Construction input prices increased 0.9% in April on a monthly basis and 2.4% compared to the same time last year, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics data released today. Nonresidential input prices rose 0.9% compared to March and are up 2.8% on an annual basis.

Among the 11 sub-categories, seven experienced price decreases last month, with the largest decreases in natural gas (-8.7%), iron and steel (-1.7%), and steel mill products (-1.7%). The four sub-categories that experienced monthly price increases were crude petroleum (+13.9%), unprocessed energy materials (+3.7%), prepared asphalt products (+2.7%) and concrete products (+1.1%). Year over year, prepared asphalt products (+7.5%), steel mill products (+5.8%) and plumbing fixtures (+4.3%) experienced the largest price increases.

“Even though April was the third consecutive month that input prices increased and overall materials prices remained elevated, there is little reason for contractors to be on high alert,” said ABC Chief Economist Anirban Basu. “The increase in materials prices was primarily driven by higher energy prices. In particular, the price of oil mainly rose for political reasons, and therefore is not an indication that materials prices will aggressively increase.

“What’s more, the year-over-year increase in construction input prices is a mere 2.4%, which is only slightly higher than overall inflation and a bit lower than wage growth,” said Basu. “With much of the global economy slowing and given ongoing trade tensions between American and Chinese policymakers, it’s likely materials price increases will remain modest going forward, even in the context of a robust nonresidential construction sector.

Related Stories

Market Data | May 10, 2022

Hybrid work could result in 20% less demand for office space

Global office demand could drop by between 10% and 20% as companies continue to develop policies around hybrid work arrangements, a Barclays analyst recently stated on CNBC.

Market Data | May 6, 2022

Nonresidential construction spending down 1% in March

National nonresidential construction spending was down 0.8% in March, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau.

Market Data | Apr 29, 2022

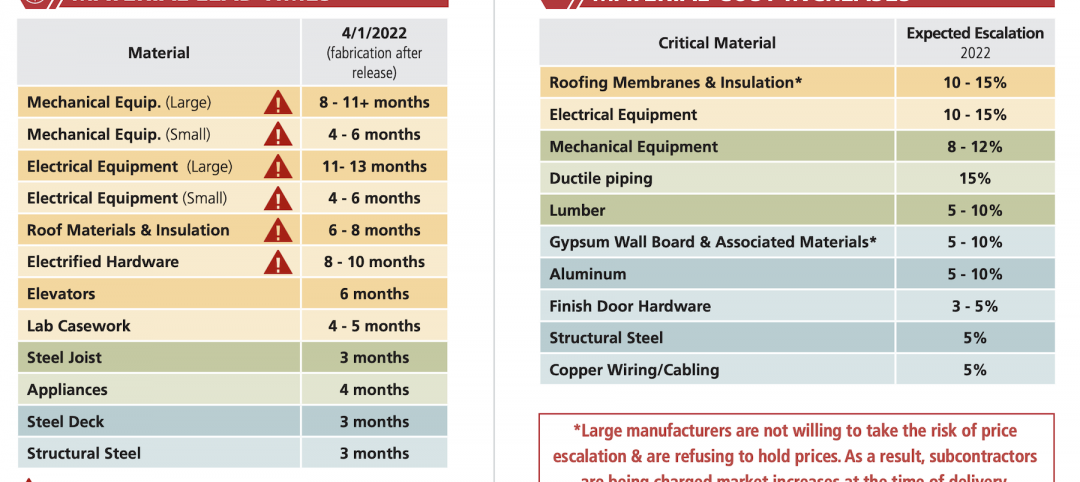

Global forces push construction prices higher

Consigli’s latest forecast predicts high single-digit increases for this year.

Market Data | Apr 29, 2022

U.S. economy contracts, investment in structures down, says ABC

The U.S. economy contracted at a 1.4% annualized rate during the first quarter of 2022.

Market Data | Apr 20, 2022

Pace of demand for design services rapidly accelerates

Demand for design services in March expanded sharply from February according to a new report today from The American Institute of Architects (AIA).

Market Data | Apr 14, 2022

FMI 2022 construction spending forecast: 7% growth despite economic turmoil

Growth will be offset by inflation, supply chain snarls, a shortage of workers, project delays, and economic turmoil caused by international events such as the Russia-Ukraine war.

Industrial Facilities | Apr 14, 2022

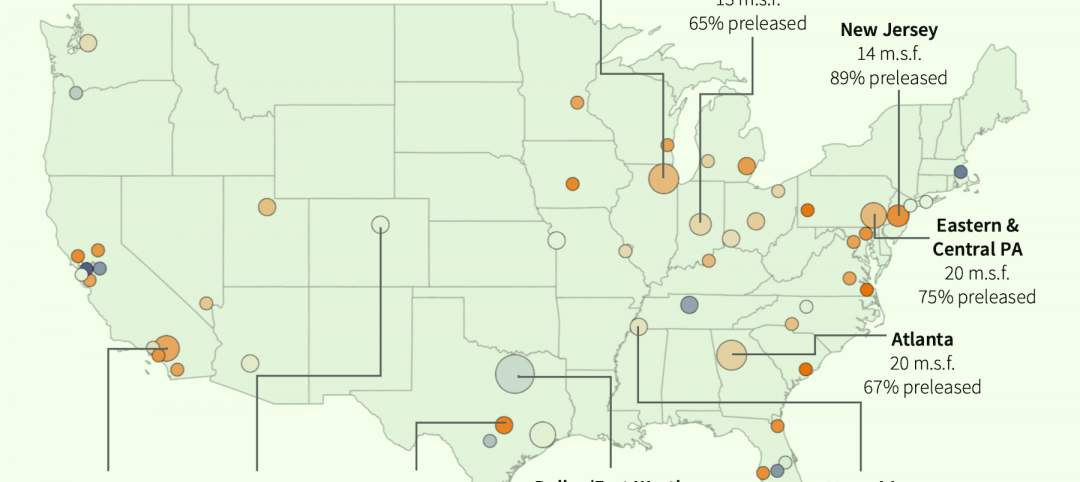

JLL's take on the race for industrial space

In the previous decade, the inventory of industrial space couldn’t keep up with demand that was driven by the dual surges of the coronavirus and online shopping. Vacancies declined and rents rose. JLL has just published a research report on this sector called “The Race for Industrial Space.” Mehtab Randhawa, JLL’s Americas Head of Industrial Research, shares the highlights of a new report on the industrial sector's growth.

Codes and Standards | Apr 4, 2022

Construction of industrial space continues robust growth

Construction and development of new industrial space in the U.S. remains robust, with all signs pointing to another big year in this market segment

Reconstruction & Renovation | Mar 28, 2022

Is your firm a reconstruction sector giant?

Is your firm active in the U.S. building reconstruction, renovation, historic preservation, and adaptive reuse markets? We invite you to participate in BD+C's inaugural Reconstruction Market Research Report.

Industry Research | Mar 28, 2022

ABC Construction Backlog Indicator unchanged in February

Associated Builders and Contractors reported today that its Construction Backlog Indicator remained unchanged at 8.0 months in February, according to an ABC member survey conducted Feb. 21 to March 8.