Get ready for a surge in prefabrication activity by contractors.

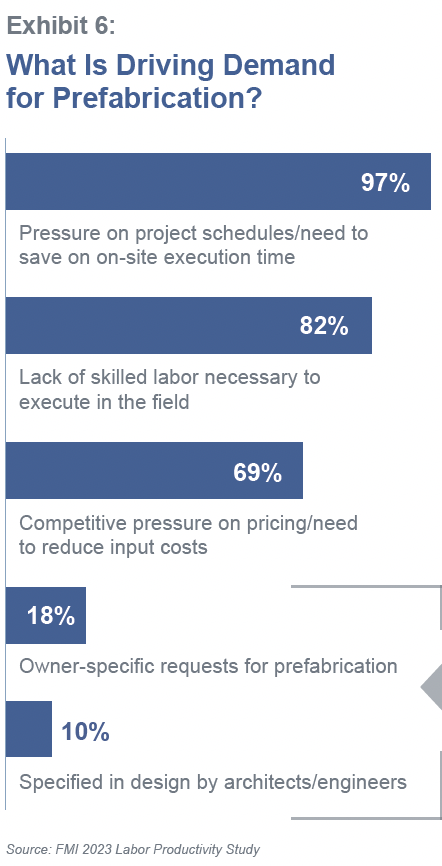

FMI, the consulting and investment banking firm, recently polled contractors about how much time they were spending, in craft labor hours, on prefabrication for construction projects. More than 250 contractors participated in the survey, and the average response to that question was 18%. More revealing, however, was the participants’ anticipation that craft hours dedicated to prefab would essentially double, to 34%, within the next five years.

The study—a sequel to FMI’s 2023 Labor Productivity Study—reiterates how the industry’s receptivity to prefab solutions corresponds with its ongoing labor shortages and compressed project schedules. (Contractors experienced approximately $30 billion to $40 billion in lost profits due to labor inefficiencies in 2022.) In its latest study, contractors told FMI that “improved quality” was prefab’s greatest perceived benefit. “Reducing the risk and variability” is how one contractor put it. Other benefits cited include reductions in construction schedules and improved worker safety.

(Nearly three fifths of the respondents to FMI’s study are MEP contractors, with another 15% being framing and drywall contractors.)

Contractors that consider prefabrication must determine how to do it at scale, profitably, and in a way that increases company earnings. Successful prefab practices, says FMI, require long-term strategic thinking and planning across an organization, along with the development of a comprehensive operational blueprint.

Which prefab model is right for pros?

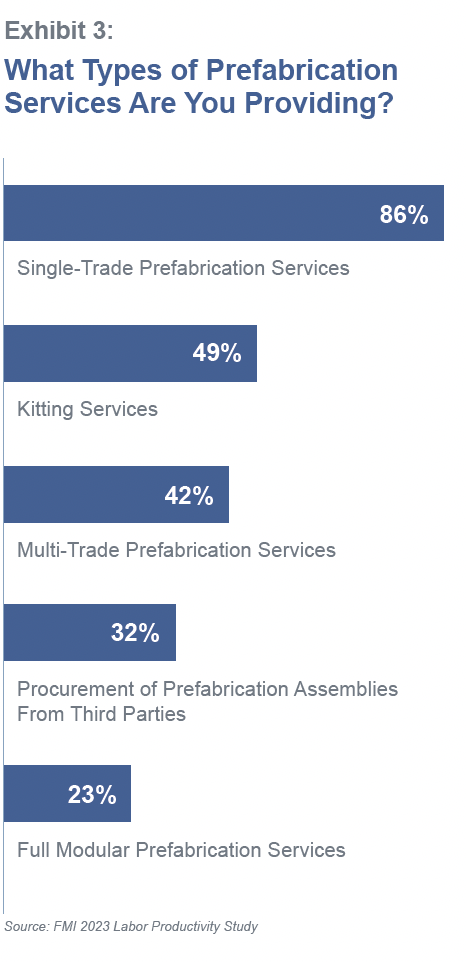

It’s not like prefabrication is an alien concept for contractors. FMI’s study found that 86% of respondents currently offer single-trade prefab services. Three quarters of the concrete contractors surveyed said they are prefabricating on their jobsites; 57% of self-performing general contractors polled are prefabbing on-site, too.

