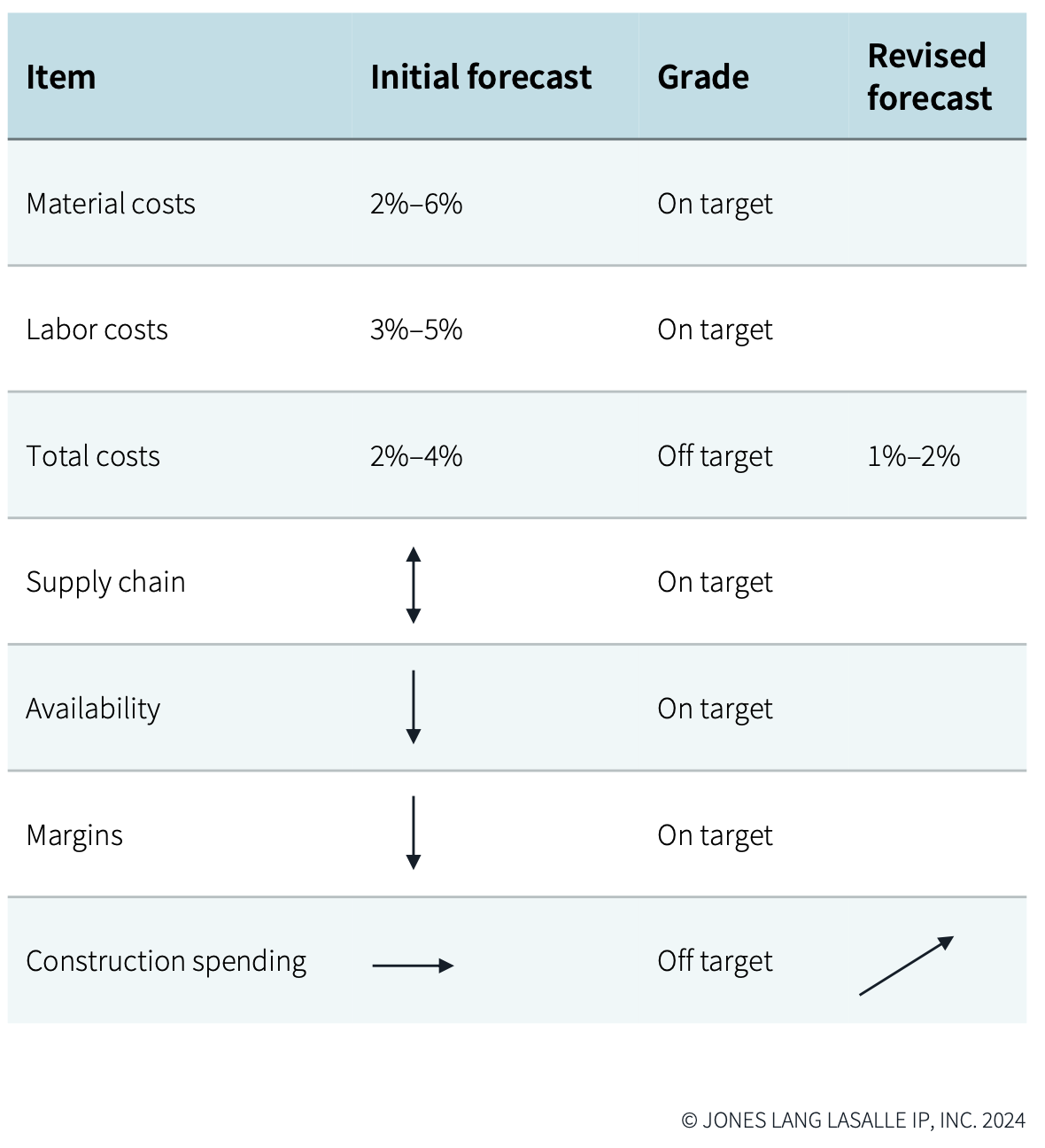

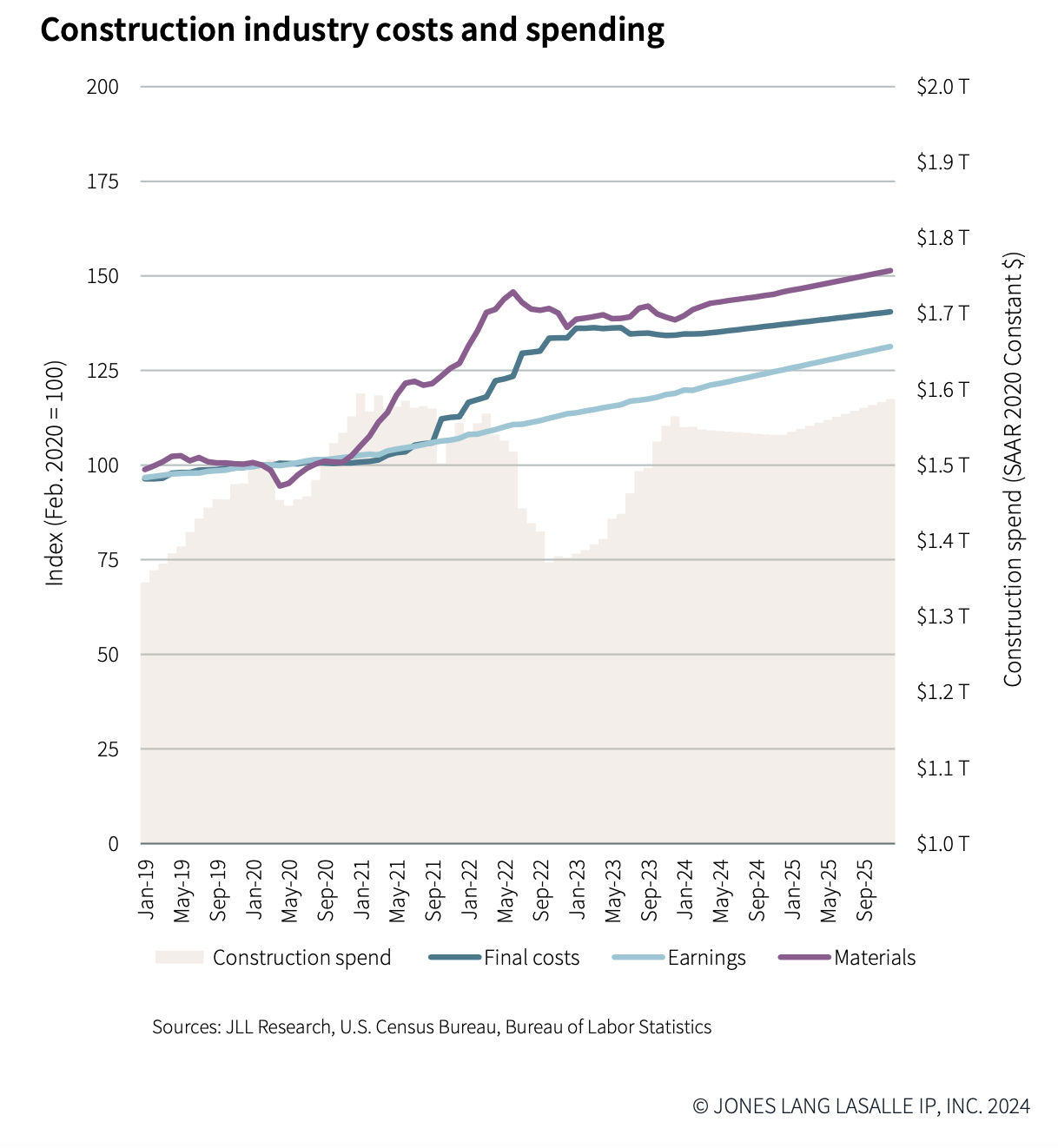

In the first half of 2024, construction costs stabilized. And through the remainder of this year, total cost growth is projected to be modest, and matched by an overall increase in construction spending.

That prediction can be found in JLL’s 2024 Midyear Construction Update and Reforecast, released today. JLL bases its market analyses on insights gleaned from its global team of more than 550 research professionals who track economic and property trends and forecast future conditions in over 60 countries.

