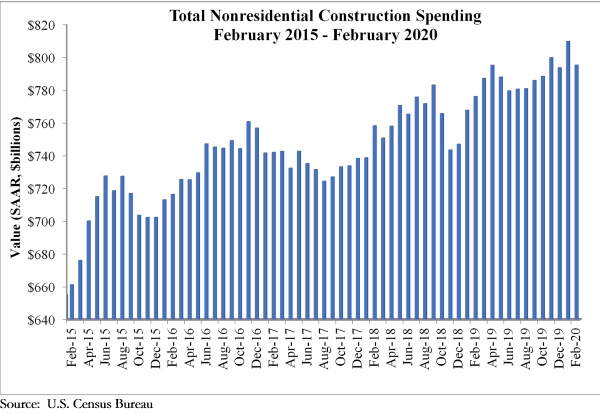

National nonresidential construction spending fell 1.8% in February, but is up 2.5% compared to the same time last year, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, spending totaled $795.1 billion for the month.

Private nonresidential spending declined 2% on a monthly basis and is down 0.7% compared to February 2019. Public nonresidential construction spending was down 1.5% for the month, but is up 7.2% on a year-over-year basis.

“Data characterizing the economy prior to the coronavirus outbreak continues to trickle in,” said ABC Chief Economist Anirban Basu. “While nonresidential construction spending declined in February, according to today’s data release, the decline was modest and overall performance was not substantially different from prior months.

“However, with communities in Massachusetts, Pennsylvania, California and elsewhere recently shutting down certain construction projects in an effort to better support social distancing and with economic activity generally grinding toward a halt, the construction spending data will undoubtedly deteriorate further and faster during the months to come,” said Basu. “Unfortunately, that is not where the pain will end. Once the crisis is over, hotel chains will be weaker financially, more storefronts will be empty and fewer employers will be interested in relocating to high-end office space, which will result in diminished demand for nonresidential construction services even after the broader economy comes back to life.

“Typically, nonresidential construction holds up better during the early stages of a downturn as contractors continue to work through their collective backlog, which stood at 8.9 months in January 2020, according to ABC’s Construction Backlog Indicator,” said Basu. “That may still be the case, but, given growing liquidity and solvency problems spreading through the economy, it is quite likely that many construction projects presently on the drawing board will be postponed or canceled. Backlog may disappear quickly as project owners resort to the use of force majeure clauses or other mechanisms to back out of contractual obligations. Time will tell, and eventually the extent to which projects are delayed will be reflected in the construction spending data.”

Related Stories

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

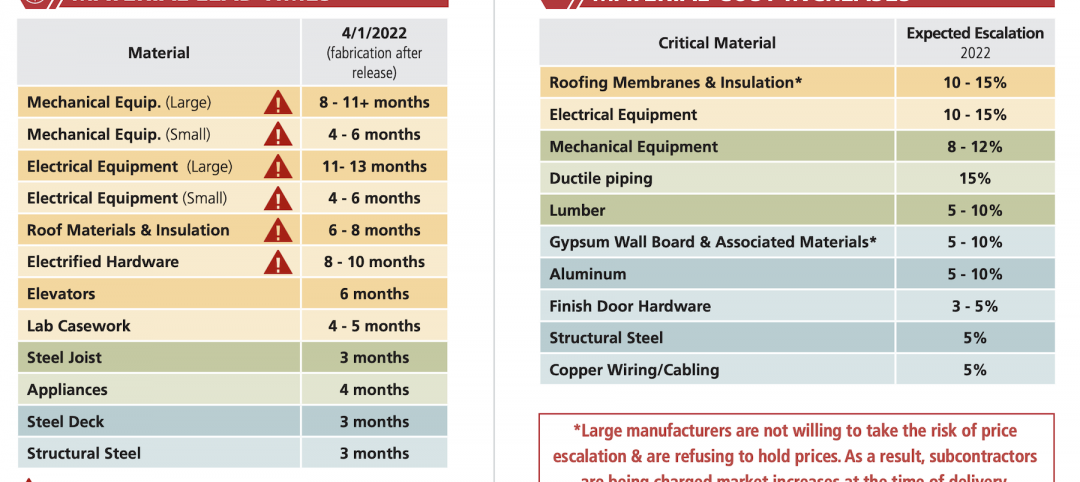

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

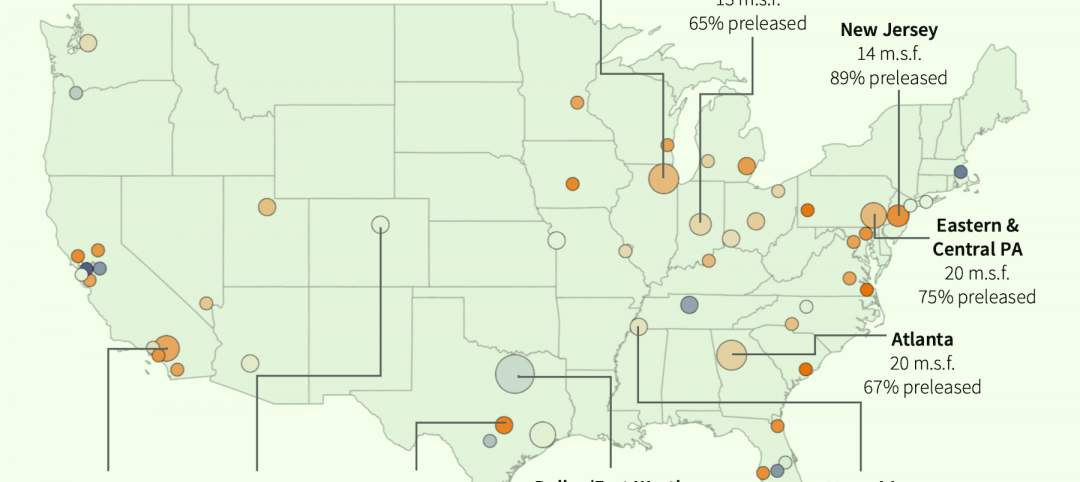

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.