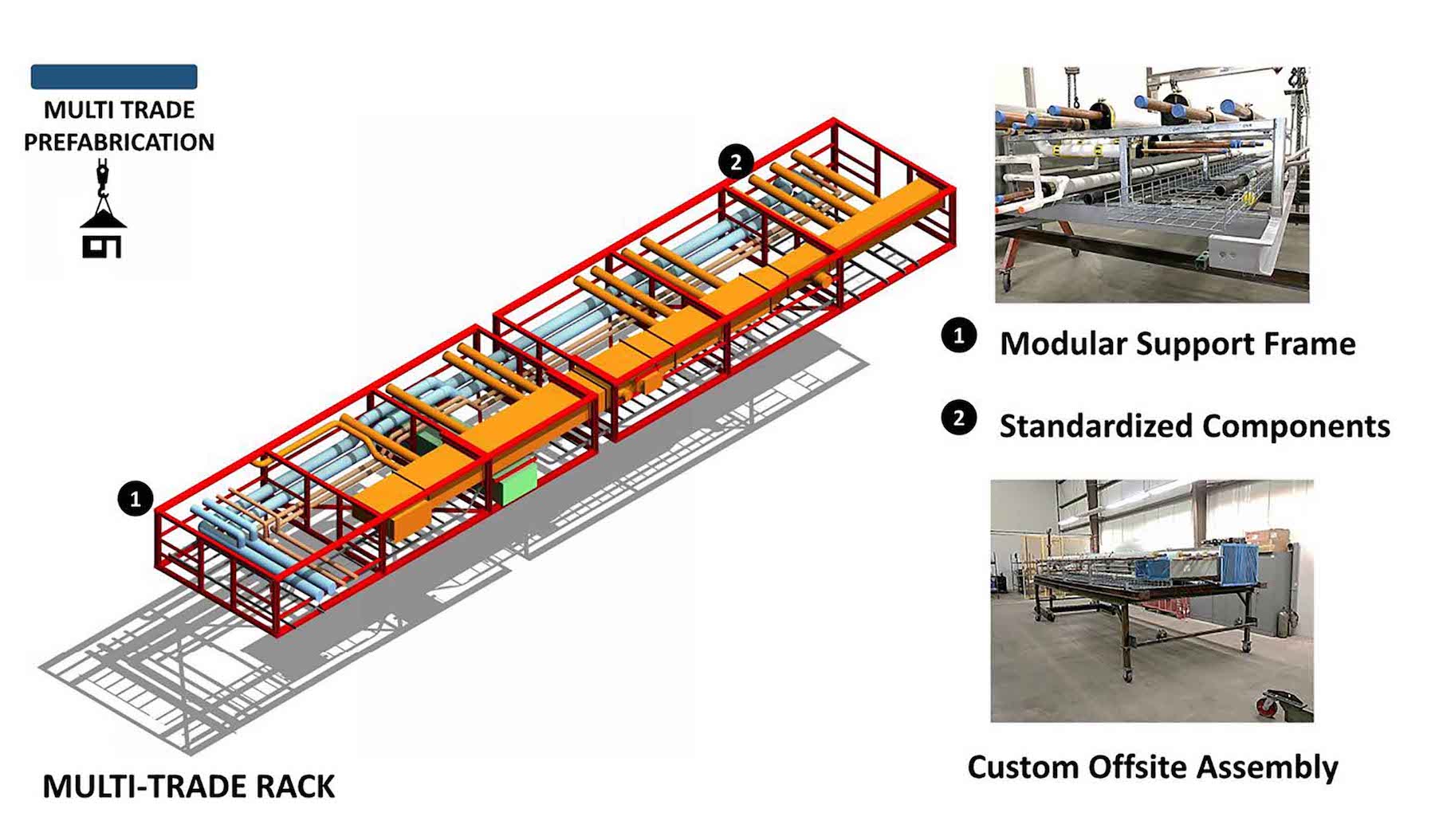

What’s often lacking, however, is a clear vision of what they want their prefab capabilities to become. To make prefab work, says FMI, contractors need to shift their operating models, processes and systems. Contractors also need to decide which prefab models and combinations would work best for their companies; these include kitting services, multi-trade services, procurement, and modular services.

In making these determinations, contractors should be asking themselves:

•Why do we want to do more prefabrication?

•What is the total addressable portion of our work mix (today) that could be prefabricated?

•What investments would need to be made to scale our prefabrication capabilities to capture that opportunity?

•When fully optimized, what does the earnings stream from prefabrication look like?

•What does the return on investment look like for the enterprise?

•Do we have alternative investment options for other initiatives in the business? How do those options stack up against our prefabrication ambitions?

•Will prefab make the company better, more profitable, and resilient?

Prefabrication a different kind of business

Prefabrication is a manufacturing endeavor that’s different from building construction. Contractors diving into prefab in a bigger way need to think about whether prefab will be a unique business or separate entity, and how autonomously construction and prefabrication operate? Will prefab services be proprietary or available to other contractors? Will prefab be a profit or cost center? How will manufacturing cost overruns, if there are any, be accounted for?

FMI says that contractors need to establish clear project management lines that encompass how prefabricated products are tracked, stored, and billed for. Tracking labor productivity across prefabrication and field installation is key.

Owners and designers need to buy in more

One of the contractors whom FMI polled mentioned a recent casino and hotel project that required 25% less labor in the field, and cut nearly two months off of its installation time, by using prefabrication methods.

Scheduling is driving prefab demand, says FMI. But expanding that demand depends on acceptance by owners and AEC firms, and right now, that acceptance is middling: only 18% of the contractors polled by FMI said that owner-specific requests drove prefab, and only 10% said that prefab was specified by architects or engineers.

“For the industry to realize substantial gains in prefabrication and productivity, owners and designers need to be a bigger part of the demand equation,” says FMI.

FMI’s study found that the industry still struggles with broad adoption. The biggest challenges to adopting prefab are a project’s design and coordination, stakeholder awareness and education, the mindset and culture of a project’s active players, and the investment in facilities and equipment.

But given current and projected labor force limitations, “it’s clear that prefabrication will need to become part of the solution.” For that to happen, building teams need to demonstrate a bolder vision, strategic planning, commitment to investing, consistent communication, and a proactive engagement by external stakeholders.