The Update acknowledges that the industry has been adjusting to new patterns of demand, as not all sectors are performing equally well. Interest in projects in general has increased, lending regulations are not tightening, and spending is up more than originally anticipated.

Still, the trajectory of interest rates “continues to elude forecasters,” observes JLL, “making ‘higher for longer’ the correct operating paradigm.” Yet despite financial constraints, JLL expects cost growth and development to continue. Stakeholders need to account for maturing debt, lease expirations, and emerging global advantages as they navigate the realities of sustained higher interest rates and varied local outcomes.

One area of opportunity for AEC firms, under these circumstances, is resilient and sustainable design and construction, says JLL.

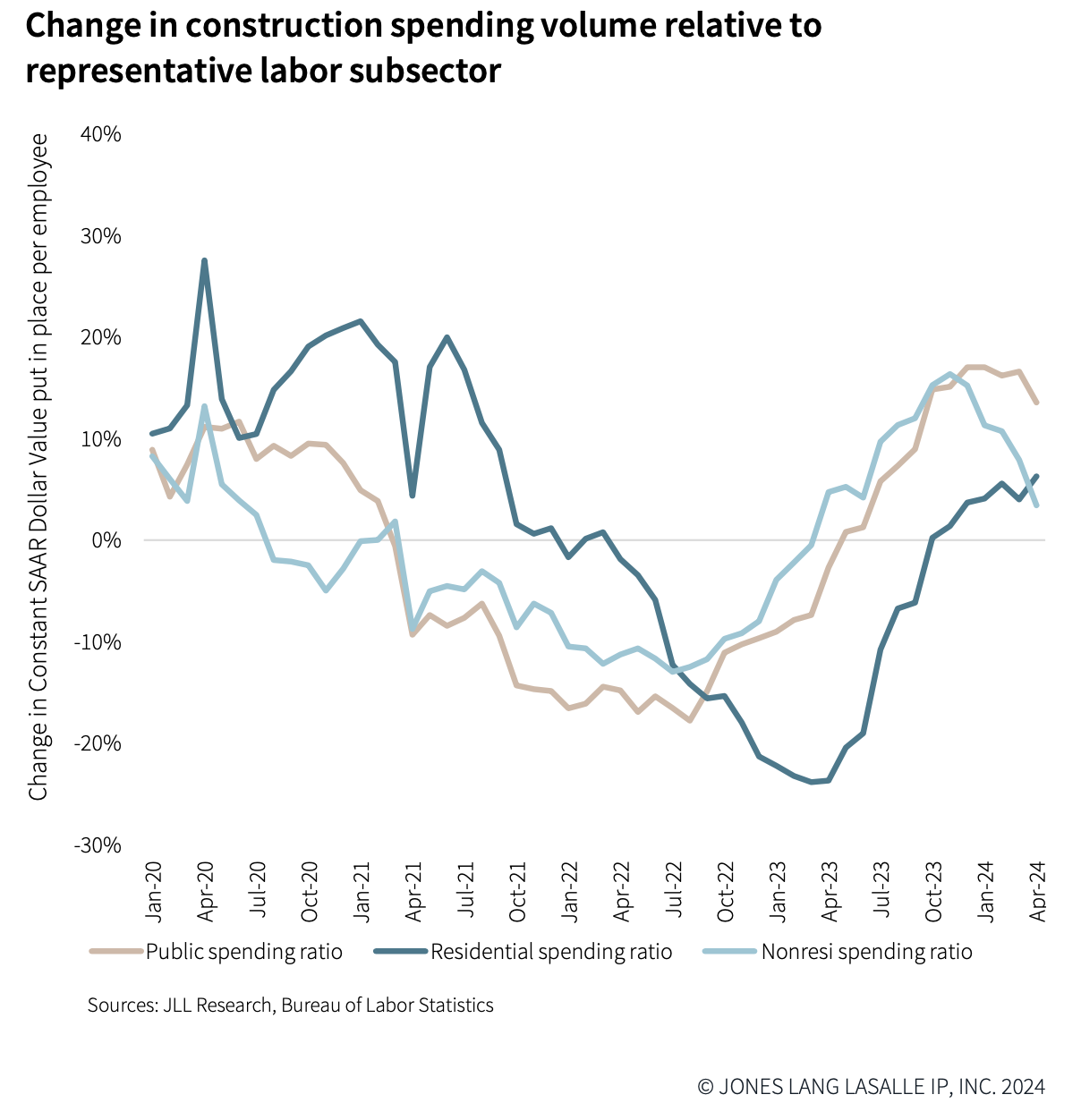

Spending is outpacing employment availability

With these positive outlooks, construction employment has risen, along with compensation. Labor costs driven by limited availability continue to provide a growth floor for broader industry costs. JLL states that its predictions of wage growth at moderately higher than historical rates remain unchanged.

This is because construction spending has been outpacing employment. “Relative strain in production value required per employee is returning to pre-pandemic points [but] with a very different workforce, and remains heavily concentrated in select metros,” JLL states.

While overall growth has been restrained to average below expectations, volatility persists, notably on the cost of materials. Demand for finished goods remains high, especially for MEP products as more sectors electrify and upgrade their operating systems.

Staples of demand are changing and, with them, expectations for price moderation and normal market behavior. For example, bid prices for staple materials such as metals and concrete are at their lowest average monthly movement since 2020. JLL observes that price stability reflects efforts to develop backlogs and secure work and margins. But with global events being so unpredictable, this current period of price stability, says JLL, is transient “and likely short-lived.”

Big question: continued infrastructure investment

JLL believes that market participants, namely developers, suppliers, and AEC firms, are going to hold their current growth pace over the short term. Its Update advises stakeholders to engage the nuances of local markets and design demands “as early as possible” to determine market direction and to navigate disruptions.

So far, firms have been able to compress their margins, mainly because material costs have trended lower than expected, which in turn has allowed for higher-than-anticipated construction spending. But labor challenges continue unabated and are expected to exert pressure on costs into 2025 and beyond.

