??Construction growth is looking up, according to the Winter 2013 release of the periodic report Construction Economics, authored by Gilbane Building Company. Construction spending for 2013 will finish the year 5% higher than 2012. All of the growth will be attributed to residential construction. However, the Dodge Momentum Index, a leading indicator, is up more than 20% since January 2013, indicating growth in 2014. ??

The Architecture Billings Index (ABI) dropped below 50 in April, briefly indicating declining workload. Through September, we’ve seen five more months of growth, a good leading indicator for future new construction work. In October we’ve just had another drop, but not below 50, indicating slower gains rather than declines.

??ENR published selling price data for 2013 that shows contractors adding to their margins.

Some economic factors are still negative:

- ??The monthly rate of spending for nonbuilding infrastructure may climb from September through January, but then may decline by 10% through 2014. ??An anticipated decline in spending from February to May 2014 is influenced only mildly by a slight dip in nonresidential buildings and a flattening in residential but is influenced strongly by a steep decline in nonbuilding infrastructure spending.

- ??The construction workforce is still 25% below the peak. It will take a minimum of four more years to return to peak levels.

- ??As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity, and the ability to readily increase construction volume.

Impact of recent events:

- ??FMI’s Third Quarter 2013 Construction Outlook Report mentions a few reasons why spending is not rapidly increasing: the decline in public construction as sequestration continues; lenders are still tight with lending criteria and consumers are still cautious about increasing debt load, and that includes the consumers’share of public debt.

- ??Comments regarding the outlook for economic stimulus have recently caused interest rates to increase rapidly. Lending criteria is still tight and borrowers are cautious about taking on new debt. Rates will continue to rise and borrowing costs will add potential cost to future funding of projects. The cheapest time to build is now behind us.

- ??Construction jobs growth has slowed. Jobs grew by 90,000 in the first half of 2013, but have grown by only 33,000 since June.

The impacts of growth:

- ??Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- ??As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ??ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices up on average about 2% to 2.5% year over year. However, selling price indices are up on average 4%. The difference between these indices is increased margins.

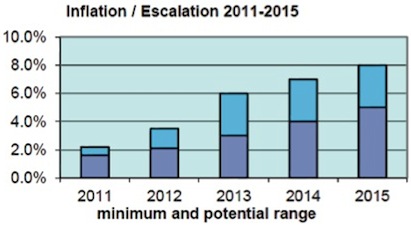

Supported by overall positive growth trends for the year 2013, expect margins and overall escalation to climb more rapidly than we have seen in five years.

Nonresidential buildings construction slowed in the first five months but is expected to increase substantially in the last few months of 2013. We will see a decline in nonbuilding infrastructure extend completely through 2014. Residential work will remain extremely active. Once growth in nonresidential construction picks up, and both residential and nonresidential are active, we will begin to see more significant labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. Even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here for the full report.

About Gilbane

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Author Ed Zarenski, a 40-year construction veteran and a member of the Gilbane team for more than 33 years, is an Estimating Executive who has managed multimillion dollar project budgeting, owner capital plan cost control, value engineering and life cycle cost analysis. He compiles economic information and provides data analysis and opinion for this quarterly report.

Related Stories

| Nov 3, 2010

Park’s green education center a lesson in sustainability

The new Cantigny Outdoor Education Center, located within the 500-acre Cantigny Park in Wheaton, Ill., earned LEED Silver. Designed by DLA Architects, the 3,100-sf multipurpose center will serve patrons of the park’s golf courses, museums, and display garden, one of the largest such gardens in the Midwest.

| Nov 3, 2010

Public works complex gets eco-friendly addition

The renovation and expansion of the public works operations facility in Wilmette, Ill., including a 5,000-sf addition that houses administrative and engineering offices, locker rooms, and a lunch room/meeting room, is seeking LEED Gold certification.

| Nov 3, 2010

Sailing center sets course for energy efficiency, sustainability

The Milwaukee (Wis.) Community Sailing Center’s new facility on Lake Michigan counts a geothermal heating and cooling system among its sustainable features. The facility was designed for the nonprofit instructional sailing organization with energy efficiency and low operating costs in mind.

| Nov 3, 2010

Seattle University’s expanded library trying for LEED Gold

Pfeiffer Partners Architects, in collaboration with Mithun Architects, programmed, planned, and designed the $55 million renovation and expansion of Lemieux Library and McGoldrick Learning Commons at Seattle University. The LEED-Gold-designed facility’s green features include daylighting, sustainable and recycled materials, and a rain garden.

| Nov 3, 2010

Recreation center targets student health, earns LEED Platinum

Not only is the student recreation center at the University of Arizona, Tucson, the hub of student life but its new 54,000-sf addition is also super-green, having recently attained LEED Platinum certification.

| Nov 3, 2010

New church in Connecticut will serve a growing congregation

Tocci Building Companies will start digging next June for the Black Rock Congregational Church in Fairfield, Conn. Designed by Wiles Architects, the 103,000-sf multiuse facility will feature a 900-person worship center with tiered stadium seating, a children’s worship center, a chapel, an auditorium, a gymnasium, educational space, administrative offices, commercial kitchen, and a welcome center with library and lounge.

| Nov 3, 2010

Senior housing will be affordable, sustainable

Horizons at Morgan Hill, a 49-unit affordable senior housing community in Morgan Hill, Calif., was designed by KTGY Group and developed by Urban Housing Communities. The $21.2 million, three-story building will offer 36 one-bed/bath units (773 sf) and 13 two-bed/bath units (1,025 sf) on a 2.6-acre site.

| Nov 3, 2010

Designs complete for new elementary school

SchenkelShultz has completed design of the new 101,270-sf elementary Highlands Elementary School, as well as designs for three existing buildings that will be renovated, in Kissimmee, Fla. The school will provide 48 classrooms for 920 students, a cafeteria, a media center, and a music/art suite with outdoor patio. Three facilities scheduled for renovations total 19,459 sf and include an eight-classroom building that will be used as an exceptional student education center, a older media center that will be used as a multipurpose building, and another building that will be reworked as a parent center, with two meeting rooms for community use. W.G. Mills/Ranger is serving as CM for the $15.1 million project.

| Nov 3, 2010

Chengdu retail center offers a blend of old and new China

The first phase of Pearl River New Town, an 80-acre project in Chengdu, in China’s Wenjiang District, is under way along the banks of the Jiang’an River. Chengdu was at one time a leading center for broadcloth production, and RTKL, which is overseeing the project’s master planning, architecture, branding, and landscape architecture, designed the project’s streets, pedestrian pathways, and bridges to resemble a woven fabric.

| Nov 3, 2010

Rotating atriums give Riyadh’s first Hilton an unusual twist

Goettsch Partners, in collaboration with Omrania & Associates (architect of record) and David Wrenn Interiors (interior designer), is serving as design architect for the five-star, 900-key Hilton Riyadh.