The recession is weighing heavily on architects, engineers, and contractors, if the results of an exclusive BD+C survey of 504 AEC professionals are any measure of the commercial construction industry’s outlook on business prospects for 2012.

More than three-fourths of respondents (78.4%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in the next year, followed by competition from other firms (40.1%) and lack of capital funding for their projects (34.5%).

Nearly three in four (74.8%) described the current business situation for their firms as “very” to “intensely” competitive—a strong verification of the dog-eat-dog climate that many in the AEC industry have reported anecdotally in the last couple of years.

On the brighter side, nearly half of respondents (49.7%) said their firms were in at least “good” financial health, and four-fifths (80.2%) said their companies would at least hold steady in revenue in 2012.

Layoffs over the last two years were reported by 44.8% of respondents, with another 37.3% saying that hours had been reduced, while more than half (51.0%) said their firms had eliminated or cut back on bonuses.

Looking toward 2012, nearly half of respondents (46.8%) said they thought their companies would be beefing up PR and marketing initiatives to revive their businesses.

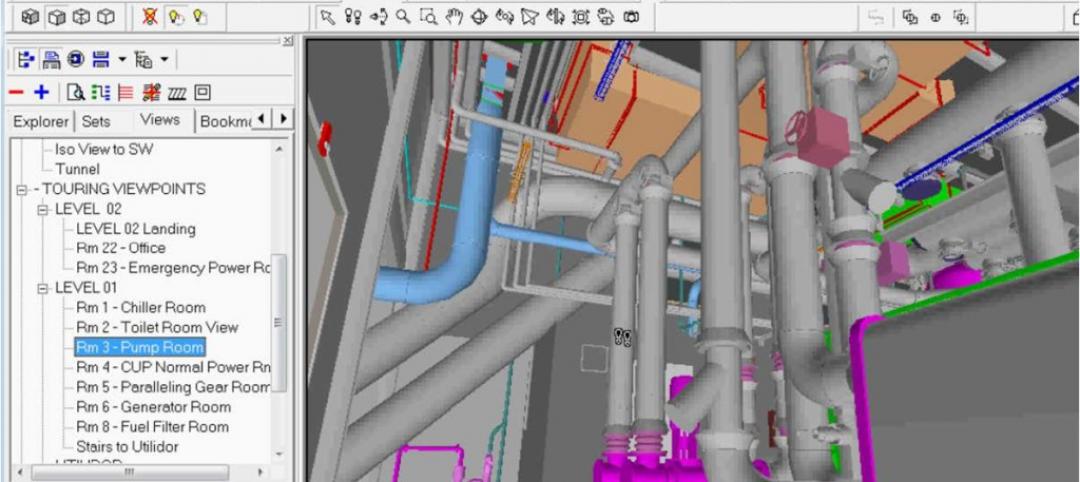

More than a third (35.7%) said their firms would be pumping dollars into technology. However, more than one in five (20.6%) said their firms were not using building information modeling; of those who said BIM was used in their shops, a clear majority (58.4%) said BIM figured in less than 25% of projects, while only slightly more than one-fourth (26.8%) said BIM was being used most of the time (i.e., 50% or more of projects, based on dollar value).

Healthcare remains strongest sector

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- Healthcare was the most highly rated sector, with a strong majority of respondents (54.6%) giving it a “good” to “excellent” rating.

- Data centers and mission-critical facilities were also given good marks, with 45.2% of respondents in the good/excellent category.

- Government and military work was rated good to excellent by more than two-fifths of respondents (41.1%).

- Senior and assisted-living facilities drew a fairly strong 37.8% of respondents in the good to excellent category.

