Construction spending increased by 1.4% in August as strong gains in residential construction outweighed decreases in most private nonresidential segments and many public categories, according to an analysis by the Associated General Contractors of America of government data released today. Association officials cautioned that nonresidential construction demand will likely continue to stagnate without new federal measures to offset the economic impacts from the coronavirus.

“The August spending report shows a stark divide between housing and nonresidential markets that appears likely to widen over the coming months,” said Ken Simonson, the association’s chief economist. “With steadily rising business closures and worker layoffs, and growing budget gaps for state and local governments, project cancellations are likely to mount and new starts will dwindle.”

Construction spending in August totaled $1.41 trillion at a seasonally adjusted annual rate, an increase of 1.4% from July’s upwardly revised total. Residential spending jumped by 3.7%, while private and public nonresidential spending inched down by a combined 0.1%.

Private nonresidential construction spending contracted by 0.3% from July to August, with decreases in nine out of 11 categories. The two largest private nonresidential segments, power construction and commercial construction—comprising retail, warehouse and farm structures—each shrank by 1.1%. Among other large segments, manufacturing construction rose 2.2% and office construction slipped 0.3%.

Public construction spending edged up 0.1% in August but eight of 13 categories declined. Despite the increase in August, public construction spending has trended down by 2.5% from its high point in March.

Private residential construction spending increased by 3.7% in August, powered by a 5.5% jump in single-family homebuilding and a 3.0% gain in residential improvements. In contrast, new multifamily construction spending dipped by 0.1% from July.

Association officials noted that demand for nonresidential construction was being impacted by broader economic challenges brought about by the coronavirus. These challenges are impacting demand for many commercial projects while also impacting state and local construction budgets. The construction officials urged Congress and the White House to work together to enact new recovery measures to help boost economic activity and demand for construction.

“One of the biggest challenges facing the construction industry is the lack of demand for many new types of commercial and local infrastructure projects, especially after the current crop of projects is completed,” said Stephen E. Sandherr, the association’s chief executive officer. “Washington officials can give a needed boost to construction demand and employment by boosting infrastructure and putting in place liability protections for firms that are protecting workers from the coronavirus.”

Related Stories

Market Data | Apr 13, 2021

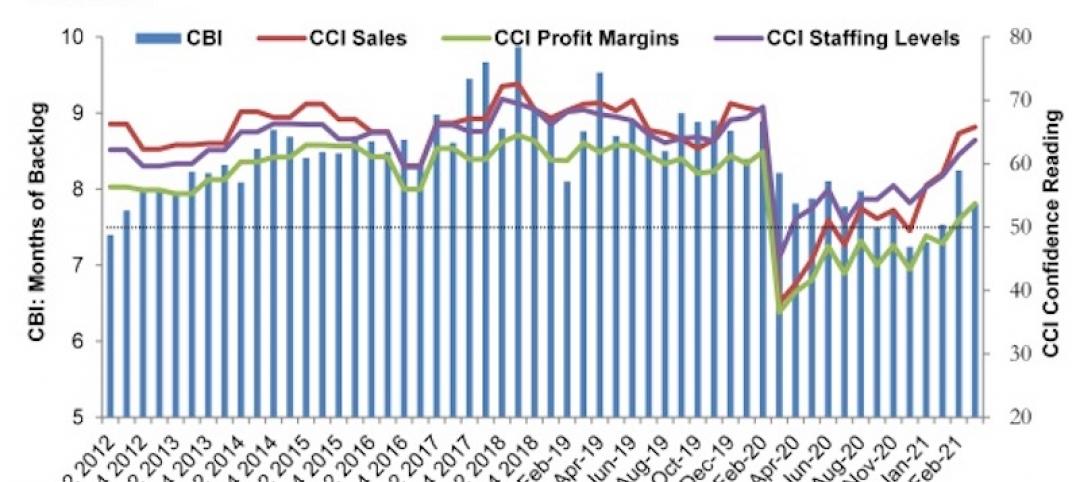

ABC’s Construction Backlog slips in March; Contractor optimism continues to improve

The Construction Backlog Indicator fell to 7.8 months in March.

Market Data | Apr 9, 2021

Record jump in materials prices and supply chain distributions threaten construction firms' ability to complete vital nonresidential projects

A government index that measures the selling price for goods used construction jumped 3.5% from February to March.

Contractors | Apr 9, 2021

Construction bidding activity ticks up in February

The Blue Book Network's Velocity Index measures month-to-month changes in bidding activity among construction firms across five building sectors and in all 50 states.

Industry Research | Apr 9, 2021

BD+C exclusive research: What building owners want from AEC firms

BD+C’s first-ever owners’ survey finds them focused on improving buildings’ performance for higher investment returns.

Market Data | Apr 7, 2021

Construction employment drops in 236 metro areas between February 2020 and February 2021

Houston-The Woodlands-Sugar Land and Odessa, Texas have worst 12-month employment losses.

Market Data | Apr 2, 2021

Nonresidential construction spending down 1.3% in February, says ABC

On a monthly basis, spending was down in 13 of 16 nonresidential subcategories.

Market Data | Apr 1, 2021

Construction spending slips in February

Shrinking demand, soaring costs, and supply delays threaten project completion dates and finances.

Market Data | Mar 26, 2021

Construction employment in February trails pre-pandemic level in 44 states

Soaring costs, supply-chain problems jeopardize future jobs.

Market Data | Mar 24, 2021

Architecture billings climb into positive territory after a year of monthly declines

AIA’s ABI score for February was 53.3 compared to 44.9 in January.

Market Data | Mar 22, 2021

Construction employment slips in 225 metros from January 2020 to January 2021

Rampant cancellations augur further declines ahead.