Gilbane Building Company today announces the publication of the Spring 2013 edition of Construction Economics – Market Conditions in Construction. Based on an array of economic data, construction starts, and material cost trends, the data is the most positive the company has seen in recent years.

“We are in a growth period that by all leading indicators seems here to stay. From 2006 to 2010, as work declined, we saw the largest decline of margins in recent history. In 2011 that trend began to reverse slightly” says Ed Zarenski, the report’s author and a 40-year veteran of the construction industry. “I expect the positive growth to continue.”

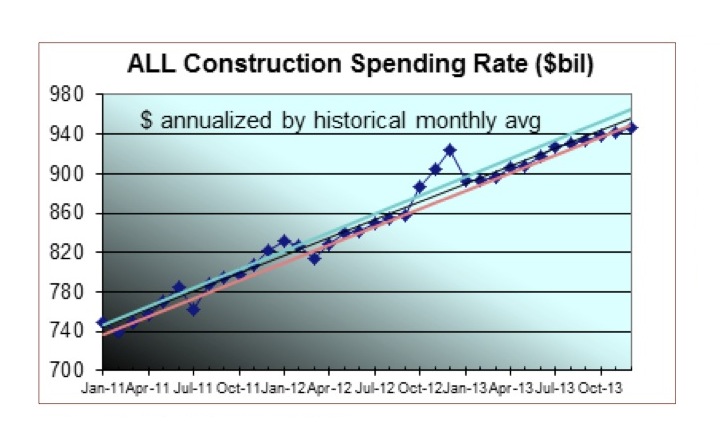

According to the report, the monthly rate of construction spending is up 20% in 24 months and increased in 18 of the last 24 months, which is a good leading indicator for new construction work in Q3-Q4 2013.

Other highlights include:

- Residential spending will take the lead in 2013, nonresidential spending will lag.

- Public spending will decline. Private spending will lead the charge in 2013.

- As spending continues to increase, even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

- Predicted spending growth of 8.2% for Commercial markets, 5.2% for Office and 2.3% for Healthcare.

Construction jobs grew by 150,000 in the last five months. Just to meet the needs of the predicted residential building expansion, the workforce needs to grow by 750,000 jobs in the next two years, faster than the entire construction workforce has ever grown in history.

Future escalation, in order to support labor growth, materials demand and to capture increasing margins, will be higher than normal labor/material cost growth. Lagging regions may take longer to experience high escalation. Residential escalation will be near the upper end of the range.

This free report and its executive summary are available for download at http://www.gilbaneco.com/economic-report.

About Gilbane, Inc.

Gilbane provides a full slate of construction and facilities-related services – from pre-construction planning and integrated consulting capabilities to comprehensive construction management, close-out and facility management services – for clients across various markets. Marking its 140th year in operation and still a privately held, family-run company, Gilbane has more than 60 office locations around the world. To find out what the next 140 years have in store, visit www.gilbaneco.com.

Related Stories

| May 31, 2012

2011 Reconstruction Award Profile: Seegers Student Union at Muhlenberg College

Seegers Student Union at Muhlenberg College has been reconstructed to serve as the core of social life on campus.

| May 31, 2012

2011 Reconstruction Awards Profile: Ka Makani Community Center

An abandoned historic structure gains a new life as the focal point of a legendary military district in Hawaii.

| May 31, 2012

5 military construction trends

Defense spending may be down somewhat, but there’s still plenty of project dollars out there if you know where to look.

| May 31, 2012

New School’s University Center in NYC topped out

16-story will provide new focal point for campus.

| May 31, 2012

Day & Zimmermann taps Jobe for ECM VP

Ken Jobe, a senior executive with 30+ years of industry-related experience, joins Day & Zimmermann to expand footprint in the process & industrial markets.

| May 31, 2012

Perkins+Will-designed engineering building at University of Buffalo opens

Clad in glass and copper-colored panels, the three-story building thrusts outward from the core of the campus to establish a new identity for the School of Engineering and Applied Sciences and the campus at large.

| May 30, 2012

Construction milestone reached for $1B expansion of San Diego International Airport

Components of the $9-million structural concrete construction phase included a 700-foot-long, below-grade baggage-handling tunnel; metal decks covered in poured-in-place concrete; slab-on-grade for the new terminal; and 10 exterior architectural columns––each 56-feet tall and erected at a 14-degree angle.

| May 30, 2012

Pringle Brandon in discussions to join forces with Perkins+Will

The London offices would be known as Pringle Brandon Perkins+Will.

| May 30, 2012

Boral Bricks announces winners of “Live.Work.Learn” student architecture contest

Eun Grace Ko, a student at the Ryerson University in Toronto, Canada, named winner of annual contest.