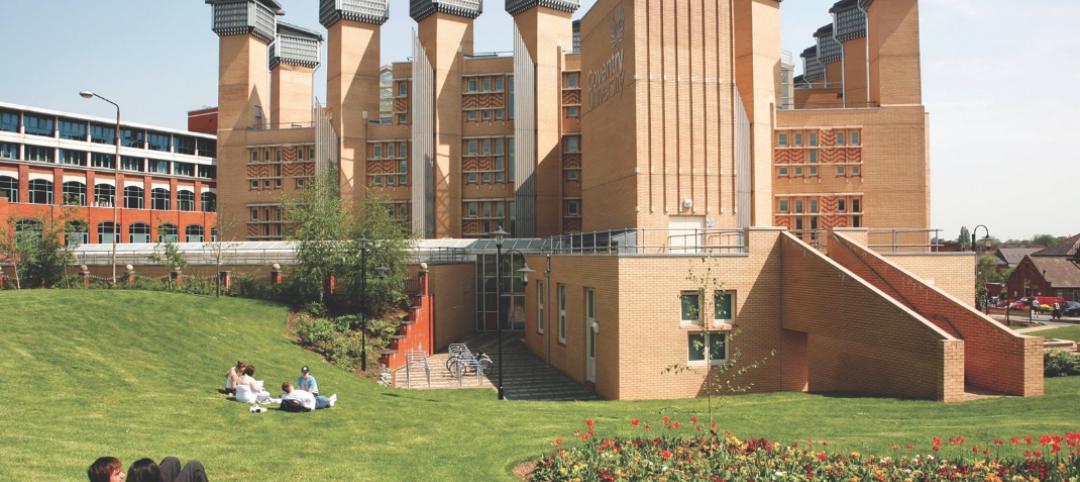

- University/college facilities were rated good to excellent by nearly a third of respondents (32.3%).

Other sectors had much less optimistic support from respondents. Only one in nine (11.1%) said they thought retail commercial construction would have a good to excellent year. Less than 1% thought cultural/performing arts centers had a chance to have even a good year, and only 1.5% were sanguine about industrial and warehouse facilities.

The prospects for office buildings were bleak as well, with only 9.4% saying that market would be good to excellent—and nearly two-thirds (67.3%) predicting office buildings would be “weak” or “very weak.” However, office interiors and fitouts fared better, with 28.0% saying that sector would be good to excellent.

“Good to excellent” prospects for other sectors were mixed: 23.2% for K-12 schools and 24.0% for multifamily projects (condos and apartments, but most likely the latter).

In sum, hardly the cheeriest of prognostications for the 2012 commercial design and construction industry, according to respondents to our exclusive survey.

Note: Of the 494 who gave their professional description, 41.3% are architects; 19.0%, engineers; 18.8%, contractors; 10.7% building owners, developers, or facility/property managers; and 10.2%, consultants or “other.”

For more information visit www.BDCnetwork.com/forecast/2012. BD+C

Related Stories

| Jan 13, 2014

6 legislative actions to ignite the construction economy

The American Institute of Architects announced its “punch list” for Congress that, if completed, will ignite the construction economy by spurring much needed improvements in energy efficiency, infrastructure, and resiliency, and create jobs for small business.

| Jan 12, 2014

CES showcases innovations: Can any of these help you do your job better?

The Consumer Electronics Show took place this past week in Las Vegas. Known for launching new products and technologies, many of the products showcased there set the bar for future innovators. The show also signals trends to watch in technology applicable to the design and building industry.

| Jan 12, 2014

The ‘fuzz factor’ in engineering: when continuous improvement is neither

The biggest threat to human life in a building isn’t the potential of natural disasters, but the threat of human error. I believe it’s a reality that increases in probability every time a code or standard change is proposed.

| Jan 12, 2014

5 ways virtual modeling can improve facilities management

Improved space management, streamlined maintenance, and economical retrofits are among the ways building owners and facility managers can benefit from building information modeling.

| Jan 11, 2014

Getting to net-zero energy with brick masonry construction [AIA course]

When targeting net-zero energy performance, AEC professionals are advised to tackle energy demand first. This AIA course covers brick masonry's role in reducing energy consumption in buildings.

