Gilbane has released its Spring 2014 edition of the periodic report "Construction Economics: Market Conditions in Construction" (download the full report).

Among the findings from the Executive Summary:

CONSTRUCTION GROWTH IS LOOKING UP

- Construction Spending for 2014 will finish the year 6.6% higher than 2013. Nonresidential buildings will contribute substantially to the growth.

- The Architecture Billings Index (ABI) in 2013 dropped below 50 in April, November and December briefly, indicating declining workload. Overall the ABI portrays a good leading indicator for future new construction work.

- Selling price data for 2013 shows contractors adding to their margins.

- Construction jobs grew by 156,000 in 2013, less than anticipated. However, hours worked also grew by 3%, the equivalent of another 150,000+ jobs.

SOME ECONOMIC FACTORS ARE STILL NEGATIVE

- We are experiencing a slight slowdown in construction spending that could last through May, influenced by a slight dip in nonresidential buildings and a brief flattening in residential, but more so by a steep decline in nonbuilding infrastructure spending. The monthly rate of spending for nonbuilding infrastructure may decline by 10% through Q3 2014.

- The construction workforce and hours worked is still 22% below the 2006 peak. At peak average growth rates, it will take a minimum of five more years to return to previous peak levels.

- Construction volume is 23% below peak inflation adjusted spending, which was almost constant from 2000 through 2006. At average peak growth rates of 8% per year, and factoring out inflation to get real volume growth, it will take eight more years to regain previous peak volume levels.

- As workload expands in the next few years, a shortage of available skilled workers may have a detrimental effect on cost, productivity and the ability to readily increase construction volume.

THE EFFECTS OF GROWTH

- Construction spending during the first five months of 2013 declined from the rate of spending in Q4 2012. Growth has been inconsistent, even in the booming residential sector, which has seen recent declines. We see more consistent growth in 2014 for buildings.

- As spending continues to increase, contractors gain more ability to pass along costs and increase margins. The growth in contractor margins slowed since last year. However, expected increases in volume should reverse that in 2014.

- ENR’s Third Quarter 2013 Cost Report shows general purpose and material cost indices increased on average about 2% to 2.5% year over year. However, selling price indices increased 4% on average. The difference between these indices is increased margins.

IMPACT OF RECENT EVENTS

- There are several reasons why spending is not rapidly increasing: public sector construction remains depressed as sequestration continues; the government is spending less on schools and infrastructure; lenders are just beginning to loosen lending criteria; consumers are still cautious about increasing debt load, including the consumers’ share of public debt and we may be constrained by a skilled labor shortage.

- Supported by overall positive growth trends for year 2014, Gilbane expects margins and overall escalation to climb more rapidly than we have seen in six years.

- Growth in nonresidential buildings and residential construction in 2014 will lead to more significant labor demand, resulting in labor shortages and productivity losses. Margins regained a positive footing in 2012 and extended those gains in 2013. Expect margins to grow stronger in 2014. When activity picks up in all sectors, escalation will begin to advance rapidly.

Click here to download the complete report and a list of data sources.

ABOUT THIS REPORT

Gilbane Inc. is a full service construction and real estate development company, composed of Gilbane Building Company and Gilbane Development Company. The company (www.gilbaneco.com) is one of the nation’s largest construction and program managers providing a full slate of facilities related services for clients in education, healthcare, life sciences, mission critical, corporate, sports and recreation, criminal justice, public and aviation markets. Gilbane has more than 50 offices worldwide, with its corporate office located in Providence, Rhode Island. The information in this report is not specific to any one region.

