??Construction growth is looking up, according to the Winter 2013 release of the periodic report Construction Economics, authored by Gilbane Building Company. Construction spending for 2013 will finish the year 5% higher than 2012. All of the growth will be attributed to residential construction. However, the Dodge Momentum Index, a leading indicator, is up more than 20% since January 2013, indicating growth in 2014. ??

The Architecture Billings Index (ABI) dropped below 50 in April, briefly indicating declining workload. Through September, we’ve seen five more months of growth, a good leading indicator for future new construction work. In October we’ve just had another drop, but not below 50, indicating slower gains rather than declines.

??ENR published selling price data for 2013 that shows contractors adding to their margins.

Some economic factors are still negative:

- ??The monthly rate of spending for nonbuilding infrastructure may climb from September through January, but then may decline by 10% through 2014. ??An anticipated decline in spending from February to May 2014 is influenced only mildly by a slight dip in nonresidential buildings and a flattening in residential but is influenced strongly by a steep decline in nonbuilding infrastructure spending.

- ??The construction workforce is still 25% below the peak. It will take a minimum of four more years to return to peak levels.

- ??As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity, and the ability to readily increase construction volume.

Impact of recent events:

- ??FMI’s Third Quarter 2013 Construction Outlook Report mentions a few reasons why spending is not rapidly increasing: the decline in public construction as sequestration continues; lenders are still tight with lending criteria and consumers are still cautious about increasing debt load, and that includes the consumers’share of public debt.

- ??Comments regarding the outlook for economic stimulus have recently caused interest rates to increase rapidly. Lending criteria is still tight and borrowers are cautious about taking on new debt. Rates will continue to rise and borrowing costs will add potential cost to future funding of projects. The cheapest time to build is now behind us.

- ??Construction jobs growth has slowed. Jobs grew by 90,000 in the first half of 2013, but have grown by only 33,000 since June.

The impacts of growth:

- ??Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- ??As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ??ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices up on average about 2% to 2.5% year over year. However, selling price indices are up on average 4%. The difference between these indices is increased margins.

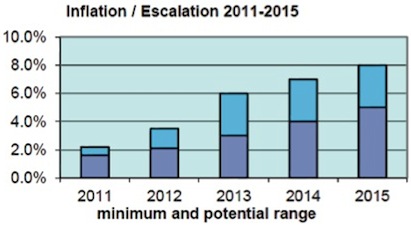

Supported by overall positive growth trends for the year 2013, expect margins and overall escalation to climb more rapidly than we have seen in five years.

Nonresidential buildings construction slowed in the first five months but is expected to increase substantially in the last few months of 2013. We will see a decline in nonbuilding infrastructure extend completely through 2014. Residential work will remain extremely active. Once growth in nonresidential construction picks up, and both residential and nonresidential are active, we will begin to see more significant labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. Even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here for the full report.

About Gilbane

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Author Ed Zarenski, a 40-year construction veteran and a member of the Gilbane team for more than 33 years, is an Estimating Executive who has managed multimillion dollar project budgeting, owner capital plan cost control, value engineering and life cycle cost analysis. He compiles economic information and provides data analysis and opinion for this quarterly report.

Related Stories

Building Team Awards | Jun 1, 2016

Central utility power plant takes center stage at UC San Diego Jacobs Medical Center

An undulating roof, floor-to-ceiling glass, and façade scheme give visual appeal to a plant that serves the 10-story medical center.

Architects | May 31, 2016

JLG Architects acquires Minneapolis-based Studio Five Architects

Led by Linda McCracken-Hunt, SFA is one of Minnesota’s oldest woman-owned architecture firms.

Building Team Awards | May 31, 2016

Gonzaga's new student center is a bustling social hub

Retail mall features, comfortable furniture, and floor-to-ceiling glass add vibrancy to the new John J. Hemmingson Center.

Building Team Awards | May 27, 2016

Big police academy trains thousands of New York's finest

The Police Training Academy in Queens, N.Y., consists of a 480,000-sf academic/administration building and a 240,000-sf physical training facility, linked by an aerial pedestrian bridge.

Building Team Awards | May 26, 2016

Cimpress office complex built during historically brutal Massachusetts winter

Lean construction techniques were used to build 275 Wyman Street during a winter that brought more than 100 inches of snow to suburban Boston.

Building Team Awards | May 25, 2016

New health center campus provides affordable care for thousands of Northern Californians

The 38,000-sf, two-level John & Susan Sobrato Campus in Palo Alto is expected to serve 25,000 patients a year by the end of the decade.

Architects | May 24, 2016

Lissoni Architettura’s NYC Aquatrium takes first place in New York City Waterfront Design competition

NYC Aquatrium was selected from among 178 proposals from 40 countries as the winner of Arch Out Loud’s NYC Aquarium & Public Waterfront design competition

Building Team Awards | May 24, 2016

Los Angeles bus depot squeezes the most from a tight site

The Building Team for the MTA Division 13 Bus Operations and Maintenance Facility fit 12 acres’ worth of programming in a multi-level structure on a 4.8-acre site.

Building Team Awards | May 23, 2016

'Greenest ballpark' proves a winner for St. Paul Saints

Solar arrays, a public art courtyard, and a picnic-friendly “park within a park" make the 7,210-seat CHS Field the first ballpark to meet Minnesota sustainable building standards.

Architects | May 20, 2016

NCARB survey indicates continued growth of U.S. architects

The number of U.S. architects surpassed 110,000 in 2015, a 2% increase from the previous year.