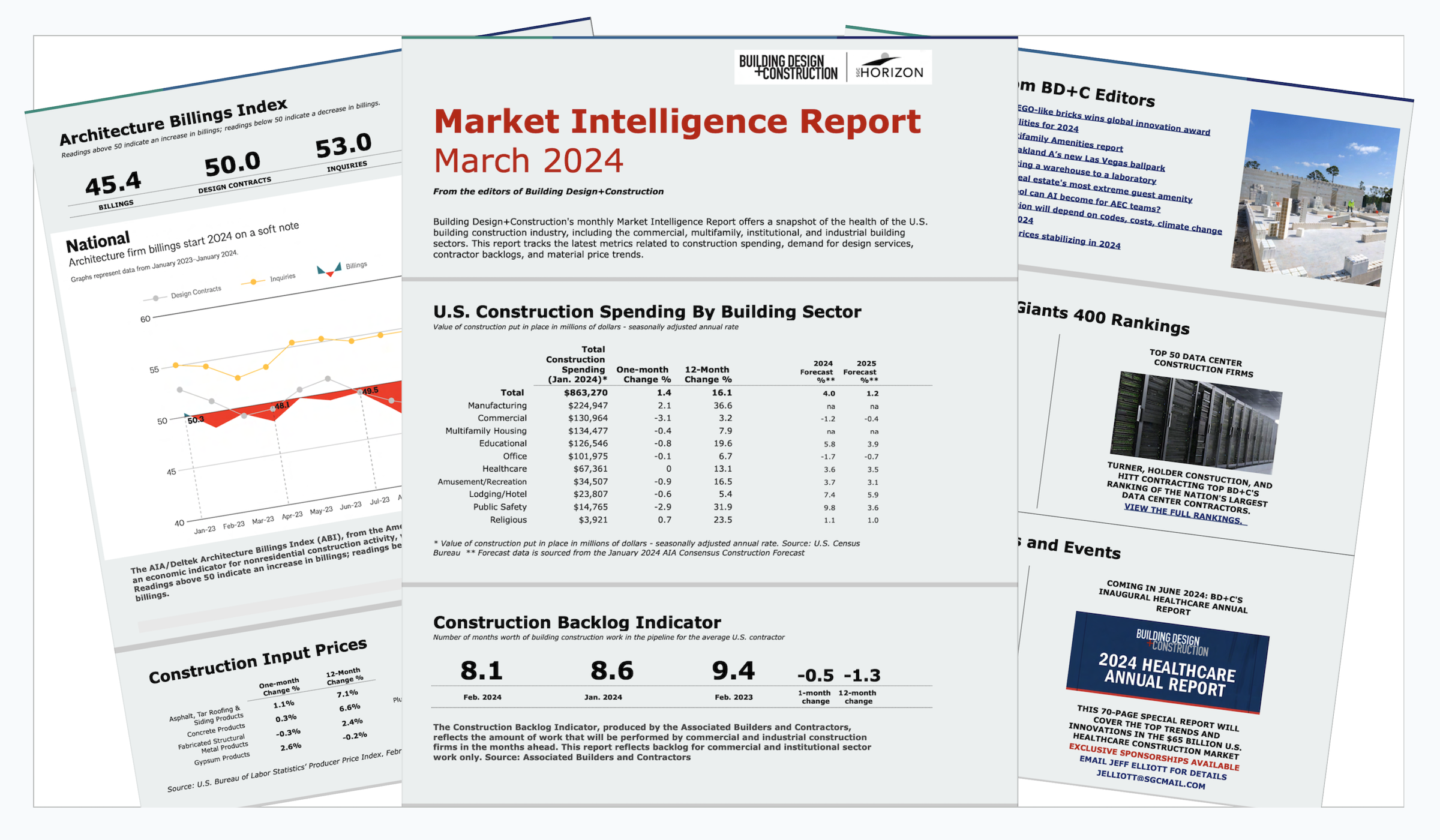

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Data for the Market Intelligence Report is gleaned from reputable economic sources, including the American Institute of Architects, Associated Builders and Contractors, and the U.S. Census Bureau.

Here are some of the highlights from the March 2024 report:

- U.S. construction spending for commercial, institutional, industrial, and multifamily buildings continues its historic run, rising to $863.3 billion in annualized spending as of late January (up 1.4% from the previous month and 16.1% from the previous year).

- When looking at year-over-year spending growth, the following sectors saw the biggest jump: manufacturing, public safety, religious, educational, amusement/recreation, and healthcare.

- Construction backlogs shrink: The average U.S. contractor had 8.1 months worth of building construction work in the pipeline as of February 2024, down 1.3 months from the same time last year. There are a variety of factors at play here, namely an increase in project postponements and cancellations, the high cost of capital, and inflation.

- AIA's Architecture Billings Index dipped to 45.4, extending its streak of sub-50 marks to seven months. This means that, among the architecture firms surveyed by AIA in January, more firms than not reported a decrease in billings.

- Construction material prices rose 1.4% in February, making it back-to-back months of rising prices following a streak of three consecutive monthly declines.

Related Stories

Market Data | Jun 7, 2021

Construction employment slips by 20,000 in May

Seasonally adjusted construction employment in May totaled 7,423,000.

Market Data | Jun 2, 2021

Construction employment in April lags pre-covid February 2020 level in 107 metro areas

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 14-month construction job losses.

Market Data | Jun 1, 2021

Nonresidential construction spending decreases 0.5% in April

Spending was down on a monthly basis in nine of 16 nonresidential subcategories.

Market Data | Jun 1, 2021

Nonresidential construction outlays drop in April to two-year low

Public and private work declines amid supply-chain woes, soaring costs.

Market Data | May 24, 2021

Construction employment in April remains below pre-pandemic peak in 36 states and D.C.

Texas and Louisiana have worst job losses since February 2020, while Utah and Idaho are the top gainers.

Market Data | May 19, 2021

Design activity strongly increases

Demand signals construction is recovering.

Multifamily Housing | May 18, 2021

Multifamily housing sector sees near record proposal activity in early 2021

The multifamily sector led all housing submarkets, and was third among all 58 submarkets tracked by PSMJ in the first quarter of 2021.

Market Data | May 18, 2021

Grumman|Butkus Associates publishes 2020 edition of Hospital Benchmarking Survey

The report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | May 13, 2021

Proliferating materials price increases and supply chain disruptions squeeze contractors and threaten to undermine economic recovery

Producer price index data for April shows wide variety of materials with double-digit price increases.

Market Data | May 7, 2021

Construction employment stalls in April

Soaring costs, supply-chain challenges, and workforce shortages undermine industry's recovery.