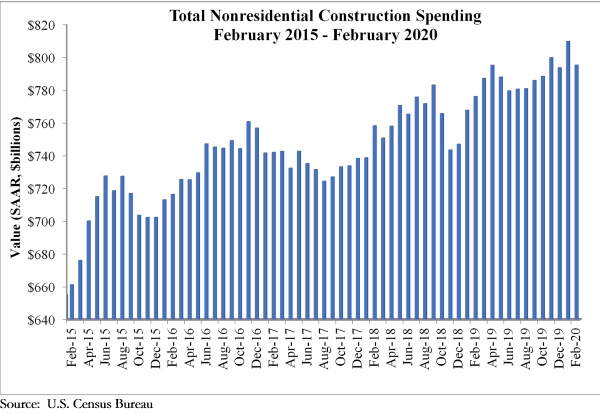

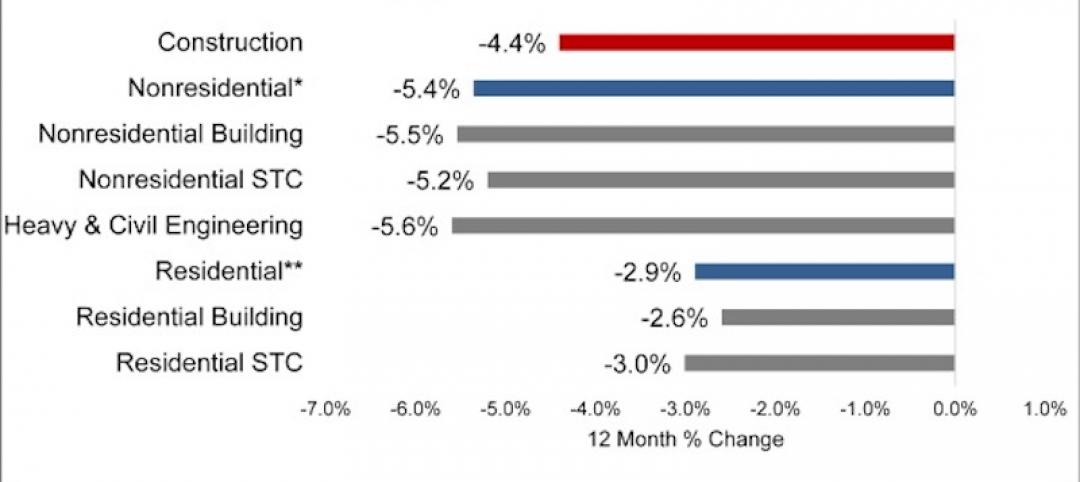

National nonresidential construction spending fell 1.8% in February, but is up 2.5% compared to the same time last year, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $795.1 billion for the month.

Private nonresidential spending declined 2% on a monthly basis and is down 0.7% compared to February 2019. Public nonresidential construction spending was down 1.5% for the month, but is up 7.2% on a year-over-year basis.

“Data characterizing the economy prior to the coronavirus outbreak continues to trickle in,” said ABC Chief Economist Anirban Basu. “While nonresidential construction spending declined in February, according to today’s data release, the decline was modest and overall performance was not substantially different from prior months.

“However, with communities in Massachusetts, Pennsylvania, California and elsewhere recently shutting down certain construction projects in an effort to better support social distancing and with economic activity generally grinding toward a halt, the construction spending data will undoubtedly deteriorate further and faster during the months to come,” said Basu. “Unfortunately, that is not where the pain will end. Once the crisis is over, hotel chains will be weaker financially, more storefronts will be empty and fewer employers will be interested in relocating to high-end office space, which will result in diminished demand for nonresidential construction services even after the broader economy comes back to life.

“Typically, nonresidential construction holds up better during the early stages of a downturn as contractors continue to work through their collective backlog, which stood at 8.9 months in January 2020, according to ABC’s Construction Backlog Indicator,” said Basu. “That may still be the case, but, given growing liquidity and solvency problems spreading through the economy, it is quite likely that many construction projects presently on the drawing board will be postponed or canceled. Backlog may disappear quickly as project owners resort to the use of force majeure clauses or other mechanisms to back out of contractual obligations. Time will tell, and eventually the extent to which projects are delayed will be reflected in the construction spending data.”

Related Stories

Market Data | Jul 8, 2020

North America’s construction output to fall by 6.5% in 2020, says GlobalData

Even though all construction activities have been allowed to continue in most parts of the US and Canada since the start of the COVID-19 pandemic, many projects in the bidding or final planning stages have been delayed or canceled.

Market Data | Jul 8, 2020

5 must reads for the AEC industry today: July 8, 2020

AEMSEN develops concept for sustainable urban living and nonresidential construction has recovered 56% of jobs lost since March.

Market Data | Jul 7, 2020

Nonresidential construction has recovered 56% of jobs lost since March employment report

Nonresidential construction employment added 74,700 jobs on net in June.

Market Data | Jul 7, 2020

7 must reads for the AEC industry today: July 7, 2020

Construction industry adds 158,000 workers in June and mall owners open micro distribution hubs for e-commerce fulfillment.

Market Data | Jul 6, 2020

Nonresidential construction spending falls modestly in May

Private nonresidential spending declined 2.4% in May and public nonresidential construction spending increased 1.2%.

Market Data | Jul 6, 2020

Construction industry adds 158,000 workers in June but infrastructure jobs decline

Gains in June are concentrated in homebuilding as state and local governments postpone or cancel roads and other projects in face of looming budget deficits.

Market Data | Jul 6, 2020

5 must reads for the AEC industry today: July 6, 2020

Demand growth for mass timber components and office demand has increased as workers return.

Market Data | Jul 2, 2020

Fall in US construction spending in May shows weakness of country’s construction industry, says GlobalData

Dariana Tani, Economist at GlobalData, a leading data and analytics company, offers her view on the situation

Market Data | Jul 2, 2020

6 must reads for the AEC industry today: July 2, 2020

Construction spending declines 2.1% in May and how physical spaces may adapt to a post-COVID world.

Market Data | Jul 1, 2020

Construction spending declines 2.1% in May as drop in private work outweighs public pickup

Federal infrastructure measure can help offset private-sector demand that is likely to remain below pre-coronavirus levels amid economic uncertainty.