There probably isn’t a contractor in this country that at some point hasn’t been a victim of jobsite theft. In 2014, there were 11,625 heavy-equipment thefts reported to law enforcement, up 1.2% from 2013, according to the latest data from the National Insurance Crime Bureau in a report coproduced by the National Crime Information Center.

Total construction equipment theft now stands at around $1 billion annually. And only 23% of the heavy equipment stolen last year was recovered, the NICB report stated.

A survey conducted last year by Cygnus Business Media Research on behalf of LoJack, which makes theft-detection and –prevention devices, found that 83% of construction equipment owners polled had experienced equipment theft.

Courtney DeMilio, LoJack’s National Vice President of Commercial and Fleet, points out that theft can have a greater, negative impact on a business. “Loss in job productivity, the inability to complete a job, a diminished professional reputation—all while the owner is spending a substantial amount of time and money to replace the equipment,” she says.

The Canton, Mass.-based LoJack recently released its annual “Construction Equipment Theft and Recovery in the United States” report, based on its tracking, from January through December 2014, of theft reports in 28 states where equipment theft was reported and where construction equipment outfitted with a LoJack device led police to recover the stolen assets.

Graphics courtesy LoJack

Graphics courtesy LoJack

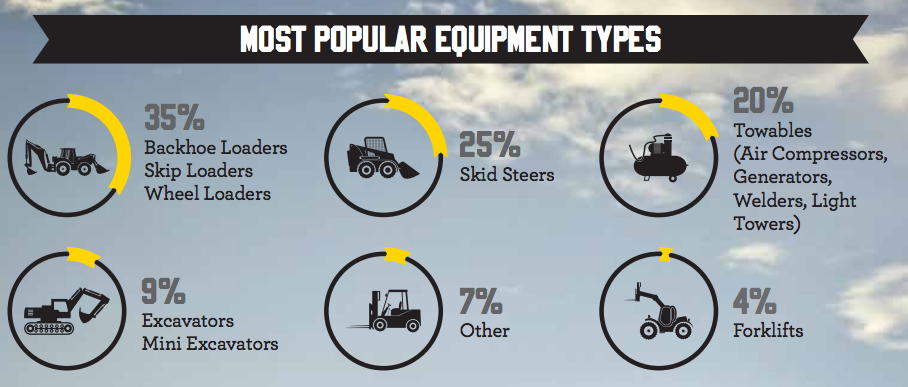

From that sample, the report identifies backhoe loaders, skip loaders and wheel loaders as the most popular equipment targeted by thieves. “There is little visual differentiation from one backhoe to another, and they all share a common key,” the report explains. “Therefore, they are prime targets for thieves based on the ease of theft and how hard they are to track once one is stolen.”

Skid steers, generators/air compressors/welders and portable light towers; and excavators are also most susceptible to robbery.

