The recession is weighing heavily on architects, engineers, and contractors, if the results of an exclusive BD+C survey of 504 AEC professionals are any measure of the commercial construction industry’s outlook on business prospects for 2012.

More than three-fourths of respondents (78.4%) rated “general economic conditions (i.e., recession)” as the most important concern their firms will face in the next year, followed by competition from other firms (40.1%) and lack of capital funding for their projects (34.5%).

Nearly three in four (74.8%) described the current business situation for their firms as “very” to “intensely” competitive—a strong verification of the dog-eat-dog climate that many in the AEC industry have reported anecdotally in the last couple of years.

On the brighter side, nearly half of respondents (49.7%) said their firms were in at least “good” financial health, and four-fifths (80.2%) said their companies would at least hold steady in revenue in 2012.

Layoffs over the last two years were reported by 44.8% of respondents, with another 37.3% saying that hours had been reduced, while more than half (51.0%) said their firms had eliminated or cut back on bonuses.

Looking toward 2012, nearly half of respondents (46.8%) said they thought their companies would be beefing up PR and marketing initiatives to revive their businesses.

More than a third (35.7%) said their firms would be pumping dollars into technology. However, more than one in five (20.6%) said their firms were not using building information modeling; of those who said BIM was used in their shops, a clear majority (58.4%) said BIM figured in less than 25% of projects, while only slightly more than one-fourth (26.8%) said BIM was being used most of the time (i.e., 50% or more of projects, based on dollar value).

Healthcare remains strongest sector

Respondents were asked to rate their firms’ prospects in specific construction sectors on a five-point scale from “excellent” to “very weak.” (Respondents who checked “Not applicable/No opinion/Don’t know” are not counted here.) Among the findings:

- Healthcare was the most highly rated sector, with a strong majority of respondents (54.6%) giving it a “good” to “excellent” rating.

- Data centers and mission-critical facilities were also given good marks, with 45.2% of respondents in the good/excellent category.

- Government and military work was rated good to excellent by more than two-fifths of respondents (41.1%).

- Senior and assisted-living facilities drew a fairly strong 37.8% of respondents in the good to excellent category.

- University/college facilities were rated good to excellent by nearly a third of respondents (32.3%).

Other sectors had much less optimistic support from respondents. Only one in nine (11.1%) said they thought retail commercial construction would have a good to excellent year. Less than 1% thought cultural/performing arts centers had a chance to have even a good year, and only 1.5% were sanguine about industrial and warehouse facilities.

The prospects for office buildings were bleak as well, with only 9.4% saying that market would be good to excellent—and nearly two-thirds (67.3%) predicting office buildings would be “weak” or “very weak.” However, office interiors and fitouts fared better, with 28.0% saying that sector would be good to excellent.

“Good to excellent” prospects for other sectors were mixed: 23.2% for K-12 schools and 24.0% for multifamily projects (condos and apartments, but most likely the latter).

In sum, hardly the cheeriest of prognostications for the 2012 commercial design and construction industry, according to respondents to our exclusive survey.

Note: Of the 494 who gave their professional description, 41.3% are architects; 19.0%, engineers; 18.8%, contractors; 10.7% building owners, developers, or facility/property managers; and 10.2%, consultants or “other.”

For more information visit www.BDCnetwork.com/forecast/2012. BD+C

Related Stories

| Jun 30, 2014

Research finds continued growth of design-build throughout United States

New research findings indicate that for the first time more than half of projects above $10 million are being completed through design-build project delivery.

| Jun 30, 2014

Narrow San Francisco lots to be developed into micro-units

As a solution to San Francisco’s density and low housing supply compared to demand, local firms Build Inc. and Macy Architecture each are to build micro-unit housing in a small parcel of land in Hayes Valley.

| Jun 30, 2014

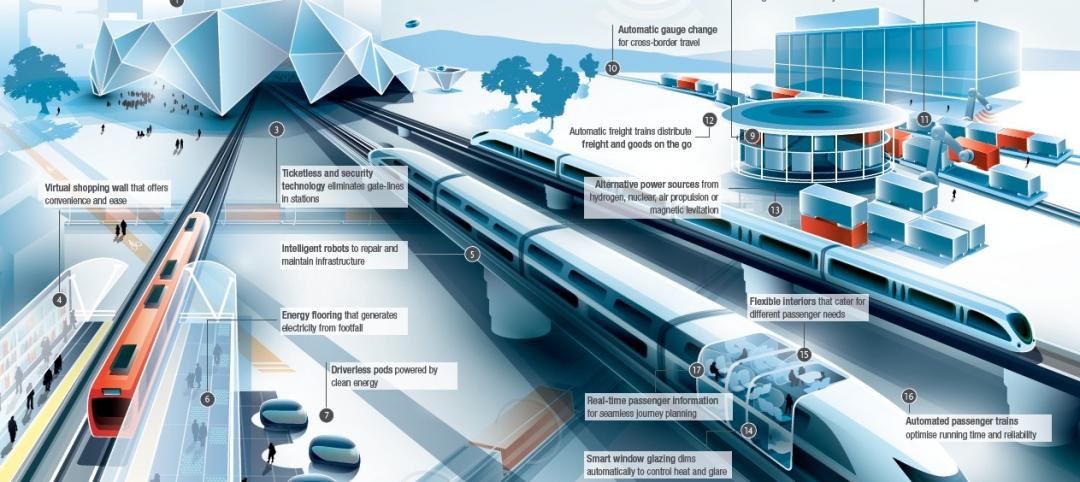

Arup's vision of the future of rail: driverless trains, maintenance drones, and automatic freight delivery

In its Future of Rail 2050 report, Arup reveals a vision of the future of rail travel in light of trends such as urban population growth, climate change, and emerging technologies.

| Jun 30, 2014

4 design concepts that remake the urban farmer's market

The American Institute of Architects held a competition to solve the farmer's markets' biggest design dilemma: lightweight, bland canopies that although convenient, does not protect much from the elements.

| Jun 30, 2014

Harvard releases the State of the Nation’s Housing 2014

Although the housing industry saw notable increases in construction, home prices, and sales in 2013, household growth has yet to fully recover from the effects of the recession, according to a new Harvard University report.

| Jun 30, 2014

OMA's The Interlace honored as one of the world's most 'community-friendly' high-rises

The 1,040-unit apartment complex in Singapore has won the inaugural Urban Habitat award from the Council on Tall Buildings and Urban Habitat, which highlights projects that demonstrate a positive contribution to the surrounding environment.

| Jun 30, 2014

Work starts on Jean Nouvel-designed European Patent Office in the Netherlands [slideshow]

With around 80,000 sm and a budget of €205 million self-financed by the EPO, the complex will be one of the biggest office construction sites ever in the Netherlands.

| Jun 30, 2014

Growth of crowdfunding, public-private partnerships among top trends in architecture marketplace

A new report by the American Institute of Architects highlights several emerging trends in the architecture marketplace, including the growth of the P3 project delivery model and designing for health.

| Jun 30, 2014

Report recommends making infrastructure upgrades a cabinet-level priority

The ASCE estimates that $3.6 trillion must be invested by 2020 to make critically needed upgrades and expansions of national infrastructure—and avoid trillions of dollars in lost business sales, exports, disposable income, and GDP.

| Jun 30, 2014

Gen X, not Baby Boomers, spending the most money on homes [infographic]

It turns out that Generation X, who have the highest incomes of the three generations surveyed, are paying the highest home payments and tend to have the largest households.