TOP ARCHITECTURE FIRMS

2012 Total Revenue ($)1 Gensler $807,143,5502 Perkins+Will $360,300,0003 NBBJ $187,017,0004 Kohn Pedersen Fox Associates $153,821,1005 Perkins Eastman $145,000,0006 Callison $134,112,5657 ZGF Architects $107,412,2748 Corgan $85,377,0409 Populous $84,000,00010 HMC Architects $77,986,678

TOP ARCHITECTURE/ENGINEERING FIRMS

2012 Total Revenue ($)1 Stantec $467,254,4212 HOK $406,780,0003 HDR Architecture $325,900,0004 Skidmore, Owings & Merrill $281,686,0005 IBI Group $252,552,3436 HKS $240,300,0007 RTKL Associates $202,823,0008 Cannon Design $202,000,0009 SmithGroupJJR $166,600,00010 DLR Group $116,400,000

Giants 300 coverage of Architecture Firms brought to you by Sage www.sageglass.com

Read BD+C's full Giants 300 Report

Related Stories

| Jul 17, 2014

A harmful trade-off many U.S. green buildings make

The Urban Green Council addresses a concern that many "green" buildings in the U.S. have: poor insulation.

| Jul 17, 2014

A high-rise with outdoor, vertical community space? It's possible! [slideshow]

Danish design firm C.F. Møller has developed a novel way to increase community space without compromising privacy or indoor space.

| Jul 17, 2014

How the 'pop-up' retail concept can be applied to workplace design

“Pop-up” has rapidly become one of the most pervasive design trends in recent years. It has given us pop-up shops and pop-up restaurants, but can it be applied to the professional work environment?

Sponsored | | Jul 17, 2014

A major hop forward

The construction of efficient metal buildings has helped Perrault Farms expand its hops-harvesting business.

| Jul 17, 2014

22 land questions to decide if your build site works

When you’re ready to build, land needs a serious amount of attention. Since it can singlehandedly shift your building plans, land must be investigated, questioned, and eyed from every angle. SPONSORED CONTENT

| Jul 16, 2014

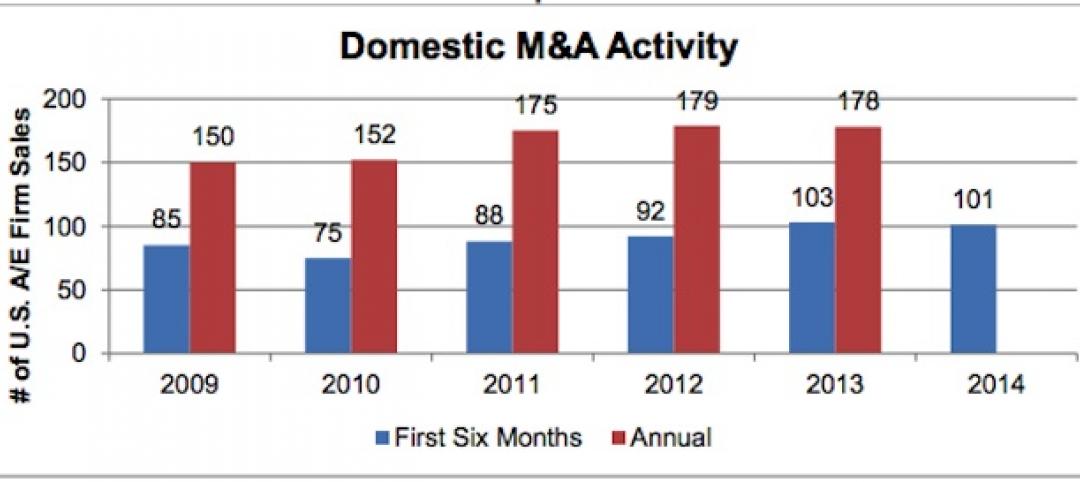

Mergers and acquisitions of AE firms on track for strong year in 2014

Through the first six months of 2014, Morrissey Goodale tracked 101 sales of U.S.-based architecture and engineering firms, roughly the same amount as during the first six months of 2013.

| Jul 16, 2014

Learning design fundamentals in the digital age – How to balance learning and technology

My colleague and I were once asked an insightful question by a Civil Engineering Professor that sparked an interesting conversation. He’d been told about our software by some of his students who had used it during their summer internship. SPONSORED CONTENT

| Jul 16, 2014

Check out this tree-like skyscraper concept for vertical farming

Aprilli Design Studio has stepped forward with a new idea for a vertical farm, which is intended to resemble a giant tree. It uses lightweight decks as outdoor growing space, adding up to about 25 acres of space.

| Jul 16, 2014

User input on aquatics center keeps students in the swim [2014 Building Team Awards]

Collaborative spirit abounds in the expansion and renovation of a high school pool facility in suburban Chicago.

| Jul 16, 2014

Nonresidential construction starts up 34% in June

Construction starts for nonresidential work saw a surge in June, rising more than a third compared with the previous month, according to Reed Construction Data.