Construction employment continued to show strength across much of the United States through November 2017, when there were 191,000 more workers in the construction industry than during the same month a year earlier, and the construction unemployment rate fell by 0.7% to 5%, the lowest it’s been on record for the month of November, according to estimates released yesterday by Associated Builders and Contractors, a national trade group representing more than 21,000 members.

However, the industry still struggles with labor shortages that could be inhibiting investment and new construction.

During the first nine months of 2017, month-by-month employment growth was “minimal,” due primarily to “historically low unemployment” that limited the new construction talent pool, according to JLL’s Construction Outlook for the third quarter of 2017, which the market research and consulting firm released late last month.

During the third quarter of 2017, construction-related spending inched up by only 1.9% from the same period in 2016. “While topline spending is still increasing, consecutive quarters are demonstrating smaller and smaller gains over past years—underlining the trajectory towards a mature and stable industry,” JLL writes. Percentage growth of year-over-year spending decreased for nine out of the preceding 11 months, but was still above zero, “pointing to a tapering growth curve.”

With qualified construction workers being harder to find, labor costs were volatile through the first nine months of last year. Image: JLL Research

Citing Census Bureau estimates, Associated Builders and Contractors posted that nonresidential construction spending declined in November by 1.3%, to $719.2 billion, compared to the same month a year earlier. Private nonres spending was down by 3.1%, while public-sector nonres spending grew by 1.7%. The gainers included commercial, educational, lodging, transportation, healthcare, and public safety. Manufacturing construction took the biggest hit, down 15.6%.

Commercial real estate has proven over the past several years that it can perform well regardless of how the economy in general is growing. “Right now we see little in fundamentals to cause concern about real estate as an asset class,” JLL writes.

Public construction, infrastructure and public works projects picked up steam during the third quarter of 2017, while single-family home construction grew at nearly double-digit annualized growth, which is expected to continue in 2018. Multifamily starts, on the other hand, dipped.

While the groundbreaking of large scale private commercial projects began to scale back due to stretched-out timelines, commercial renovation and fit-out work strengthened, and should prevail through the next several quarters and beyond into 2019, JLL predicts.

The cost of building slowed in the third quarter, up by just 3% from third quarter 2016. But it still grew faster than construction spending primarily because of increasing labor costs. (Wages grew by nearly 3.4%, on an annualized basis, in the third quarter of 2017.) Indeed, JLL expects labor shortages to persist through 2018, at least, and for construction costs to be up another 3% this year. JLL expects wage growth to accelerate, potentially hitting 5% or higher during peak building seasons.

The severe weather events that hit certain areas of the country had a surprisingly minor impact on the availability of most building materials. Nevertheless, materials costs rose by 3% in the third quarter compared to the same period a year ago, and those costs “are beginning to outpace current demand,” says JLL. Impending tariffs on Canadian lumber imports could jack up lumber prices for U.S. purchasers by 20% this year.

Manpower shortages, and the prospect that labor and products will cost more, could finally push the construction industry to embrace technology to a greater degree than it has done so to this point. JLL sees BIM, artificial intelligence and big data, and prefab and offsite construction as the three technologies that show the most promise this year.

Related Stories

| Nov 21, 2014

Rental apartment construction soars to 27-year high: WSJ report

The multifamily sector is now outpacing the peak construction rate in the previous housing cycle, in 2006, according to the WSJ.

| Nov 21, 2014

Nonresidential Construction Index rises in fourth quarter

There are a number of reasons for optimism among respondents of FMI's quarterly Nonresidential Construction Index survey, including healthier backlogs and low inflation.

| Nov 21, 2014

NCARB: Number of architects in U.S. grows 1.6% in 2014, surpasses 107,500

The architecture profession continues to grow along with a gradually recovering economy, based on the results of the 2014 Survey of Architectural Registration Boards, conducted by the National Council of Architectural Registration Boards.

| Nov 20, 2014

Lean Led Design: How Building Teams can cut costs, reduce waste in healthcare construction projects

Healthcare organizations are under extreme pressure to reduce costs, writes CBRE Healthcare's Lora Schwartz. Tools like Lean Led Design are helping them cope.

| Nov 19, 2014

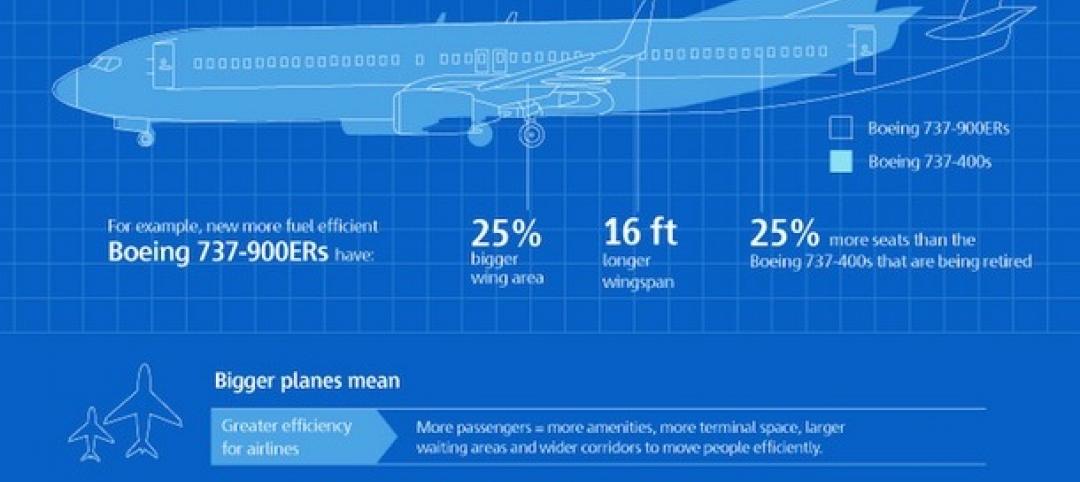

The evolution of airport design and construction [infographic]

Safety, consumer demand, and the new economics of flight are three of the major factors shaping how airlines and airport officials are approaching the need for upgrades and renovations, writes Skanska USA's MacAdam Glinn.

| Nov 19, 2014

Construction unemployment hits eight-year low, some states struggle to find qualified labor

The construction industry, whose workforce was decimated during the last recession, is slowly getting back on its feet. However, in certain markets—especially those where oil drilling and production have been prospering—construction workers can still be scarce.

Sponsored | | Nov 19, 2014

3 technology trends on the horizon

As technology continues to evolve exponentially, construction firms have ongoing opportunities to enhance the quality, speed, and efficiency of building projects and processes. SPONSORED CONTENT

Sponsored | | Nov 19, 2014

Long-life coatings vs. long-life screws

Are you concerned with the long-life protection of your metal building project? SPONSORED CONTENT

Sponsored | | Nov 19, 2014

Build green while you work green

Leading general contractors, including Skanska USA and Turner Construction, are implementing sustainable modular jobsite offices throughout the country. SPONSORED CONTENT

Sponsored | | Nov 19, 2014

Fire resistive, blast-resistant glazing: Where security, safety, and transparency converge

Security, safety and transparency don’t have to be mutually exclusive thanks to new glazing technology designed to support blast and fire-resistant secure buildings. SPONSORED CONTENT