Recently released county and metro-level population growth data by the U.S. Census Bureau shows that the fastest growing areas are found in exurbs and emerging suburbs.

Analysis of the data by Cushman & Wakefield shows population growth in all areas since the 2020 census, with the exception of urban cores that have had declining numbers. In 2022, however, the rate of decline in urban counties slowed significantly, buoyed by the resumption of international migration following the Covid pandemic.

The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, outpacing the metro area with the second largest population gains, Houston, by nearly 50,000 people. The New York metro region saw its population shrink by about 139,000.

Since the 2020 Census, Austin, Texas and Raleigh, N.C., rank as the two fastest growing metros on a percentage basis among major markets.

Here are Cushman & Wakefield's five takeaways from its recent analysis of the census, as authored by Sam Tenenbaum, Head of Multifamily Insights:

- Further-flung counties, those in Exurbs and Emerging suburbs, saw their population grow the fastest, with the former growing by 1.9% and the latter by 1.5%. These areas continue to accelerate population gains.

- All districts saw population gains with the exception of Urban Cores. However, with international migration making a big rebound in 2022, those counties saw the biggest change in population, stemming the tide of major population declines experienced from 2020-2021.

- Urban cores saw 70% of international migration among major U.S. counties in 2022 but high costs pushed more residents out, with domestic migration outflows of more than 1.1 million people.

- Mirroring the urban core rebound, Gateway markets largely saw the largest turnaround in population growth with New York, San Francisco, King County (Seattle) and Miami representing the biggest change in population growth from 2021 to 2022. New York and San Francisco still saw net population losses, but they were much limited than 2021.

- The Dallas–Fort Worth metroplex grew by roughly 170,000 residents, dwarfing No. 2 Houston by nearly 50,000 people. On the other hand, the New York metro division saw its population shrink by about 139,000. Since the 2020 Census, Austin, TX and Raleigh, NC rank as the two fastest growing metros on a percentage basis among major markets.

Related Stories

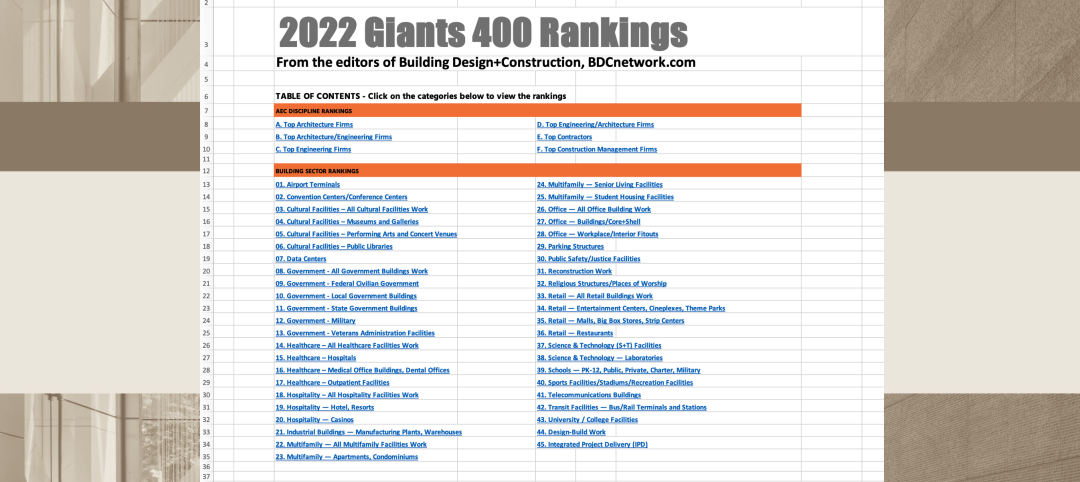

Giants 400 | Feb 9, 2023

New Giants 400 download: Get the complete at-a-glance 2022 Giants 400 rankings in Excel

See how your architecture, engineering, or construction firm stacks up against the nation's AEC Giants. For more than 45 years, the editors of Building Design+Construction have surveyed the largest AEC firms in the U.S./Canada to create the annual Giants 400 report. This year, a record 519 firms participated in the Giants 400 report. The final report includes 137 rankings across 25 building sectors and specialty categories.