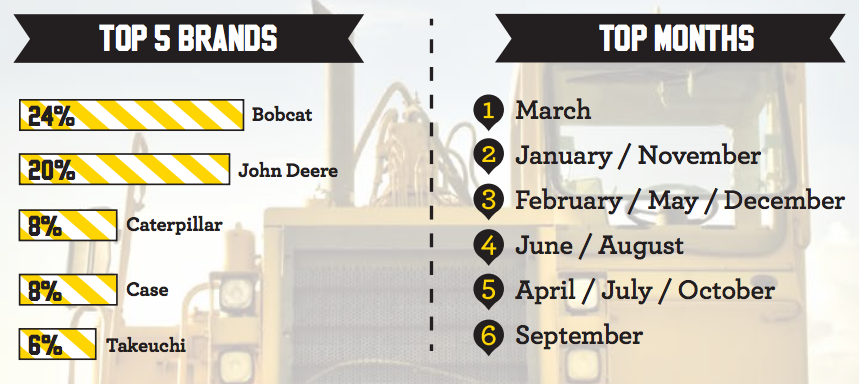

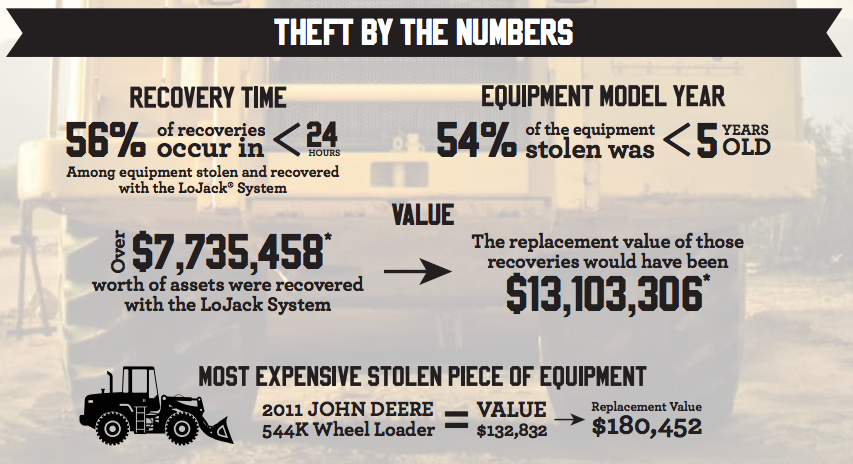

The report notes that thieves typically go after newer and brand-name equipment. In 2014, 54% of the tracked equipment stolen was less than five years old. And 65% of the thefts were of products made by top manufacturers such as Bobcat (24% of the equipment stolen), John Deere (20%), Caterpiller and Case (tied at 8% each), Takeuchi (6%) and Magnum (5%).

The report gives several reasons why construction equipment and tools continue to be vulnerable to thieves. For one thing, titling and registration of equipment aren’t mandated, so it’s often hard to report theft and harder for law enforcement to track what’s stolen. There’s also no standardized identification numbers on this stuff, like the Vehicle Identification Numbers on cars and trucks.

In addition, jobsite security is not always as tight as it could be, and the sites themselves can be remote. And because equipment and tools are constantly being transferred between sites, owners can be lax in their inventory accounting.

“The thief isn’t always somebody unrelated to the job, as often he or she can be a member of the company that owns the equipment,” DeMilio tells BD+C. But inside jobs aside, the industry has a “natural exposure” to theft because jobsites are on predictable schedules, leaving opportunities open for thieves will often scope out sites looking for weak spots.

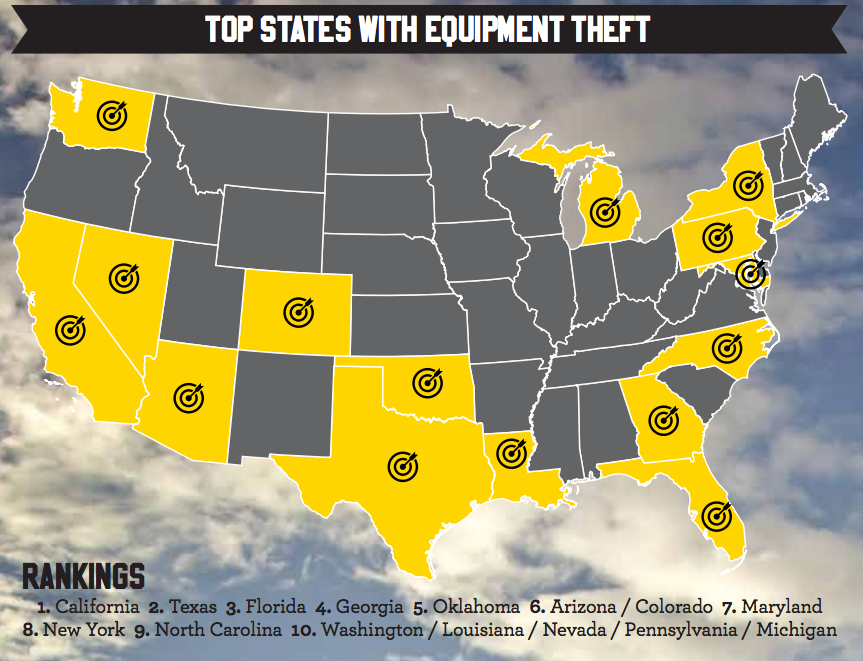

Not surprisingly, theft is more prevalent in states where there’s more construction activity, with California and Texas having the highest occurrences. But unlike cars, which when stolen often end up in other states, 95% of the stolen construction equipment and tools that are recovered are found in the same state they were stolen in.