Related Stories

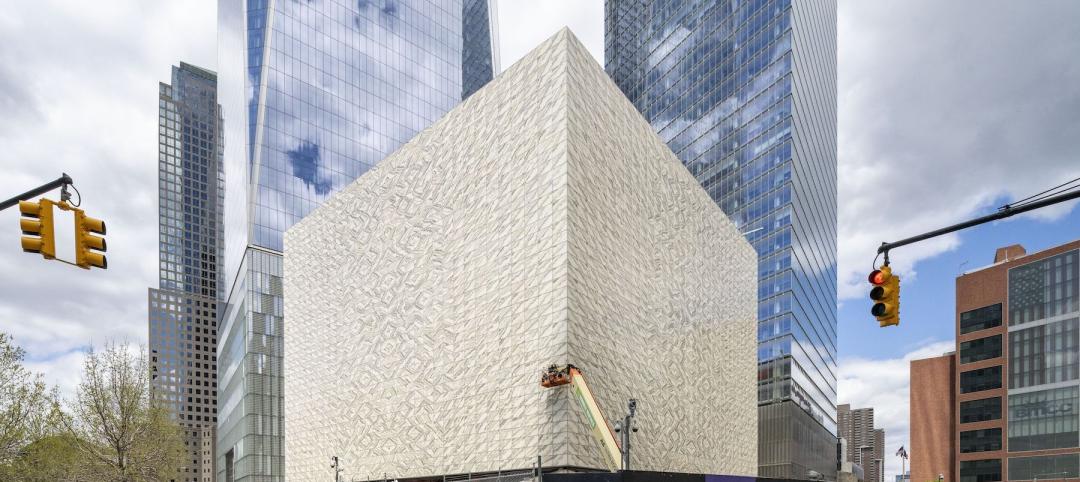

Performing Arts Centers | Mar 9, 2023

Two performing arts centers expand New York’s cultural cachet

A performing arts center under construction and the adaptive reuse for another center emphasize flexibility.

Industry Research | Mar 9, 2023

Construction labor gap worsens amid more funding for new infrastructure, commercial projects

The U.S. construction industry needs to attract an estimated 546,000 additional workers on top of the normal pace of hiring in 2023 to meet demand for labor, according to a model developed by Associated Builders and Contractors. The construction industry averaged more than 390,000 job openings per month in 2022.

Building Team | Mar 8, 2023

Call for Speakers: BD+C’s 2023 Women in Residential + Commercial Construction Conference

The 2023 Women in Residential + Commercial Construction conference event will take place October 25-27 in Nashville, Tenn., and will bring together more than 300 women leaders from all facets of the $1.4 trillion U.S. residential and commercial constructing sector.

Multifamily Housing | Mar 7, 2023

Multifamily housing development in Chicago takes design inspiration from patchwork and quilting

HUB 32, a 65-unit multifamily housing development, will provide affordable housing and community amenities in Chicago’s Garfield Park neighborhood. Brooks + Scarpa’s recently unveiled design takes inspiration from the American tradition of patchwork and quilting.

Industrial Facilities | Mar 6, 2023

The largest planned logistics and business park in North America gets under way in Southern California

The $25 billion World Logistics Center will boost the supply chain capabilities of Southern California and will serve as a distribution center for destinations across the continent.

Adaptive Reuse | Mar 5, 2023

Pittsburgh offers funds for office-to-residential conversions

The City of Pittsburgh’s redevelopment agency is accepting applications for funding from developers on projects to convert office buildings into affordable housing. The city’s goals are to improve downtown vitality, make better use of underutilized and vacant commercial office space, and alleviate a housing shortage.

Student Housing | Mar 5, 2023

Calif. governor Gavin Newsom seeks to reform environmental law used to block student housing

California Gov. Gavin Newsom wants to reform a landmark state environmental law that he says was weaponized by wealthy homeowners to block badly needed housing for students at the University of California, Berkeley.

Green Renovation | Mar 5, 2023

Dept. of Energy offers $22 million for energy efficiency and building electrification upgrades

The Buildings Upgrade Prize (Buildings UP) sponsored by the U.S. Department of Energy is offering more than $22 million in cash prizes and technical assistance to teams across America. Prize recipients will be selected based on their ideas to accelerate widespread, equitable energy efficiency and building electrification upgrades.

Windows and Doors | Mar 5, 2023

2022 North American Fenestration Standard released

The 2022 edition of AAMA/WDMA/CSA 101/I.S.2/A440, “North American Fenestration Standard/Specification for windows, doors, and skylights” (NAFS) has been published. The updated 2022 standard replaces the 2017 edition, part of a continued evolution of the standard to improve harmonization across North America, according to a news release.

AEC Innovators | Mar 3, 2023

Meet BD+C's 2023 AEC Innovators

More than ever, AEC firms and their suppliers are wedding innovation with corporate responsibility. How they are addressing climate change usually gets the headlines. But as the following articles in our AEC Innovators package chronicle, companies are attempting to make an impact as well on the integrity of their supply chains, the reduction of construction waste, and answering calls for more affordable housing and homeless shelters. As often as not, these companies are partnering with municipalities and nonprofit interest groups to help guide their production.