Related Stories

| Oct 30, 2014

CannonDesign releases guide for specifying flooring in healthcare settings

The new report, "Flooring Applications in Healthcare Settings," compares and contrasts different flooring types in the context of parameters such as health and safety impact, design and operational issues, environmental considerations, economics, and product options.

| Oct 30, 2014

Perkins Eastman and Lee, Burkhart, Liu to merge practices

The merger will significantly build upon the established practices—particularly healthcare—of both firms and diversify their combined expertise, particularly on the West Coast.

| Oct 29, 2014

Better guidance for appraising green buildings is steadily emerging

The Appraisal Foundation is striving to improve appraisers’ understanding of green valuation.

| Oct 29, 2014

Increasing number of design projects meeting carbon reduction targets, says AIA report

Of the 2,464 projects accounted for in AIA's 2030 Commitment 2013 Progress Report, 401 are meeting the 60% carbon reduction target—a 200% increase from 2012.

Sponsored | | Oct 29, 2014

What’s the difference between your building’s coating chalking and fading?

While the reasons for chalk and fade are different, both occurrences are something to watch for. SPONSORED CONTENT

Sponsored | | Oct 29, 2014

Historic Washington elementary school incorporates modular design

More and more architects and designers are leveraging modern modular building techniques for expansion projects planned on historical sites. SPONSORED CONTENT

| Oct 29, 2014

Diller Scofidio + Renfro selected to design Olympic Museum in Colorado Springs

The museum is slated for an early 2018 completion, and will include a hall of fame, theater, retail space, and a 20,000-sf hall that will showcase the history of the Olympics and Paralympics.

Smart Buildings | Oct 29, 2014

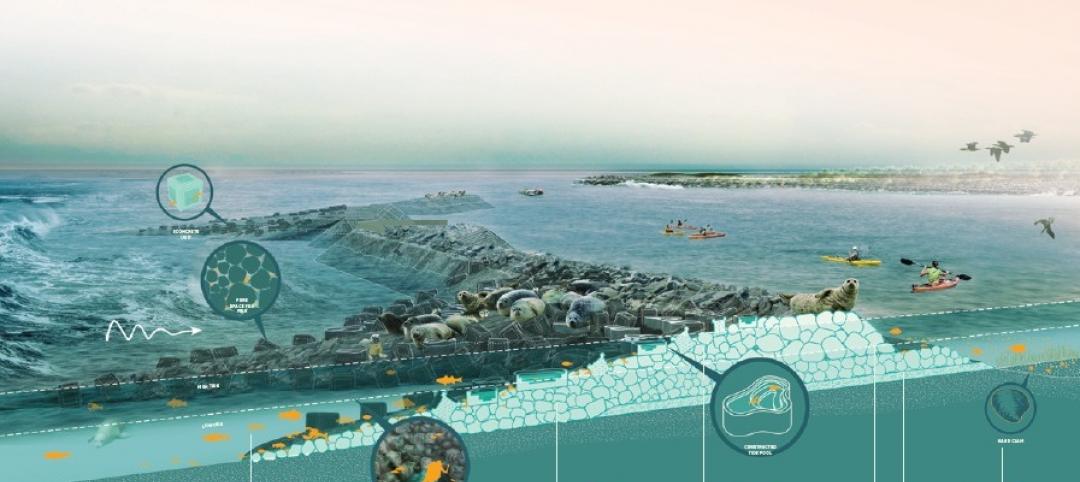

SCAPE’s 'living breakwaters' resiliency development wins 2014 Buckminster Fuller Challenge

New York-based landscape architecture firm SCAPE won the Buckminster Fuller Institute’s 2014 Fuller Challenge, billed as socially responsible design’s highest award.

| Oct 28, 2014

4 keys to mastering 'design thinking' and the iteration process

When using design thinking and iteration, we’ll sometimes spend multiple days iterating idea after idea, heads down, only to realize we still don’t have it right, writes HDR's Amy Lussetto. She offers tips for success with these idea-nurturing tools.

| Oct 28, 2014

Miami accepts more modest plan to renovate its convention center

The city of Miami has awarded an $11 million contract for its on-again, off-again convention center renovation to Denver-based Fentress Architects, which will serve as the design criteria professional on this project.