DeMilio says contractors and owners need to keep their equipment off the street in secured areas patrolled by guards. They should also be in close contact with police “so they are aware of the area and can be monitoring during off hours.” She recommends that owners adopt technology that includes cameras, electronic access pads, GPS geo-fencing, and covert RF recover devices.

LoJack, naturally, pitches the efficacy of installing detection and telematic devices on construction equipment so that owners are alerted to unauthorized use during off hours, and police have a better shot at retrieving stolen goods. It points out that 56% of stolen equipment with a LoJack system was recovered within 24 hours after being reported, and 5% was recovered within an hour.

Related Stories

Contractors | Nov 14, 2022

U.S. construction firms lean on technology to manage growth and weather the pandemic

In 2021, Gilbane Building Company and Nextera Robotics partnered in a joint venture to develop an artificial intelligence platform utilizing a fleet of autonomous mobile robots. The platform, dubbed Didge, is designed to automate construction management, maximize reliability and safety, and minimize operational costs. This was just one of myriad examples over the past 18 months of contractor giants turning to construction technology (ConTech) to gather jobsite data, manage workers and equipment, and smooth the construction process.

University Buildings | Nov 13, 2022

University of Washington opens mass timber business school building

Founders Hall at the University of Washington Foster School of Business, the first mass timber building at Seattle campus of Univ. of Washington, was recently completed. The 84,800-sf building creates a new hub for community, entrepreneurship, and innovation, according the project’s design architect LMN Architects.

Giants 400 | Nov 9, 2022

Top 50 Data Center Contractors + CM Firms for 2022

Holder, Turner, DPR, and HITT Contracting head the ranking of the nation's largest data center contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 8, 2022

Top 110 Sports Facility Architecture and AE Firms for 2022

Populous, HOK, Gensler, and Perkins and Will top the ranking of the nation's largest sports facility architecture and architecture/engineering (AE) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Giants 400 | Nov 8, 2022

Top 60 Sports Facility Contractors and CM Firms for 2022

AECOM, Mortenson, Clark Group, and Turner Construction top the ranking of the nation's largest sports facility contractors and construction management (CM) firms for 2022, as reported in Building Design+Construction's 2022 Giants 400 Report.

Industry Research | Nov 8, 2022

U.S. metros take the lead in decarbonizing their built environments

A new JLL report evaluates the goals and actions of 18 cities.

Hotel Facilities | Nov 8, 2022

6 hotel design trends for 2022-2023

Personalization of the hotel guest experience shapes new construction and renovation, say architects and construction experts in this sector.

Green | Nov 8, 2022

USGBC and IWBI will develop dual certification pathways for LEED and WELL

The U.S. Green Building Council (USGBC) and the International WELL Building Institute (IWBI) will expand their strategic partnership to develop dual certification pathways for LEED and WELL.

Reconstruction & Renovation | Nov 8, 2022

Renovation work outpaces new construction for first time in two decades

Renovations of older buildings in U.S. cities recently hit a record high as reflected in architecture firm billings, according to the American Institute of Architects (AIA).

Sponsored | Steel Buildings | Nov 7, 2022

Steel structures offer faster path to climate benefits

Faster delivery of buildings isn’t always associated with sustainability benefits or long-term value, but things are changing. An instructive case is in the development of steel structures that not only allow speedier erection times, but also can reduce embodied carbon and create durable, highly resilient building approaches.