Trepp, LLC, a provider of information, analytics and technology to the commercial real estate and banking markets, released its August 2013 U.S. CMBS Delinquency Report today.

The delinquency rate for US commercial real estate loans in CMBS dropped for the third straight month to 8.38%. This represents a 10-basis-point drop since July's reading and a 175-basis-point improvement from a year ago. The August 2013 level is the lowest Trepp delinquency rate in three years.

There were about $2.5 billion in new delinquencies in August, which was slightly higher than the $2.4 billion July total. Helping to offset these newly delinquent loans were $1.5 billion of loans that cured. Loan resolutions, although down nearly 50 percent from July, totaled just over $1 billion, while under half a billion dollars in formerly delinquent loans were paid off in August without a loss. Both categories of loans put further downward pressure on the delinquency rate.

"August saw a continuation of the year-long downward trend in the Trepp CMBS delinquency rate, which reached an all-time high of 10.34% just over 12 months ago," said Manus Clancy, Senior Managing Director at Trepp. "We anticipate this trend will carry forward in the months ahead as a new wave of expected deals will put additional downward pressure on the numbers."

There are currently $45.5 billion in delinquent U.S. CMBS loans, excluding loans that are past their balloon date but current on their interest payments. About 2,900 are currently with the special servicer.

Among the major property types, retail remains the best performer, while industrial remains the worst, despite substantial improvement in August. The lodging delinquency rate saw the best month to month improvement, while CMBS office loans saw a small increase in the delinquency rate.

For additional details, such as historical delinquency rates and August delinquency status, request the August 2013 U.S. CMBS Delinquency Report at http://www.trepp.com/knowledge/research. For daily CMBS and bank trading ideas, credit events and commentary, register for TreppWire or follow Trepp on Twitter.

About Trepp, LLC

Trepp, LLC is the leading provider of information, analytics and technology to the CMBS, commercial real estate and banking markets. Trepp provides primary and secondary market participants with the tools and insight they need to increase their operational efficiencies, information transparency and investment performance. For more information visit www.trepp.com.

Related Stories

Architects | Apr 25, 2017

Two Mid-Atlantic design firms join forces

Quinn Evans Architects and Cho Benn Holback + Associates have similar portfolios with an emphasis on civic work.

BIM and Information Technology | Apr 24, 2017

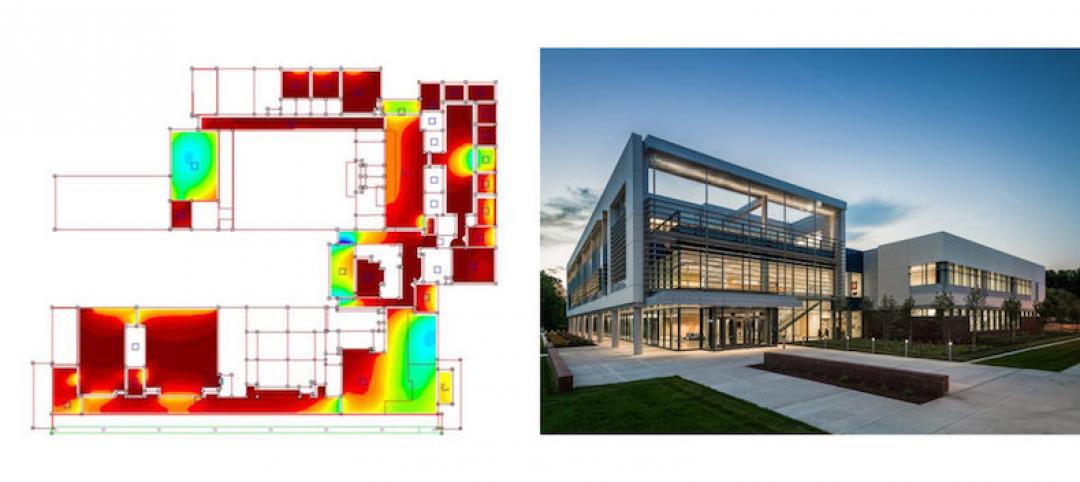

Reconciling design energy models with real world results

Clark Nexsen’s Brian Turner explores the benefits and challenges of energy modeling and discusses how design firms can implement standards for the highest possible accuracy.

Higher Education | Apr 24, 2017

Small colleges face challenges — and opportunities

Moody’s Investor Service forecasts that closure rates for small institutions will triple in the coming years, and mergers will double.

Healthcare Facilities | Apr 24, 2017

Treating the whole person: Designing modern mental health facilities

Mental health issues no longer carry the stigma that they once did. Awareness campaigns and new research have helped bring our understanding of the brain—and how to design for its heath—into the 21st century.

Architects | Apr 20, 2017

Design as a business strategy: Tapping data is easier than you think

We have been preaching “good design matters” for a long time, demonstrating the connection between the physical environment and employee satisfaction, individual and team performance, and an evolving organizational culture.

Architects | Apr 20, 2017

‘Gateways to Chinatown’ project seeks the creation of a new neighborhood landmark for NYC’s Chinatown

The winning team will have $900,000 to design and implement their proposal.

Architects | Apr 19, 2017

Tour Zaha Hadid, Frank Gehry architecture with Google Earth

Google Earth’s new ‘Voyager’ feature allows people to take interactive guided tours.

Multifamily Housing | Apr 18, 2017

Three multifamily, three specialized housing projects among 14 recipients of the AIA’s 2017 Housing Awards

2017 marks the 17th year the AIA has rewarded projects and architects with the Housing Awards.

Projects | Apr 17, 2017

BD+C's 2017 Design Innovation Report

Façades that would make Dr. Seuss smile, living walls, and exterior wall space that doubles as gallery space are all represented in this year's BD+C Design Innovation Report.

Healthcare Facilities | Apr 13, 2017

The rise of human performance facilities

A new medical facility in Chicago focuses on sustaining its customers’ human performance.