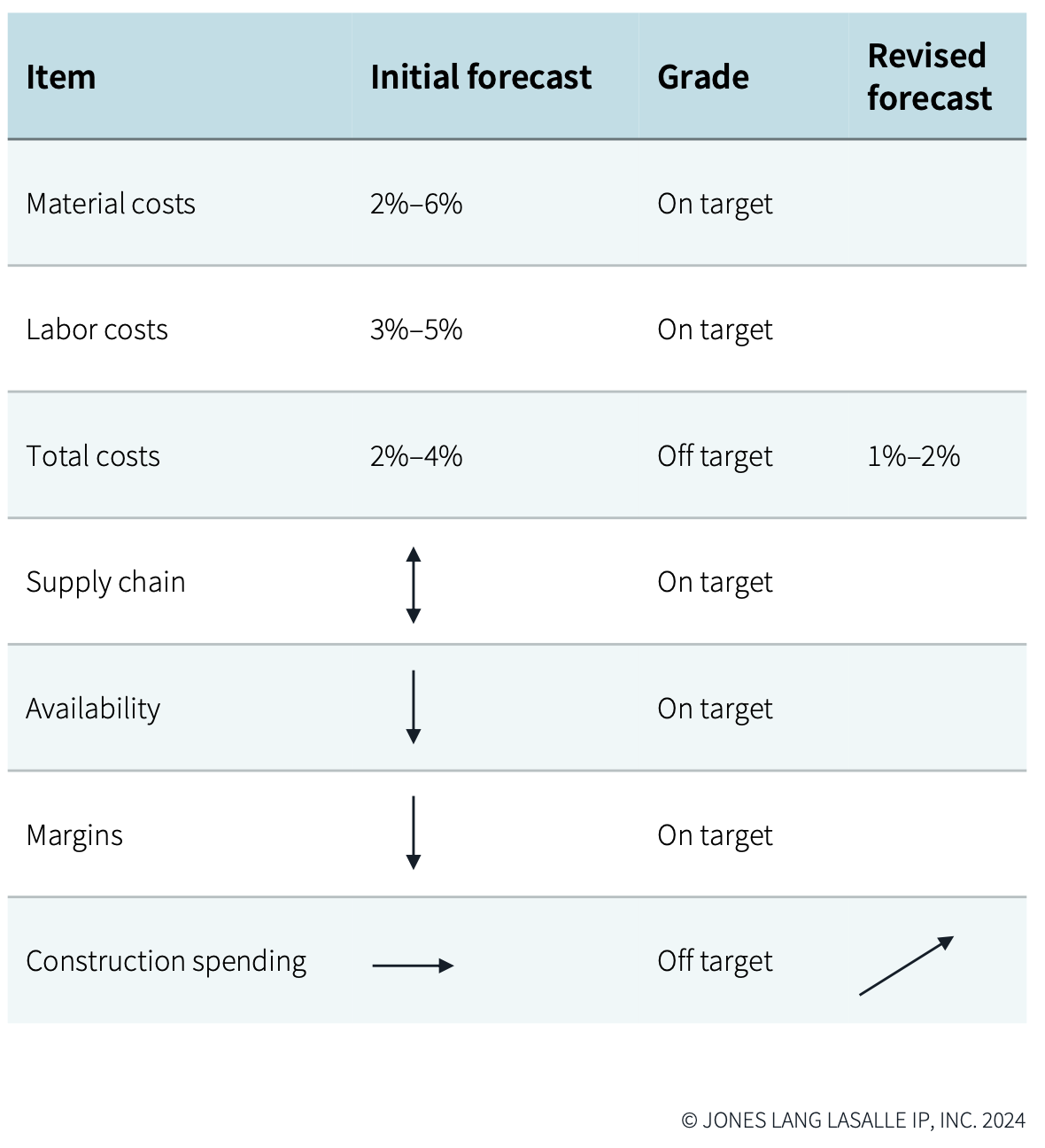

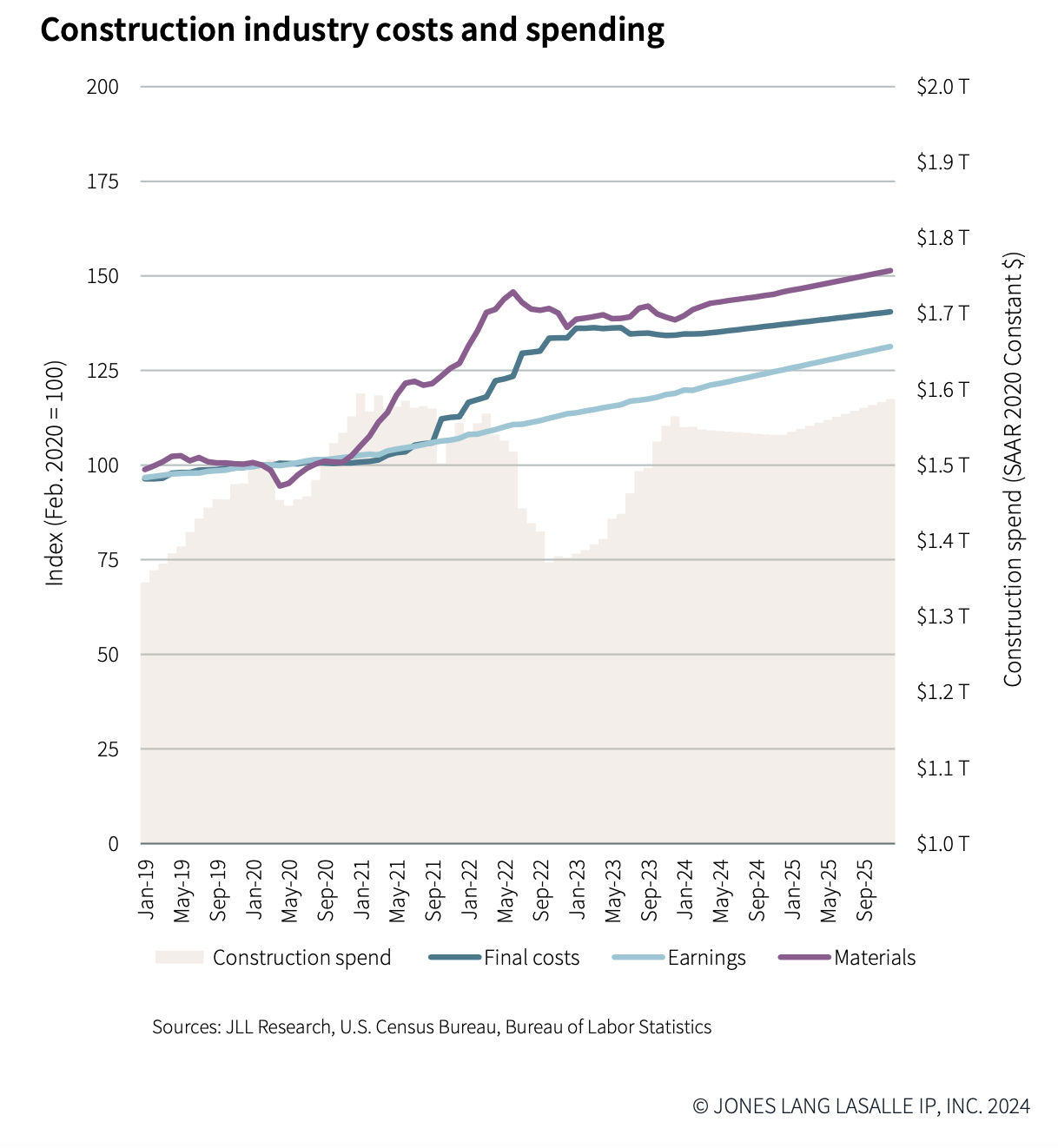

In the first half of 2024, construction costs stabilized. And through the remainder of this year, total cost growth is projected to be modest, and matched by an overall increase in construction spending.

That prediction can be found in JLL’s 2024 Midyear Construction Update and Reforecast, released today. JLL bases its market analyses on insights gleaned from its global team of more than 550 research professionals who track economic and property trends and forecast future conditions in over 60 countries.

The Update acknowledges that the industry has been adjusting to new patterns of demand, as not all sectors are performing equally well. Interest in projects in general has increased, lending regulations are not tightening, and spending is up more than originally anticipated.

