Gilbane Building Company today announces the publication of the Spring 2013 edition of Construction Economics – Market Conditions in Construction. Based on an array of economic data, construction starts, and material cost trends, the data is the most positive the company has seen in recent years.

“We are in a growth period that by all leading indicators seems here to stay. From 2006 to 2010, as work declined, we saw the largest decline of margins in recent history. In 2011 that trend began to reverse slightly” says Ed Zarenski, the report’s author and a 40-year veteran of the construction industry. “I expect the positive growth to continue.”

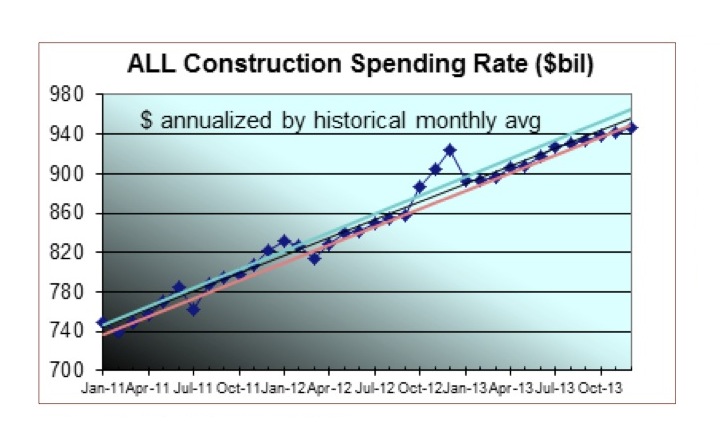

According to the report, the monthly rate of construction spending is up 20% in 24 months and increased in 18 of the last 24 months, which is a good leading indicator for new construction work in Q3-Q4 2013.

Other highlights include:

- Residential spending will take the lead in 2013, nonresidential spending will lag.

- Public spending will decline. Private spending will lead the charge in 2013.

- As spending continues to increase, even moderate growth in activity will allow contractors to pass along more material costs and increase margins. When activity picks up in all sectors, escalation will begin to advance rapidly.

- Predicted spending growth of 8.2% for Commercial markets, 5.2% for Office and 2.3% for Healthcare.

Construction jobs grew by 150,000 in the last five months. Just to meet the needs of the predicted residential building expansion, the workforce needs to grow by 750,000 jobs in the next two years, faster than the entire construction workforce has ever grown in history.

Future escalation, in order to support labor growth, materials demand and to capture increasing margins, will be higher than normal labor/material cost growth. Lagging regions may take longer to experience high escalation. Residential escalation will be near the upper end of the range.

This free report and its executive summary are available for download at http://www.gilbaneco.com/economic-report.

About Gilbane, Inc.

Gilbane provides a full slate of construction and facilities-related services – from pre-construction planning and integrated consulting capabilities to comprehensive construction management, close-out and facility management services – for clients across various markets. Marking its 140th year in operation and still a privately held, family-run company, Gilbane has more than 60 office locations around the world. To find out what the next 140 years have in store, visit www.gilbaneco.com.

Related Stories

| Jul 21, 2014

Narrowing the field: Stirling Prize shortlist announced

The list includes first-time nominees Mecanoo and Renzo Piano Building Workshop, as well as previous winners Zaha Hadid Architects and Feilden Clegg Bradley Studios.

| Jul 21, 2014

Designing the process of leadership transition

Transition planning can be one of the more complex challenges that firms face. Effective plans begin by determining the gap between a firm’s current state and the future it envisions for itself. SPONSORED CONTENT

| Jul 21, 2014

16 utility questions to answer during your building project

We need electricity to power our building projects, along with water and gas and a faultless sanitation system. That’s what we think about when we think about utility requirements for our building project, but are we missing something? SPONSORED CONTENT

| Jul 21, 2014

Commercial real estate development growing at strongest pace since recovery began: NAIOP report

Industrial, warehousing, office, and retail sectors see strong gains; Texas leads the nation in construction-value stats.

| Jul 21, 2014

Economists ponder uneven recovery, weigh benefits of big infrastructure [2014 Giants 300 Report]

According to expert forecasters, multifamily projects, the Panama Canal expansion, and the petroleum industry’s “shale gale” could be saving graces for commercial AEC firms seeking growth opportunities in an economy that’s provided its share of recent disappointments.

| Jul 21, 2014

Workplace trends survey reveals generational patterns in office use

Data analysis from Mancini•Duffy indicates significant variations among age cohorts in the workplace.

| Jul 20, 2014

IPD contract saves time and money for cancer center [2014 Building Team Awards]

Partners share the risk and reward of extreme collaboration on this LEED Silver project, which relies heavily on Lean principles.

| Jul 20, 2014

Why every major U.S. city should be nurturing ‘Innovation Hubs’

Today, more than ever, tech districts are the key to economic growth for metro markets. A new report from the Brookings Institution calls tech hubs the superchargers of innovation economies and creators of highly coveted tech jobs.

| Jul 18, 2014

Contractors warm up to new technologies, invent new management schemes [2014 Giants 300 Report]

“UAV.” “LATISTA.” “CMST.” If BD+C Giants 300 contractors have anything to say about it, these new terms may someday be as well known as “BIM” or “LEED.” Here’s a sampling of what Giant GCs and CMs are doing by way of technological and managerial innovation.