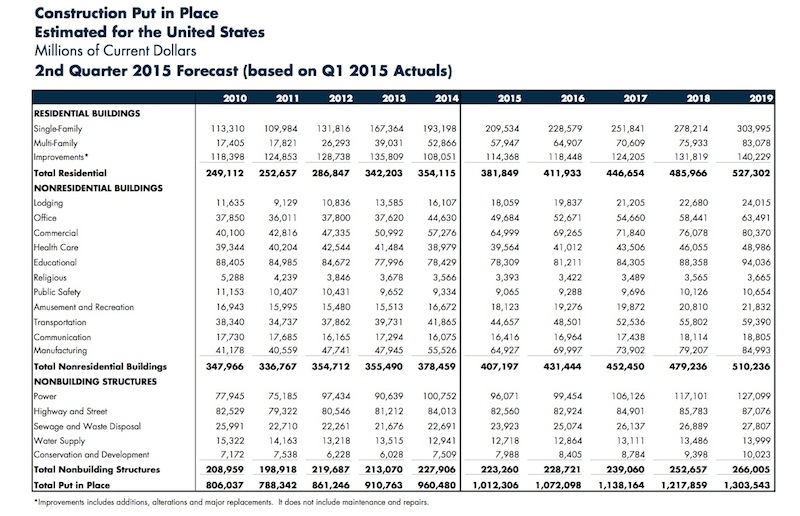

The United States is on track to end this year with its highest level of construction put in place since 2008, a total that, if achieved, would represent nearly 7% of the country’s GDP.

However, construction has slowed of late, according to FMI Corporation, the management and investment consultant. In its Q2 Construction Outlook, FMI estimates construction in place this year would rise 5% to $1.012 trillion. In the first quarter, FMI had projected an 8% annualized gain.

FMI estimates the nonresidential building portion of total construction to expand by 7.6% to $407.2 billion in 2015, and to keep growing through 2019, when it should reach $510.2 billion. However, with housing also expected to recover strongly during this period, nonresidential building’s share of total construction put in place would fall in 2019 to 39.1%, from 40.2% in 2015.

Construction spending in general “continues to build on the rapid growth experienced in the industry last year,” observes Chris Daum, FMI’s senior managing director and president of Investment Banking. FMI’s latest report looks at 17 sectors. Here are some highlights:

• Don’t anticipate much from the two big-ticket sectors, Healthcare and Education, says FMI.

Even with 2.5 million students expected to enroll over the next four year, FMI doesn’t see Education growing in 2015. “One of the biggest hurdles to new construction continues to be state and local budgets,” it writes, adding that there is likely to be “significantly less” state funding for K-12 schools.”

Healthcare should fare a little better, growing by 2% in 2015, and 4% in 2016 to $41 billion. But a “difficult funding environment,” along with changes to construction delivery methods, poses challenges. One trend FMI identifies is toward rebuilding existing facilities using modern hospital design and allow for greater use of technology.

• Manufacturing: After a double-digit gain in 2014, FMI expects manufacturing construction to increase by 17% this year, and then slow to an 8% increase in 2016. It cautions that manufacturing capital construction is highly cyclical when markets reach a state of overcapacity, as some petrochemical products are expected to do in the next few years after a spate of building.

• Amusement/recreation: This section grew by 7% in 2014, and should top that at 9% in 2015. Several major sports stadiums are under construction, and a number of smaller towns and colleges are improving their sports facilities. States also continue to welcome gaming in hopes of increasing their tax bases. A new mixed-use development model combines multiple entertainment venues and shopping into an overall plan.

• Lodging: This sector will be a bright spot, growing by 19% in 2015, and by 12% in 2016, before slowing to 7% in 2019. To buttress its projections, FMI quotes from Lodging Econometrics’ May 2015 reports, which notes that there are 3,885 projects with 488,230 rooms in the construction pipeline, “with the last three quarters posting Year-Over-Year gains of 20% or greater.”

• Office: This sector is benefiting from improving employment levels, and should see 11% growth in 2015, albeit a bit slower than the 19% it hit in 2014.

• Commercial: Capturing what’s going on in retail construction, this sector is expected to grow by 13% to $69 billion this year, but be flat in 2016. “Consumers remain relatively confident about the economy, but they are also remaining conservative in their discretionary spending, at least until wage recovery improves,” FMI writes.

• Religious: What growth there is will likely be in renovation, as new congregations move into vacated retail space or reoccupy church buildings abandoned by other faiths. FMI thinks this sector could be flatlining, and quotes statistics from Pew Research Center that show the percentage of adults (ages 18 and older) who describe themselves as Christians dropping by nearly eight percentage points in just seven years through 2014. Over that same period, the percentage of Americans who are religiously unaffiliated jumped by more than six points, to 22.8%

• Transportation: After registering 5% growth in 2014, transportation is expected to add 7% for 2015 to $44.7 billion. But this sector remains heavily dependent on government support that is never a certainty.

Related Stories

| Aug 14, 2013

Green Building Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest green design and construction firms.

| Aug 14, 2013

Military Construction Report [2013 Giants 300 Report]

Building Design+Construction's rankings of the nation's largest military sector design and construction firms, as reported in the 2013 Giants 300 Report.

| Aug 13, 2013

DPR's Phoenix office, designed by SmithGroupJJR, affirmed as world's largest ILFI-certified net-zero facility

The new Phoenix Regional Office of DPR Construction, designed by SmithGroupJJR, has been officially certified as a Net Zero Energy Building by the International Living Future Institute (ILFI). It’s the largest building in the world to achieve Net Zero Energy Building Certification through the Institute to date.

| Aug 13, 2013

USGBC joins forces with Green Sports Alliance to promote sustainable venues

The U.S. Green Building Council (USGBC) has announced a collaboration with the Green Sports Alliance, a prominent nonprofit organization supporting the development and promotion of green building initiatives in professional and collegiate sports.

| Aug 8, 2013

Energy research animates science sector [2013 Giants 300 Report]

After an era of biology-oriented spending—largely driven by Big Pharma and government concerns about bioterrorism—climate change is reshaping priorities in science and technology construction.

| Aug 8, 2013

Top Science and Technology Sector Engineering Firms [2013 Giants 300 Report]

Affiliated Engineers, Middough, URS top Building Design+Construction's 2013 ranking of the largest science and technology sector engineering and engineering/architecture firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Architecture Firms [2013 Giants 300 Report]

HDR, Perkins+Will, HOK top Building Design+Construction's 2013 ranking of the largest science and technology sector architecture and architecture/engineering firms in the U.S.

| Aug 8, 2013

Top Science and Technology Sector Construction Firms [2013 Giants 300 Report]

Skanska, DPR, Suffolk top Building Design+Construction's 2013 ranking of the largest science and technology sector contractors and construction management firms in the U.S.

| Aug 8, 2013

Level of Development: Will a new standard bring clarity to BIM model detail?

The newly released LOD Specification document allows Building Teams to understand exactly what’s in the BIM model they’re being handed.

| Aug 8, 2013

Vertegy spins off to form independent green consultancy

St. Louis-based Vertegy has announced the formation of Vertegy, LLC, transitioning into an independent company separate from the Alberici Enterprise. The new company was officially unveiled Aug. 1, 2013