Consequently, JLL has revised some of its forecasts for the remainder of 2024, most prominently that total costs would increase just 1-2% for the year, and that construction spending (which JLL previously thought would be flat) will increase.

JLL notes, too, that aggregate materials, currently on the low end of price increases, might experience more volatility. JLL also states that anticipating spending increases—and the price floor that such demand would set—will depend on continued public investment in infrastructure and other construction projects.

Related Stories

Market Data | Mar 22, 2017

After a strong year, construction industry anxious about Washington’s proposed policy shifts

Impacts on labor and materials costs at issue, according to latest JLL report.

Market Data | Mar 22, 2017

Architecture Billings Index rebounds into positive territory

Business conditions projected to solidify moving into the spring and summer.

Market Data | Mar 15, 2017

ABC's Construction Backlog Indicator fell to end 2016

Contractors in each segment surveyed all saw lower backlog during the fourth quarter, with firms in the heavy industrial segment experiencing the largest drop.

Market Data | Feb 28, 2017

Leopardo’s 2017 Construction Economics Report shows year-over-year construction spending increase of 4.2%

The pace of growth was slower than in 2015, however.

Market Data | Feb 23, 2017

Entering 2017, architecture billings slip modestly

Despite minor slowdown in overall billings, commercial/ industrial and institutional sectors post strongest gains in over 12 months.

Market Data | Feb 16, 2017

How does your hospital stack up? Grumman/Butkus Associates 2016 Hospital Benchmarking Survey

Report examines electricity, fossil fuel, water/sewer, and carbon footprint.

Market Data | Feb 1, 2017

Nonresidential spending falters slightly to end 2016

Nonresidential spending decreased from $713.1 billion in November to $708.2 billion in December.

Market Data | Jan 31, 2017

AIA foresees nonres building spending increasing, but at a slower pace than in 2016

Expects another double-digit growth year for office construction, but a more modest uptick for health-related building.

High-rise Construction | Jan 23, 2017

Growth spurt: A record-breaking 128 buildings of 200 meters or taller were completed in 2016

This marks the third consecutive record-breaking year for building completions over 200 meters.

Market Data | Jan 18, 2017

Fraud and risk incidents on the rise for construction, engineering, and infrastructure businesses

Seven of the 10 executives in the sector surveyed in the report said their company fell victim to fraud in the past year.