainability consultant. Perigon Engineering consulted on high-bay process labs. New Atlantic Contracting is building the facility.

| Nov 3, 2010

Dining center cooks up LEED Platinum rating

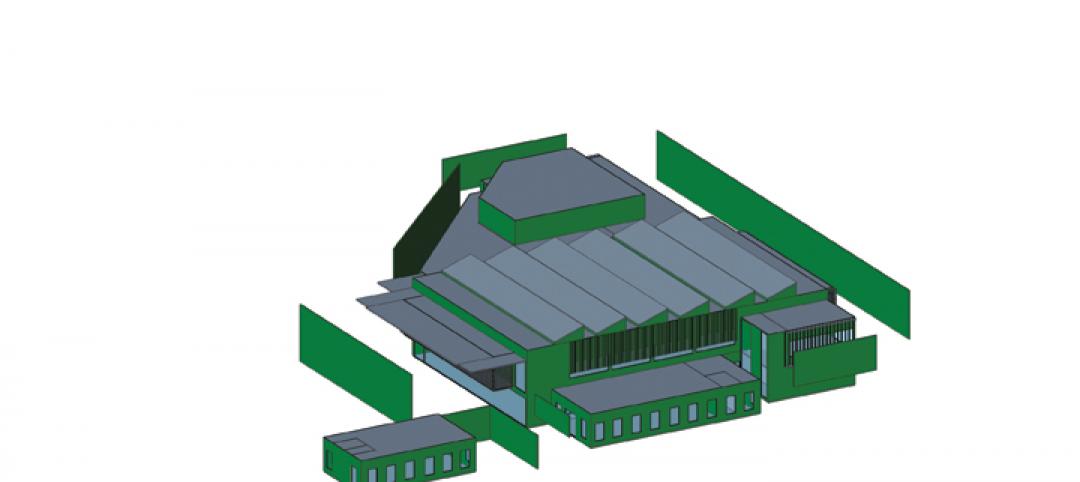

Students at Bowling Green State University in Ohio will be eating in a new LEED Platinum multiuse dining center next fall. The 30,000-sf McDonald Dining Center will have a 700-seat main dining room, a quick-service restaurant, retail space, and multiple areas for students to gather inside and out, including a fire pit and several patios—one of them on the rooftop.

| Nov 2, 2010

11 Tips for Breathing New Life into Old Office Spaces

A slowdown in new construction has firms focusing on office reconstruction and interior renovations. Three experts from Hixson Architecture Engineering Interiors offer 11 tips for office renovation success. Tip #1: Check the landscaping.

| Nov 2, 2010

Cypress Siding Helps Nature Center Look its Part

The Trinity River Audubon Center, which sits within a 6,000-acre forest just outside Dallas, utilizes sustainable materials that help the $12.5 million nature center fit its wooded setting and put it on a path to earning LEED Gold.

| Nov 2, 2010

A Look Back at the Navy’s First LEED Gold

Building Design+Construction takes a retrospective tour of a pace-setting LEED project.

| Nov 2, 2010

Wind Power, Windy City-style

Building-integrated wind turbines lend a futuristic look to a parking structure in Chicago’s trendy River North neighborhood. Only time will tell how much power the wind devices will generate.

| Nov 2, 2010

Energy Analysis No Longer a Luxury

Back in the halcyon days of 2006, energy analysis of building design and performance was a luxury. Sure, many forward-thinking AEC firms ran their designs through services such as Autodesk’s Green Building Studio and IES’s Virtual Environment, and some facility managers used Honeywell’s Energy Manager and other monitoring software. Today, however, knowing exactly how much energy your building will produce and use is survival of the fittest as energy costs and green design requirements demand precision.

| Nov 2, 2010

Yudelson: ‘If It Doesn’t Perform, It Can’t Be Green’

Jerry Yudelson, prolific author and veteran green building expert, challenges Building Teams to think big when it comes to controlling energy use and reducing carbon emissions in buildings.

| Nov 2, 2010

Historic changes to commercial building energy codes drive energy efficiency, emissions reductions

Revisions to the commercial section of the 2012 International Energy Conservation Code (IECC) represent the largest single-step efficiency increase in the history of the national, model energy. The changes mean that new and renovated buildings constructed in jurisdictions that follow the 2012 IECC will use 30% less energy than those built to current standards.

| Nov 1, 2010

Sustainable, mixed-income housing to revitalize community

The $41 million Arlington Grove mixed-use development in St. Louis is viewed as a major step in revitalizing the community. Developed by McCormack Baron Salazar with KAI Design & Build (architect, MEP, GC), the project will add 112 new and renovated mixed-income rental units (market rate, low-income, and public housing) totaling 162,000 sf, plus 5,000 sf of commercial/retail space.