Developers of multifamily apartment buildings remain mostly positive about their markets’ current conditions, according to the latest quarterly tracking data that the National Association of Home Builders released on February 26.

NAHB’s Multifamily Production Index (MPI), based on responses from 93 developers across the country, stood at 54, on a scale of 0 to 100, in the fourth quarter of 2014. The Index—a composite measure of developer sentiments about construction for low-rent units, market-rate rentals, and for-sale condos—registered above 50 for each quarter last year, and has been hovering at 50 or higher since the first quarter of 2013.

The latest reading “is in line with our view that the multifamily segment of the industry has largely recovered from the downturn,” said NAHB Chief Economist David Crowe. “After increasing steadily over the past several years, multifamily production has now reached a healthy, sustainable level.”

Developers’ attitudes are also reflected in their willingness to take on future projects. In January, permits issued for buildings with five or more units rose by 13.8% to an annualized rate of 372,000, according to the Census Bureau.

A closer look at the numbers finds that developers’ sentiments about current conditions for market-rate starts, at an index of 62, were more robust than their sentiments for either low-rent starts (52) or for-sale condo starts (50).

NAHB’s Vacancy Index, which measures the industry’s perception about apartment vacancies, stood at 39 in the fourth quarter of 2014, compared to 38 for the same quarter a year earlier. (The lower the index, the fewer the perceived vacancies.) Interestingly, developers perceived lower vacancies for Class B apartments compared to either Class A or C apartments.

Developers’ attitudes are also reflected in their willingness to take on future projects. In January, permits issued for buildings with five or more units rose by 13.8% to an annualized rate of 372,000, according to preliminary estimates released by the Census Bureau on February 18.

Multifamily starts in January were up 24.5% over the same month a year earlier to an annualized rate of 381,000 units. In 2015, NAHB expects multifamily starts ultimately to increase modestly to around 358,000. “Because of strong job growth, we expect to be able to keep building for the foreseeable future,” said W. Dean Henry, CEO of Legacy Partners Residential in Foster City, Calif., and chairman of NAHB’s Multifamily Leadership Board.

Financing projects should not be an issue, as more lenders are jumping into this sector. Banks and Commercial Mortgage-Backed Securities lenders increased their market share of lending for multifamily projects through 2014, and are expected to be even bigger players this year, as Fannie Mae and Freddie Mac pull back. “Capital is plentiful and many lenders are expanding their target markets for investments,” observed Faron Thompson, head of Jones Lang LaSalle’s multifamily debt finance team.

It’s worth noting, though, that Fannie and Freddie expect demand for multifamily housing to soften a bit over the next two years, and for most of the growth to occur in a limited number of metro markets.

Related Stories

Multifamily Housing | Sep 14, 2020

McShane Construction begins work on Gilbert, Ariz., multifamily development

Continental Properties is the project owner.

Multifamily Housing | Sep 10, 2020

COVID-19: How are you doing?

Multifamily seems to be one sector in the construction industry that’s holding its own during the pandemic.

Multifamily Housing | Sep 10, 2020

EV charging webinar to feature experts from Bozzuto, Irvine Company, and RCLCO - Wed., 9-16

EV charging webinar (9/16) to feature Bozzuto Development, The Irvine Company, RCLCO, and ChargePoint

Multifamily Housing | Sep 2, 2020

8 noteworthy multifamily projects to debut in 2020

Brooklyn's latest mega-development, Denizen Bushwick, and Related California’s apartment tower in San Francisco are among the notable multifamily projects to debut in the first half of 2020.

Multifamily Housing | Sep 2, 2020

New affordable housing in the Bronx is designed for both seniors and teens

Body Lawson Associates designed the project.

Giants 400 | Aug 28, 2020

2020 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

The 2020 Giants 400 Report features more than 130 rankings across 25 building sectors and specialty categories.

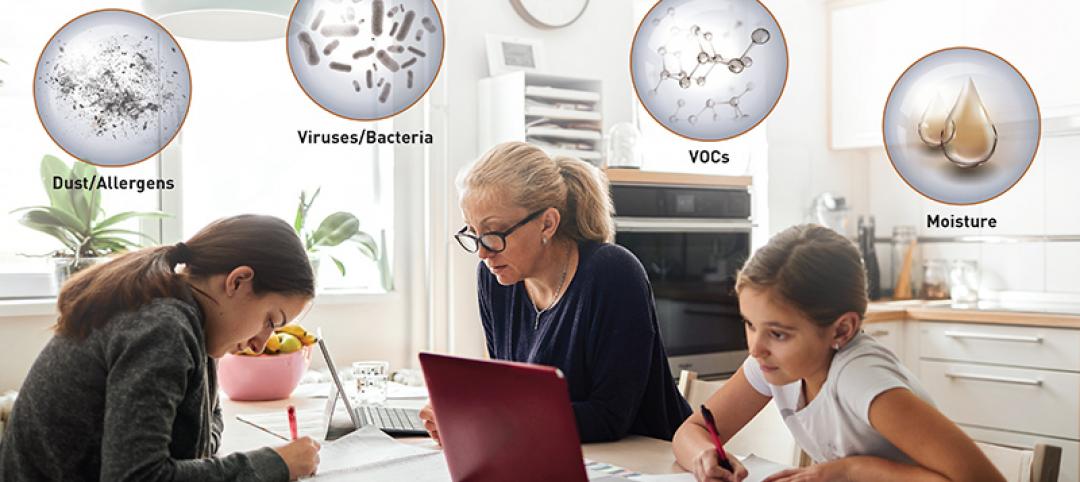

Sponsored | | Aug 26, 2020

Healthy air systems have become the new “standard equipment.”

As home buyers demand healthy air systems, builders look to differentiate themselves with a “Healthy Home Builder” designation.

Coronavirus | Aug 25, 2020

Video: 5 building sectors to watch amid COVID-19

RCLCO's Brad Hunter reveals the winners and non-winners of the U.S. real estate market during the coronavirus pandemic.

Multifamily Housing | Aug 24, 2020

Portland’s zoning reform looks to boost the ‘missing middle’ of housing

The city council in Portland, Ore., recently approved the “Residential Infill Project” (RIP), a package of amendments to the city’s zoning code that legalizes up to four homes on nearly any residential lot and sharply limits building sizes.

Multifamily Housing | Aug 24, 2020

Texaco’s century-old headquarters is now a luxury apartment community

After sitting vacant for nearly three decades, the former home of Texaco, Inc. has been converted into a 17-story, 286-unit apartment building in the heart of downtown Houston.