AEC Tech Innovation | Jan 24, 2023

ConTech investment weathered last year’s shaky economy

Investment in construction technology (ConTech) hit $5.38 billion last year (less than a 1% falloff compared to 2021) from 228 deals, according to CEMEX Ventures’ estimates. The firm announced its top 50 construction technology startups of 2023.

Multifamily Housing | Jan 24, 2023

Top 10 cities for downtown living in 2023

Based on cost of living, apartment options, entertainment, safety, and other desirable urban features, StorageCafe finds the top 10 cities for downtown living in 2023.

Industry Research | Dec 28, 2022

Following a strong year, design and construction firms view 2023 cautiously

The economy and inflation are the biggest concerns for U.S. architecture, construction, and engineering firms in 2023, according to a recent survey of AEC professionals by the editors of Building Design+Construction.

Self-Storage Facilities | Dec 16, 2022

Self-storage development booms in high multifamily construction areas

A 2022 RentCafe analysis finds that self-storage units swelled in conjunction with metros’ growth in apartment complexes.

Industry Research | Dec 15, 2022

4 ways buyer expectations have changed the AEC industry

The Hinge Research Institute has released its 4th edition of Inside the Buyer’s Brain: AEC Industry—detailing the perspectives of almost 300 buyers and more than 1,400 sellers of AEC services.

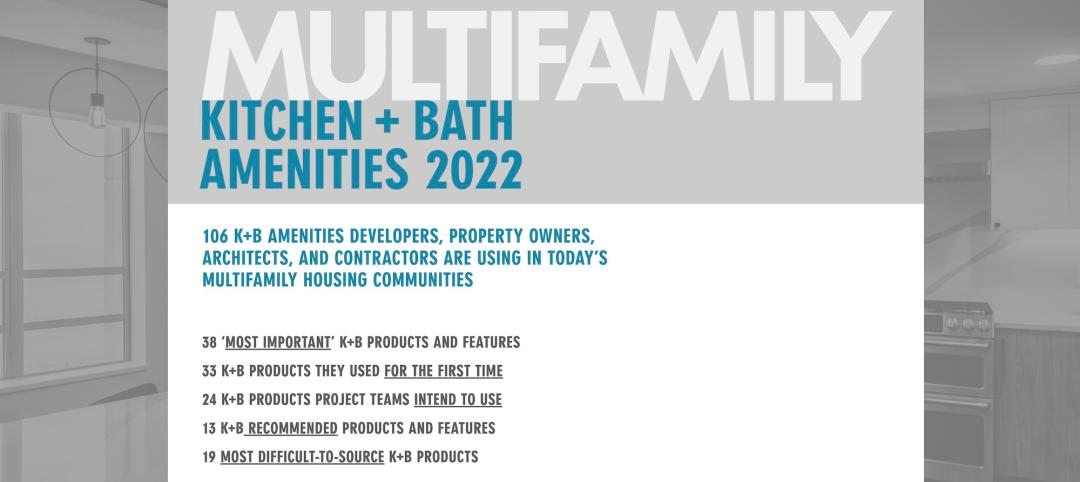

Multifamily Housing | Dec 13, 2022

Top 106 multifamily housing kitchen and bath amenities – get the full report (FREE!)

Multifamily Design+Construction's inaugural “Kitchen+Bath Survey” of multifamily developers, architects, contractors, and others made it clear that supply chain problems are impacting multifamily housing projects.

Market Data | Dec 13, 2022

Contractors' backlog of work reaches three-year high

U.S. construction firms have, on average, 9.2 months of work in the pipeline, according to ABC's latest Construction Backlog Indicator.

Contractors | Dec 6, 2022

Slow payments cost the construction industry $208 billion in 2022

The cost of floating payments for wages and invoices represents $208 billion in excess cost to the construction industry, a 53% increase from 2021, according to a survey by Rabbet, a provider of construction finance software.

Mass Timber | Dec 1, 2022

Cross laminated timber market forecast to more than triple by end of decade

Cross laminated timber (CLT) is gaining acceptance as an eco-friendly building material, a trend that will propel its growth through the end of the 2020s. The CLT market is projected to more than triple from $1.11 billion in 2021 to $3.72 billion by 2030, according to a report from Polaris Market Research.