Rising construction materials prices appear to be starting to drive up the price of construction projects, according to an analysis by the Associated General Contractors of America of government data released today. Association officials noted that despite a big jump in what contractors charge for projects, the rise in materials prices is still much higher.

“After being battered by unprecedented price increases for many materials, contractors are finally passing along more of their costs,” said Ken Simonson, the association’s chief economist. “Meanwhile, supply-chain bottlenecks and labor shortages continue to impede contractors’ ability to finish projects.”

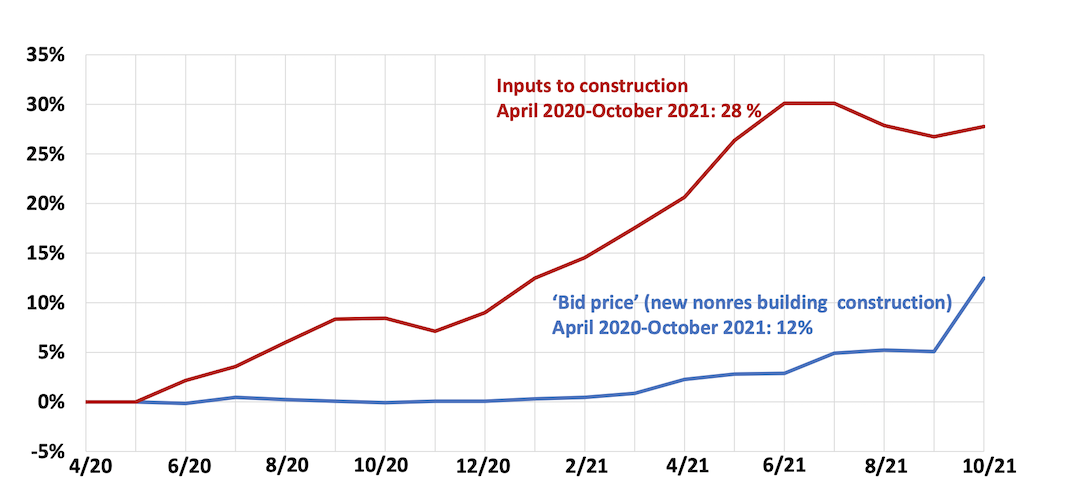

The producer price index for new nonresidential construction—a measure of what contractors say they would charge to erect five types of nonresidential buildings—jumped 7.1% from September to October and 12.6% over the past 12 months. But an index of input prices—the prices that goods producers and service providers such as distributors and transportation firms charged for inputs for nonresidential construction—climbed by an even steeper 21.1% compared to October 2020, including a 1.3% increase since September, Simonson noted.

Many products, as well as trucking services, contributed to the extreme runup in construction costs, Simonson observed. The price index for steel mill products more than doubled, soaring nearly 142% since October 2020. The indexes for both aluminum mill shapes and copper and brass mill shapes jumped more than 37% over 12 months, while the index for plastic construction products rose more than 30%. The index for gypsum products such as wallboard climbed 25% and insulation costs increased 17%. Trucking costs climbed 16.3%. The index for diesel fuel, which contractors buy directly for their own vehicles and off-road equipment and also indirectly through surcharges on deliveries of materials and equipment, doubled over the year.

Association officials urged the Biden administration and Congress to do more to address supply chain backups that are crippling construction firms and the broader economy. These measures include additional tariff relief for key construction materials. They also urged federal officials to explore other options, like waiving hours of service rules so shippers can tackle freight backlogs.

“Supply chain backlogs are clearly one of the biggest threats to the economy recovery,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials need to be more aggressive in taking steps to get key materials moving again so construction firms can continue rebuilding the country.”

View producer price index data. View chart of gap between input costs and bid prices. View the association’s Construction Inflation Alert.

Related Stories

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

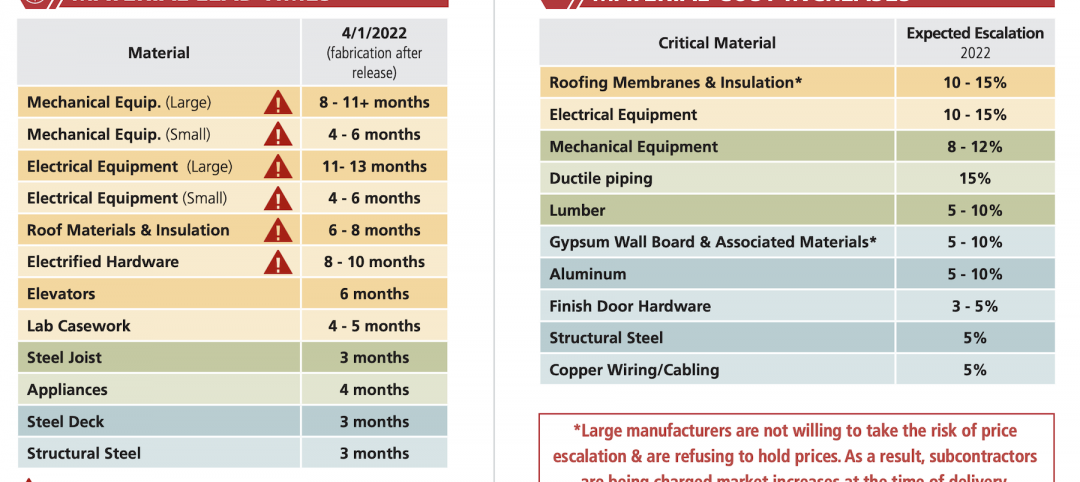

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

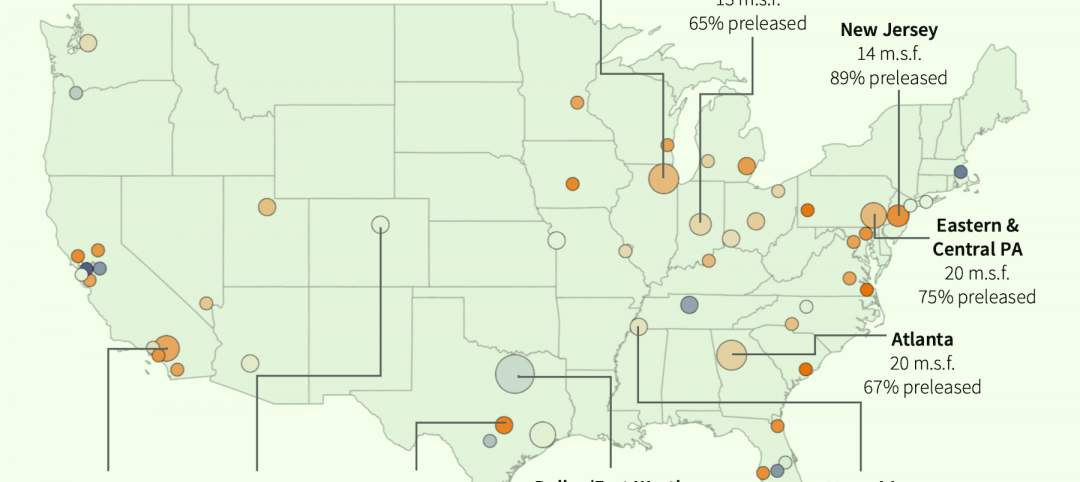

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.