According to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today, construction input prices rose 0.9% monthly in February and 1.8% in the past 12 months. Inputs to nonresidential construction were up 1% on a monthly basis and 2.7% on a yearly basis. This is the first time that input prices have risen on a monthly basis since October 2018, when prices increased by 0.5%.

Of the 11 construction subcategories, seven experienced price declines for the month, with the largest decreases in natural gas (-25.8%) and unprocessed energy materials (-10.7%). The largest monthly increases in prices were seen in softwood lumber (+4.8%) and crude petroleum (+2.6%).

“While the monthly increase in materials prices was quite substantial, it makes more sense to focus on the year-over-year statistics,” said ABC Chief Economist Anirban Basu. Several factors were at work when materials prices were expanding very rapidly, including a synchronized global expansion and the initial effects of tariffs on items such as steel, aluminum and softwood lumber. At the time, year-over-year increases in materials prices were routinely in the double digits in percentage terms.

“Today, the annualized increase in materials prices is less than 2%, despite the data characterizing February,” said Basu. Some of this is explained by the dip in oil prices during the past year, which is due in part to a softening global economy and a significant increase in U.S. oil production. However, other key construction materials prices also have declined during the last 12 months, including natural gas, nonferrous wire and cable and softwood lumber.

“With the global economy continuing to weaken, it is unlikely that materials prices will surge in the near term, despite a still very active U.S. nonresidential construction sector,” said Basu. “It is quite conceivable that much of the monthly increase in materials prices registered in February was associated with unusually severe winter weather in much of the nation. Difficulties involving transportation, for instance, have a tendency to push purchase prices higher. The implication is that the monthly increase registered in February will probably not be repeated in March and April.”

Related Stories

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

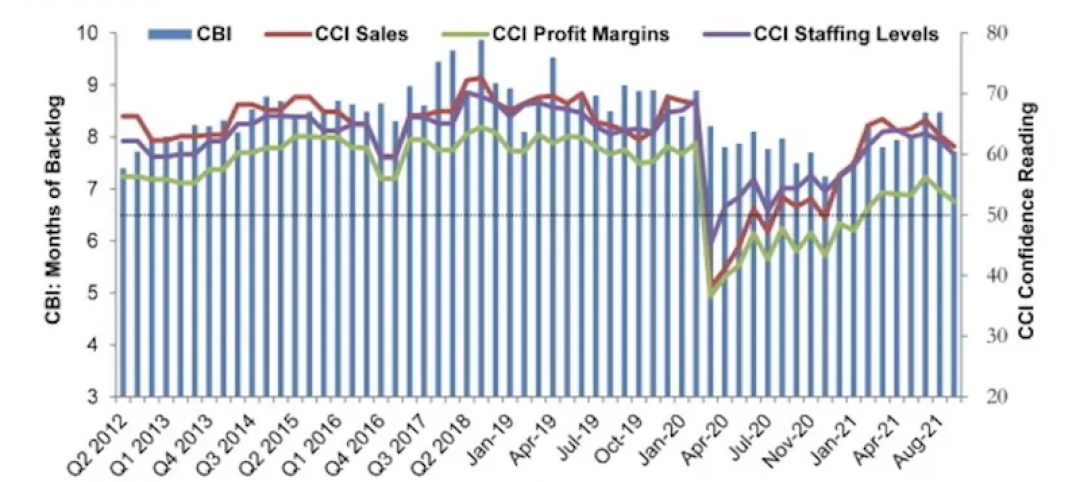

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.