| Jan 10, 2014

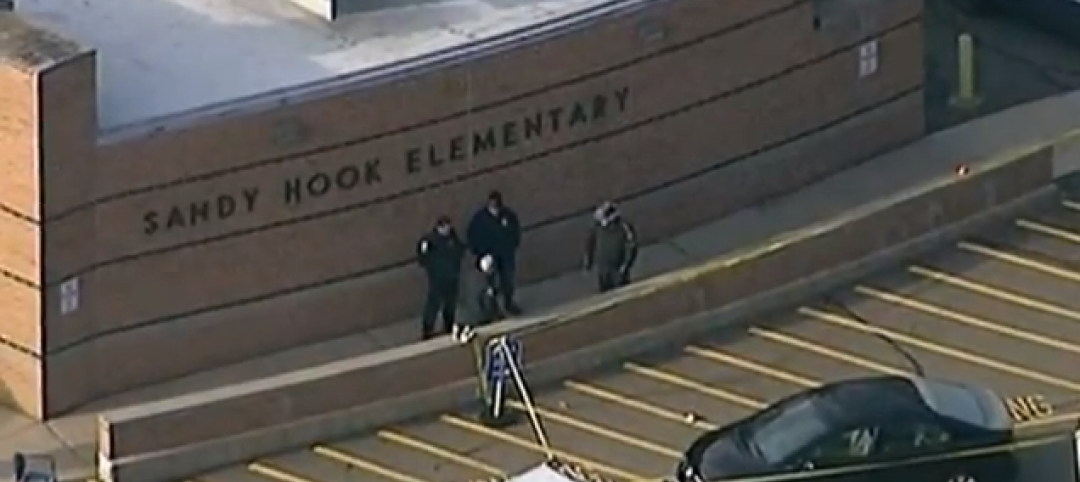

What the states should do to prevent more school shootings

To tell the truth, I didn’t want to write about the terrible events of December 14, 2012, when 20 children and six adults were gunned down at Sandy Hook Elementary School in Newtown, Conn. I figured other media would provide ample coverage, and anything we did would look cheap or inappropriate. But two things turned me around.

| Jan 10, 2014

Special Report: K-12 school security in the wake of Sandy Hook

BD+C's exclusive five-part report on K-12 school security offers proven design advice, technology recommendations, and thoughtful commentary on how Building Teams can help school districts prevent, or at least mitigate, a Sandy Hook on their turf.

| Jan 10, 2014

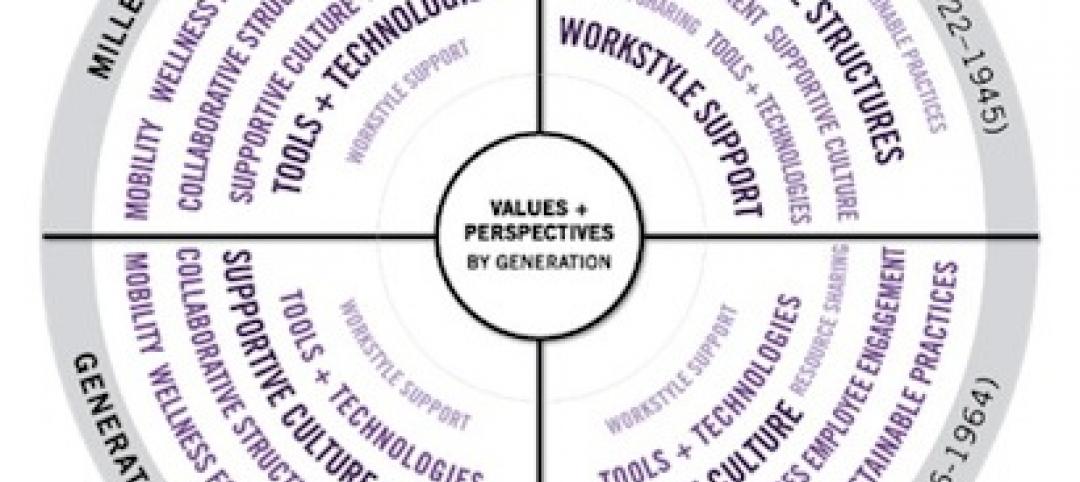

Resiliency, material health among top AEC focuses for 2014: Perkins+Will survey

Architectural giant Perkins+Will recently surveyed its staff of 1,500 design pros to forcast hot trends in the AEC field for 2014. The resulting Design + Insights Survey reflects a global perspective.

| Jan 9, 2014

How security in schools applies to other building types

Many of the principles and concepts described in our Special Report on K-12 security also apply to other building types and markets.

| Jan 9, 2014

16 recommendations on security technology to take to your K-12 clients

From facial recognition cameras to IP-based door hardware, here are key technology-related considerations you should discuss with your school district clients.