Still, the trajectory of interest rates “continues to elude forecasters,” observes JLL, “making ‘higher for longer’ the correct operating paradigm.” Yet despite financial constraints, JLL expects cost growth and development to continue. Stakeholders need to account for maturing debt, lease expirations, and emerging global advantages as they navigate the realities of sustained higher interest rates and varied local outcomes.

One area of opportunity for AEC firms, under these circumstances, is resilient and sustainable design and construction, says JLL.

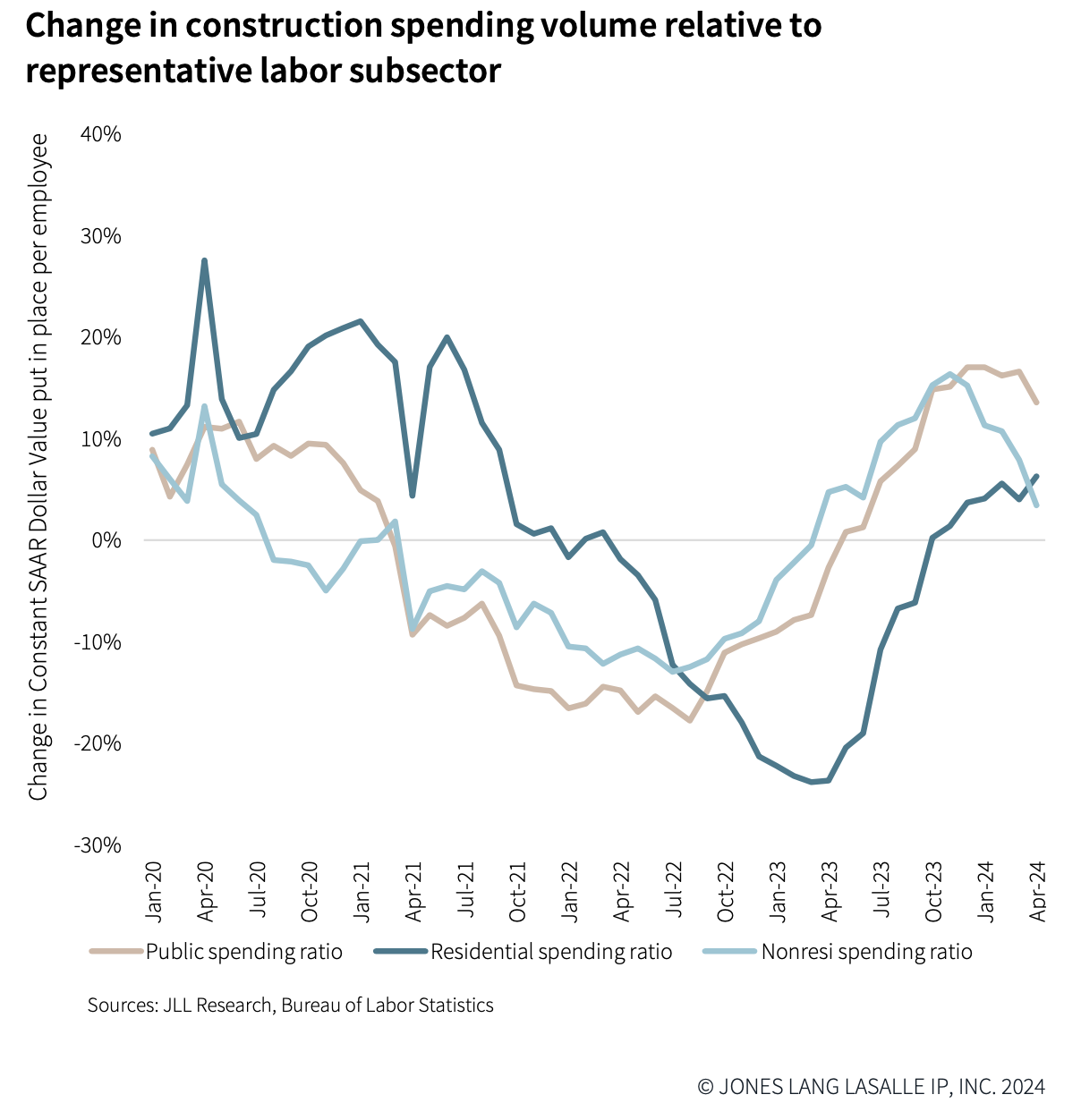

Spending is outpacing employment availability

With these positive outlooks, construction employment has risen, along with compensation. Labor costs driven by limited availability continue to provide a growth floor for broader industry costs. JLL states that its predictions of wage growth at moderately higher than historical rates remain unchanged.

