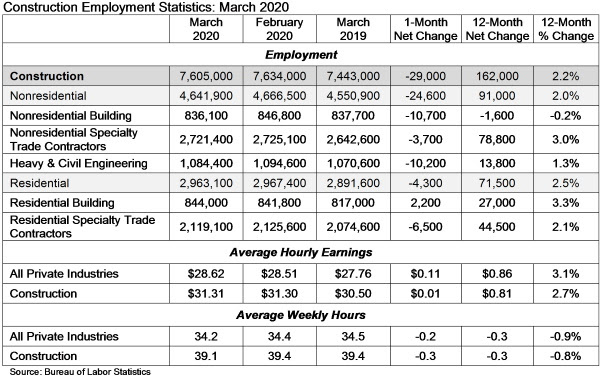

Construction industry employment declined by 29,000 in March, according to an Associated Builders and Contractors analysis of data released today by the U.S. Bureau of Labor Statistics. Nonresidential construction employment declined by 24,600 in March.

All three nonresidential segments registered job losses, with the largest decrease experienced in nonresidential building (-10,700) followed closely by heavy and civil engineering (-10,200). Nonresidential specialty trade lost 3,700 jobs on net.

The construction unemployment rate was 6.9% in March, up 1.7 percentage points from the same time one year ago. Unemployment across all industries rose from 3.5% in February to 4.4% last month, a direct result of the global pandemic.

“So ends the lengthiest expansion in American economic history,” said ABC Chief Economist Anirban Basu. “The expansion was associated with dramatic asset price increases, multi-decade lows in unemployment, persistently low costs of capital and a thriving U.S. nonresidential construction sector. While the March jobs report is horrific, ending a 113-month streak of employment gains, it is clear that employment reports in future months are likely to be even worse.

“What remains unclear is the extent to which estimated construction employment declines are due to mandated suspension of projects in Massachusetts, Pennsylvania, California and elsewhere, and how much of this is due to the emergence of recessionary forces,” said Basu. “Generally, nonresidential construction is one of the last segments of the economy to enter recession as contractors continue to work down their collective backlog, which stood at 8.9 months in ABC’s Construction Backlog Indicator. The need for social distancing renders that statistic less pertinent, meaning that nonresidential construction is susceptible to large-scale job losses immediately.

“While the recently passed stimulus package is massive and helps support the payments side of the economy, economic recovery will remain elusive until the COVID-19-engendered crisis is behind us,” said Basu. “While that is obvious, many people are still looking to compare the current crisis to other episodes in American history, including the Great Recession. As a practical matter, this period defies comparison, and must be understood on its own. Based on what is known, the downturn will be vicious. The good news is that this crisis may finally induce policymakers to fashion and implement a long-awaited infrastructure stimulus package.”

Related Stories

Market Data | Jan 26, 2022

2022 construction forecast: Healthcare, retail, industrial sectors to lead ‘healthy rebound’ for nonresidential construction

A panel of construction industry economists forecasts 5.4 percent growth for the nonresidential building sector in 2022, and a 6.1 percent bump in 2023.

Market Data | Jan 24, 2022

U.S. hotel construction pipeline stands at 4,814 projects/581,953 rooms at year-end 2021

Projects scheduled to start construction in the next 12 months stand at 1,821 projects/210,890 rooms at the end of the fourth quarter.

Market Data | Jan 19, 2022

Architecture firms end 2021 on a strong note

December’s Architectural Billings Index (ABI) score of 52.0 was an increase from 51.0 in November.

Market Data | Jan 13, 2022

Materials prices soar 20% in 2021 despite moderating in December

Most contractors in association survey list costs as top concern in 2022.

Market Data | Jan 12, 2022

Construction firms forsee growing demand for most types of projects

Seventy-four percent of firms plan to hire in 2022 despite supply-chain and labor challenges.

Market Data | Jan 7, 2022

Construction adds 22,000 jobs in December

Jobless rate falls to 5% as ongoing nonresidential recovery offsets rare dip in residential total.

Market Data | Jan 6, 2022

Inflation tempers optimism about construction in North America

Rider Levett Bucknall’s latest report cites labor shortages and supply chain snags among causes for cost increases.

Market Data | Jan 6, 2022

A new survey offers a snapshot of New York’s construction market

Anchin’s poll of 20 AEC clients finds a “growing optimism,” but also multiple pressure points.

Market Data | Jan 3, 2022

Construction spending in November increases from October and year ago

Construction spending in November totaled $1.63 trillion at a seasonally adjusted annual rate.

Market Data | Dec 22, 2021

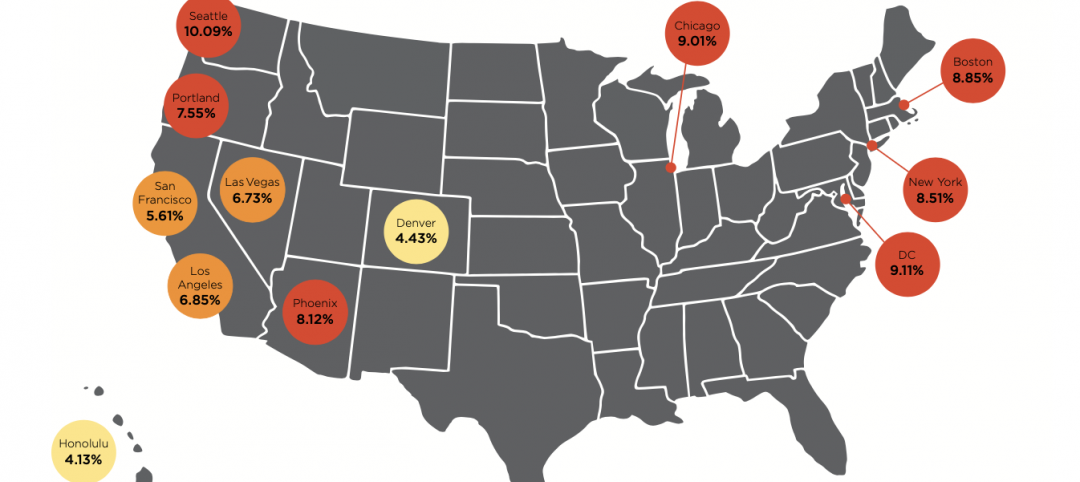

Two out of three metro areas add construction jobs from November 2020 to November 2021

Construction employment increased in 237 or 66% of 358 metro areas over the last 12 months.