Total construction spending was flat between July and August, as a decrease in nonresidential projects offset continuing gains in residential construction, according to a new analysis of federal construction spending data the Associated General Contractors of America released today. Officials urged the House of Representatives to promptly approve the bipartisan infrastructure bill that passed in the Senate earlier this year, noting that spending on infrastructure in the first eight months of 2021 declined from year-earlier levels.

“Nearly every nonresidential spending segment has deteriorated from already inadequate 2020 levels in the first two-thirds of this year,” said Ken Simonson, the association’s chief economist. “Meanwhile, soaring materials costs mean that fixed public budgets buy even less infrastructure than before.”

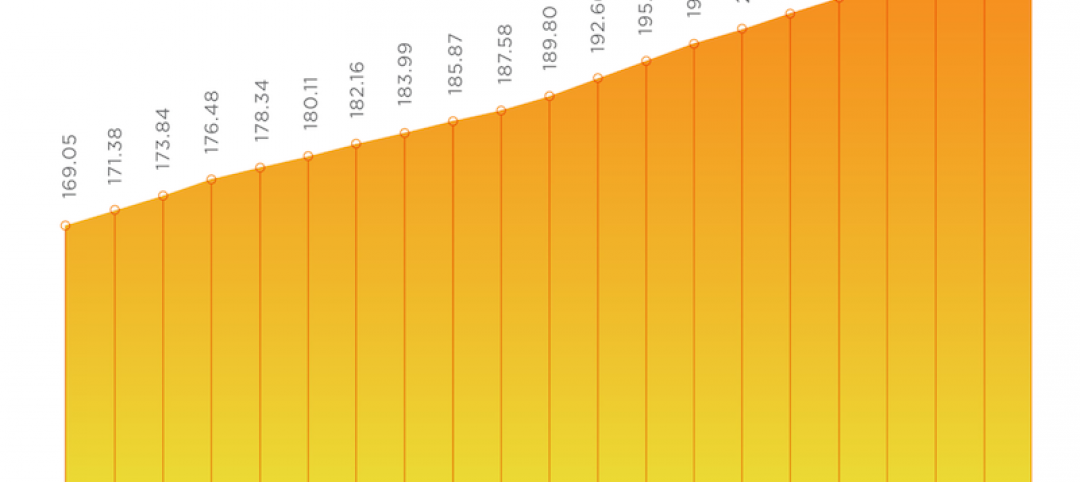

Construction spending in August totaled $1.58 trillion at a seasonally adjusted annual rate, virtually unchanged from July. Year-to-date spending increased 7.0% from the total for January-August 2020. Gains were limited to residential construction, while nonresidential construction spending slipped in August and year-to-date. The residential construction segment climbed 0.4% for the month and 26% year-to-date. Combined private and public nonresidential construction spending dropped 0.4% compared to July and 6.7% over the first eight months of 2021 compared to same interval in 2020.

Most infrastructure categories posted significant year-to-date declines, Simonson pointed out. The largest public infrastructure segment, highway and street construction, was 3.4% lower than in January-August 2020. Spending on public transportation construction slumped 6.5% year-to-date. Investment in sewage and waste disposal structures climbed 3.8%, while funding for public water supply projects slid 1.8% and conservation and development construction plunged 18%.

Other types of nonresidential spending also decreased year-to-date, Simonson added. Combined private and public spending on electric power and oil and gas projects declined 3.6%. Education construction slumped 10.6%. Commercial construction--comprising warehouse, retail, and farm structures--dipped 1.7%. Office spending fell 10.1% and manufacturing construction edged down 0.8%.

Association officials said the nearly universal decline in infrastructure spending demonstrates the urgency of enacting expanded funding for a range of infrastructure project types. They called on the House of Representatives to quickly pass the Bipartisan Infrastructure bill that already passed in the Senate by a wide margin.

“This legislation includes the kind of policy priorities that members of both parties have long claimed to support,” said Stephen E. Sandherr, the association’s chief executive officer. “There is no excuse for holding these projects hostage while sorting out other priorities. Construction workers, businesses, and the public are all losing from delay in passing this legislation.”

Related Stories

Market Data | Jan 29, 2021

The U.S. hotel construction pipeline stands at 5,216 projects/650,222 rooms at year-end 2020

At the end of Q4 ‘20, projects currently under construction stand at 1,487 projects/199,700 rooms.

Multifamily Housing | Jan 27, 2021

2021 multifamily housing outlook: Dallas, Miami, D.C., will lead apartment completions

In its latest outlook report for the multifamily rental market, Yardi Matrix outlined several reasons for hope for a solid recovery for the multifamily housing sector in 2021, especially during the second half of the year.

Market Data | Jan 26, 2021

Construction employment in December trails pre-pandemic levels in 34 states

Texas and Vermont have worst February-December losses while Virginia and Alabama add the most.

Market Data | Jan 19, 2021

Architecture Billings continue to lose ground

The pace of decline during December accelerated from November.

Market Data | Jan 19, 2021

2021 construction forecast: Nonresidential building spending will drop 5.7%, bounce back in 2022

Healthcare and public safety are the only nonresidential construction sectors that will see growth in spending in 2021, according to AIA's 2021 Consensus Construction Forecast.

Market Data | Jan 13, 2021

Atlanta, Dallas seen as most favorable U.S. markets for commercial development in 2021, CBRE analysis finds

U.S. construction activity is expected to bounce back in 2021, after a slowdown in 2020 due to challenges brought by COVID-19.

Market Data | Jan 13, 2021

Nonres construction could be in for a long recovery period

Rider Levett Bucknall’s latest cost report singles out unemployment and infrastructure spending as barometers.

Market Data | Jan 13, 2021

Contractor optimism improves as ABC’s Construction Backlog inches up in December

ABC’s Construction Confidence Index readings for sales, profit margins, and staffing levels increased in December.

Market Data | Jan 11, 2021

Turner Construction Company launches SourceBlue Brand

SourceBlue draws upon 20 years of supply chain management experience in the construction industry.

Market Data | Jan 8, 2021

Construction sector adds 51,000 jobs in December

Gains are likely temporary as new industry survey finds widespread pessimism for 2021.