Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

Architects | Oct 13, 2015

Santiago Calatrava wins the European Prize for Architecture

The award honors those who "forward the principles of European humanism."

Office Buildings | Oct 5, 2015

Renderings revealed for Apple's second 'spaceship': a curvy, lush office complex in Sunnyvale

The project has been dubbed as another “spaceship,” referencing the nickname for the loop-shaped Apple Campus under construction in Cupertino.

Airports | Oct 5, 2015

Perkins+Will selected to design Istanbul’s 'Airport City'

The mixed-use development will be adjacent to the Istanbul New Airport, which is currently under construction.

High-rise Construction | Oct 5, 2015

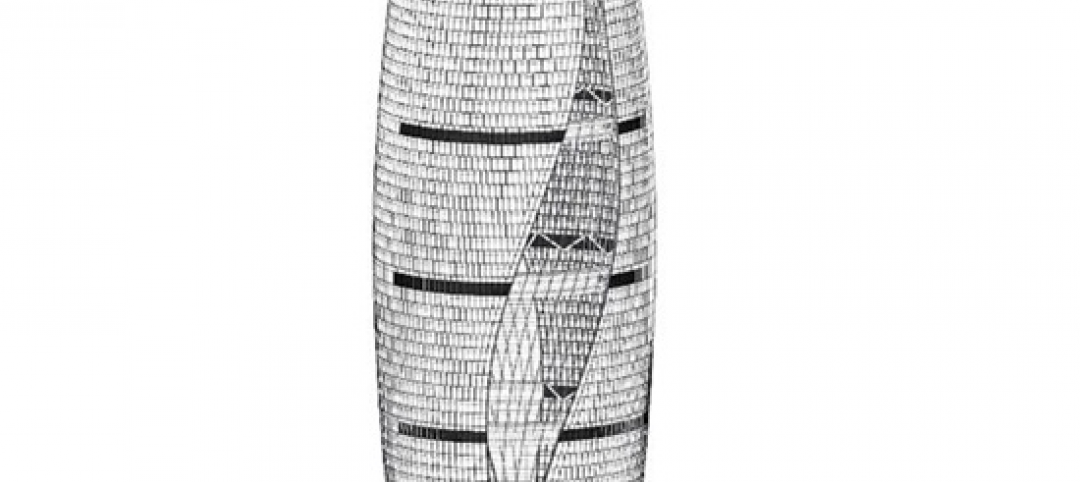

Zaha Hadid designs cylindrical office building with world’s tallest atrium

The 200-meter-high open space will cut the building in two.

Architects | Oct 2, 2015

Herzog & de Meuron unveils design for Vancouver Art Gallery expansion

The blocky, seven-story wood and concrete structure is wider in the middle and uppermost floors.

Airports | Sep 30, 2015

Takeoff! 5 ways high-flyin' airports are designing for rapid growth

Nimble designs, and technology that humanizes the passenger experience, are letting airports concentrate on providing service and generating revenue.

Contractors | Sep 30, 2015

FMI: Construction in place on track for sustained growth through 2016

FMI’s latest report singles out manufacturing, lodging, and office sectors as the drivers of nonresidential building activity and investment.

Reconstruction & Renovation | Sep 29, 2015

What went wrong? Diagnosing building envelope distress [AIA course]

With so many diverse components contributing to building envelope assemblies, it can be challenging to determine which of these myriad elements was the likely cause of a failure.

Architects | Sep 24, 2015

Supertall buildings vie for dominance along Chicago’s skyline

The latest proposals pit designs by Rafael Viñoly, Jeanne Gang, and Helmut Jahn.

Architects | Sep 24, 2015

From Gehry to the High Line: What makes a project a game-changer?

Each year, there are a handful of projects that significantly advance the AEC industry or a particular building type. Send us your game-changing projects for BD+C’s January 2016 special report.

![What went wrong? Diagnosing building envelope distress [AIA course] What went wrong? Diagnosing building envelope distress [AIA course]](/sites/default/files/styles/list_big/public/Screen%20shot%202015-09-29%20at%209.46.33%20AM.png?itok=QDq8CQJv)