Construction contractors remained confident during the second quarter of 2018, according to the latest Construction Confidence Index released today by Associated Builders and Contractors.

More than three in four construction firms expect that sales will continue to rise over the next six months, while three in five expect higher profit margins. More than seven in 10 expect to bolster staffing levels, though that proportion has fallen relative to the previous quarter, perhaps in part due to the skilled labor shortage in the United States. All three key components measured by the survey—sales, profit margins, and staffing levels—remain well above the diffusion index threshold of 50, signaling ongoing expansion in construction activity.

The survey found:

- CCI for sales expectations increased from 72.2 to 72.6 during the second quarter of 2018.

- CCI for profit margin expectations increased from 63.4 to 64.5.

- CCI for staffing levels decreased from 70.2 to 69.5 but remains elevated by historical standards.

“The U.S. economy remains steady, creating opportunities for general and subcontractors alike,” said ABC Chief Economist Anirban Basu. “Recently, infrastructure has been one of the primary drivers and, despite the absence of a federal infrastructure package, state and local governments have expanded their capital outlays. A number of states are also now running hefty budget surpluses, creating the capital and confidence necessary to drive public construction forward. As evidence, construction spending in the water supply category is up 29% on a year-over-year basis, conservation and development (e.g. flood control) by 24%, transportation by nearly 21%, public safety-related spending by 17%, and sewage and waste disposal by 11%.

“The confidence expressed by contractors is consistent with a number of other leading indicators, including the Architecture Billings Index and ABC’s Construction Backlog Indicator,” said Basu. “With financial markets surging, the nation producing a record number of available job openings, and both consumer and business confidence elevated, chances for a significant slowdown in nonresidential construction activity in late 2018 and into 2019 are remote. That helps explain why only about 6% of contractors expect sales to decline over the next six months.

“The longer-term outlook is not as clear,” said Basu. “Interest rates are rising, construction workers and materials have become more expensive and asset prices have become further elevated and therefore increasingly vulnerable to correction. There is also some evidence of overbuilding in certain real estate segments in some communities. Tariff increases and associated retaliation serve as yet another threat to longer-term economic momentum, as do faltering government pension funds. But for now, construction firms can expect to remain busy improving the nation’s built environment. A shortage of skilled workers remains the primary issue, which is expected to continue as more workers retire and insufficient workers join the skilled construction trades.”

CCI is a diffusion index. Readings above 50 indicate growth, while readings below 50 are unfavorable.

Related Stories

Market Data | Nov 22, 2021

Only 16 states and D.C. added construction jobs since the pandemic began

Texas, Wyoming have worst job losses since February 2020, while Utah, South Dakota add the most.

Market Data | Nov 10, 2021

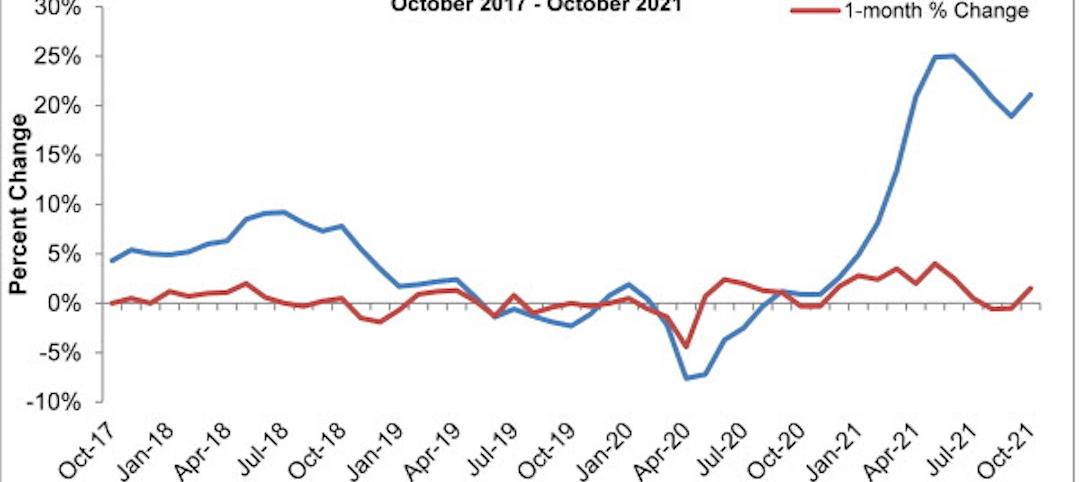

Construction input prices see largest monthly increase since June

Construction input prices are 21.1% higher than in October 2020.

Market Data | Nov 9, 2021

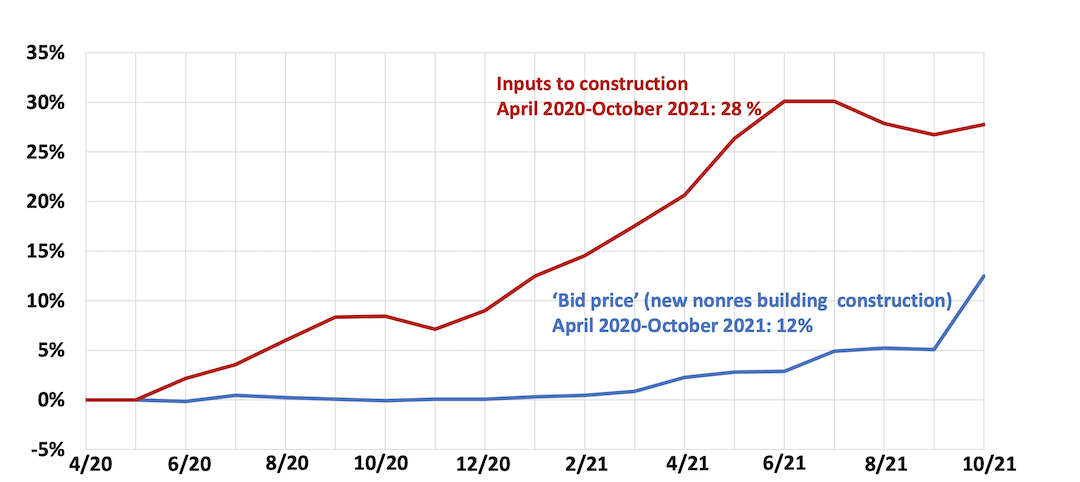

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.