Gilbane Building Company today announces the publication of the Spring 2013 edition of Construction Economics – Market Conditions in Construction. Based on an array of economic data, construction starts, and material cost trends, the data is the most positive the company has seen in recent years.

“We are in a growth period that by all leading indicators seems here to stay. From 2006 to 2010, as work declined, we saw the largest decline of margins in recent history. In 2011 that trend began to reverse slightly” says Ed Zarenski, the report’s author and a 40-year veteran of the construction industry. “I expect the positive growth to continue.”

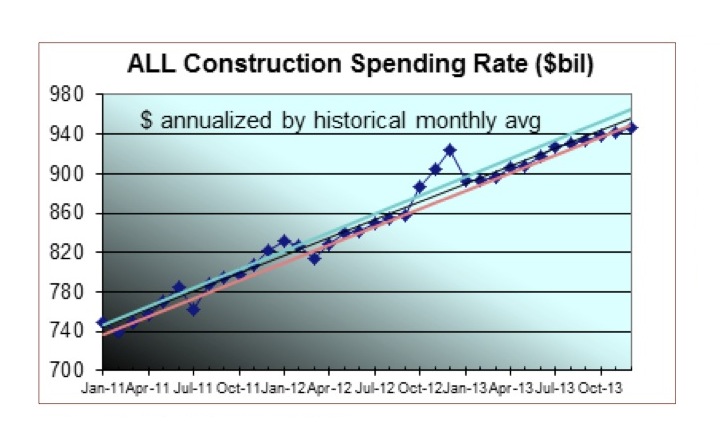

According to the report, the monthly rate of construction spending is up 20% in 24 months and increased in 18 of the last 24 months, which is a good leading indicator for new construction work in Q3-Q4 2013.

Other highlights include:

- Residential spending will take the lead in 2013, nonresidential spending will lag.

- Public spending will decline. Private spending will lead the charge in 2013.

- As spending continues to increase, even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

- Predicted spending growth of 8.2% for Commercial markets, 5.2% for Office and 2.3% for Healthcare.

Construction jobs grew by 150,000 in the last five months. Just to meet the needs of the predicted residential building expansion, the workforce needs to grow by 750,000 jobs in the next two years, faster than the entire construction workforce has ever grown in history.

Future escalation, in order to support labor growth, materials demand and to capture increasing margins, will be higher than normal labor/material cost growth. Lagging regions may take longer to experience high escalation. Residential escalation will be near the upper end of the range.

This free report and its executive summary are available for download at http://www.gilbaneco.com/economic-report.

About Gilbane, Inc.

Gilbane provides a full slate of construction and facilities-related services – from pre-construction planning and integrated consulting capabilities to comprehensive construction management, close-out and facility management services – for clients across various markets. Marking its 140th year in operation and still a privately held, family-run company, Gilbane has more than 60 office locations around the world. To find out what the next 140 years have in store, visit www.gilbaneco.com.

Related Stories

| Feb 1, 2012

New ways to work with wood

New products like cross-laminated timber are spurring interest in wood as a structural material.

| Feb 1, 2012

Blackney Hayes designs school for students with learning differences

The 63,500 sf building allows AIM to consolidate its previous two locations under one roof, with room to expand in the future.

| Feb 1, 2012

Two new research buildings dedicated at the University of South Carolina

The two buildings add 208,000 square feet of collaborative research space to the campus.

| Feb 1, 2012

List of Top 10 States for LEED Green Buildings released?

USGBC releases list of top U.S. states for LEED-certified projects in 2011.

| Feb 1, 2012

ULI and Greenprint Foundation create ULI Greenprint Center for Building Performance

Member-to-member information exchange measures energy use, carbon footprint of commercial portfolios.

| Feb 1, 2012

AEC mergers and acquisitions up in 2011, expected to surge in 2012

Morrissey Goodale tracked 171 domestic M&A deals, representing a 12.5% increase over 2010 and a return to levels not seen since 2007.

| Jan 31, 2012

AIA CONTINUING EDUCATION: Reroofing primer, in-depth advice from the experts

Earn 1.0 AIA/CES learning units by studying this article and successfully completing the online exam.

| Jan 31, 2012

28th Annual Reconstruction Awards: Modern day reconstruction plays out

A savvy Building Team reconstructs a Boston landmark into a multiuse masterpiece for Suffolk University.

| Jan 31, 2012

Chapman Construction/Design: ‘Sustainability is part of everything we do’

Chapman Construction/Design builds a working culture around sustainability—for its clients, and for its employees.

| Jan 31, 2012

Fusion Facilities: 8 reasons to consolidate multiple functions under one roof

‘Fusing’ multiple functions into a single building can make it greater than the sum of its parts. The first in a series on the design and construction of university facilities.