This is because construction spending has been outpacing employment. “Relative strain in production value required per employee is returning to pre-pandemic points [but] with a very different workforce, and remains heavily concentrated in select metros,” JLL states.

While overall growth has been restrained to average below expectations, volatility persists, notably on the cost of materials. Demand for finished goods remains high, especially for MEP products as more sectors electrify and upgrade their operating systems.

Staples of demand are changing and, with them, expectations for price moderation and normal market behavior. For example, bid prices for staple materials such as metals and concrete are at their lowest average monthly movement since 2020. JLL observes that price stability reflects efforts to develop backlogs and secure work and margins. But with global events being so unpredictable, this current period of price stability, says JLL, is transient “and likely short-lived.”

Big question: continued infrastructure investment

JLL believes that market participants, namely developers, suppliers, and AEC firms, are going to hold their current growth pace over the short term. Its Update advises stakeholders to engage the nuances of local markets and design demands “as early as possible” to determine market direction and to navigate disruptions.

So far, firms have been able to compress their margins, mainly because material costs have trended lower than expected, which in turn has allowed for higher-than-anticipated construction spending. But labor challenges continue unabated and are expected to exert pressure on costs into 2025 and beyond.

Consequently, JLL has revised some of its forecasts for the remainder of 2024, most prominently that total costs would increase just 1-2% for the year, and that construction spending (which JLL previously thought would be flat) will increase.

JLL notes, too, that aggregate materials, currently on the low end of price increases, might experience more volatility. JLL also states that anticipating spending increases—and the price floor that such demand would set—will depend on continued public investment in infrastructure and other construction projects.

Related Stories

Market Data | Mar 16, 2021

Construction employment in January lags pre-pandemic mark in 42 states

Canceled projects, supply-chain woes threaten future jobs.

Market Data | Mar 15, 2021

Rising materials prices and supply chain disruptions are hurting many construction firms

The same firms are already struggling to cope with pandemic impacts.

Market Data | Mar 11, 2021

Soaring materials costs, supply-chain problems, and project cancellations continue to impact construction industry

Costs and delayed deliveries of materials, parts, and supplies are vexing many contractors.

Market Data | Mar 8, 2021

Construction employment declines by 61,000 in February

Association officials urge congress and Biden administration to focus on new infrastructure funding.

Market Data | Mar 2, 2021

Construction spending rises in January as private nonresidential sector stages rare gain

Private nonresidential market shrinks 10% since January 2020 with declines in all 11 segments.

Market Data | Feb 24, 2021

2021 won’t be a growth year for construction spending, says latest JLL forecast

Predicts second-half improvement toward normalization next year.

Market Data | Feb 23, 2021

Architectural billings continue to contract in 2021

AIA’s Architecture Billings Index (ABI) score for January was 44.9 compared to 42.3 in December.

Healthcare Facilities | Feb 18, 2021

The Weekly show, Feb 18, 2021: What patients want from healthcare facilities, and Post-COVID retail trends

This week on The Weekly show, BD+C editors speak with AEC industry leaders from JLL and Landini Associates about what patients want from healthcare facilities, based on JLL's recent survey of 4,015 patients, and making online sales work for a retail sector recovery.

Market Data | Feb 17, 2021

Soaring prices and delivery delays for lumber and steel squeeze finances for construction firms already hit by pandemic

Association officials call for removing tariffs on key materials to provide immediate relief for hard-hit contractors and exploring ways to expand long-term capacity for steel, lumber and other materials,

Market Data | Feb 9, 2021

Construction Backlog and contractor optimism rise to start 2021, according to ABC member survey

Despite the monthly uptick, backlog is 0.9 months lower than in January 2020.