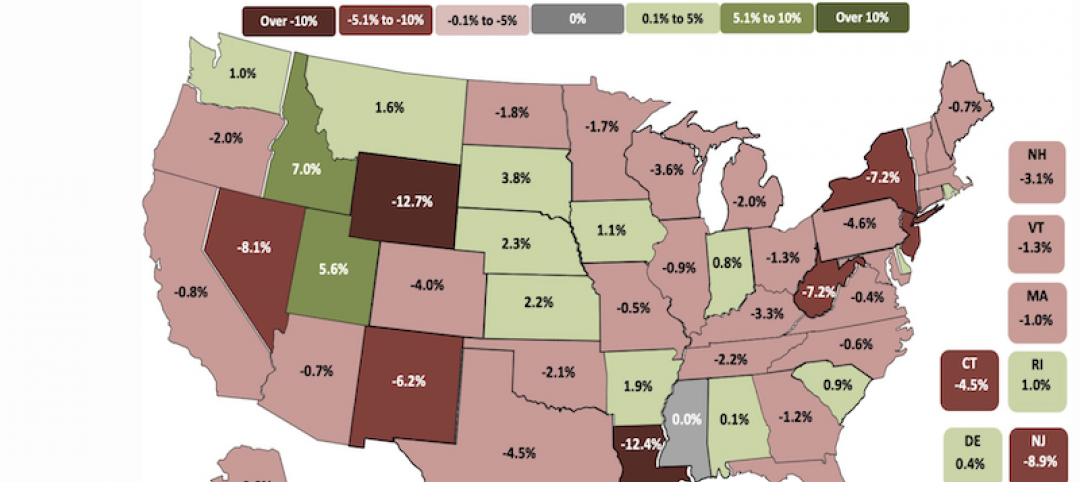

Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

| Dec 6, 2014

Future workplace designs shouldn’t need to favor one generation over another, says CBRE report

A new CBRE survey finds that what Millennials expect and need from offices doesn’t vary drastically from tenured employees.

| Dec 5, 2014

Plotting on the go: 3D-printed mechanical compass can print CAD drawings with high precision

Design student Ken Nakagaki has adapted a device to work with CAD software to replicate digital files on paper.

Sponsored | | Dec 5, 2014

New construction outlook report projects growth in 2015

A new 2015 construction outlook report predicts that total U.S. construction starts for 2015 will rise 9% to $612 billion. SPONSORED CONTENT

Sponsored | | Dec 5, 2014

Best practices for force transfer around openings

As wood-frame construction is continuously evolving, designers in many parts of the U.S. are optimizing design solutions that require the understanding of force transfer between elements in the lateral load-resisting system.

| Dec 4, 2014

World’s largest eco-resort to open soon in Indonesia

Just under 10 miles away from Singapore, Funtasy Island (yes, that's the real name) is a resort tucked away in the mangrove islands of the Riau archipelago.

| Dec 4, 2014

£175 million 'Garden Bridge' gets the green light to cross the Thames

Westminster Council has approved a £175 million 'Garden Bridge' that will allow pedestrian traffic only. There has been some controversy about this bridge, which is expected to attract seven million visitors annually.

Sponsored | | Dec 3, 2014

Modular Space Showcase: Bringing work-life balance to energy workers in the Bakken region

To meet the demands of the booming energy business, Williston needs to provide homes, recreation centers, restaurants, hotels, and other support facilities for the tidal wave of energy workers relocating to the Bakken Shale area. SPONSORED CONTENT

| Dec 3, 2014

U.S., Canada, and Mexico finalize agreement to recognize architect credentials

The agreement represents over a decade of negotiations, bringing cross-border recognition of professional credentials from concept to reality in the spirit of the North American Free Trade Agreement.

| Dec 3, 2014

35 cities added to Rockefeller Foundation's 100 Resilient Cities Challenge

Chicago, Dallas, and Pittsburgh are among the U.S. cities to join the 100 Resilient Cities Challenge, pioneered by The Rockefeller Foundation.

| Dec 2, 2014

First existing multifamily buildings to earn Energy Star certification unveiled

River City in Chicago is one of 17 existing multifamily properties to earn Energy Star certification, which became available to this sector on Sept. 16 via a scoring system for multifamily properties that Energy Star and Fannie Mae had been developing for three years.