Construction employment rebounded from April to May in 45 states and the District of Columbia, following the loss of nearly one million construction jobs nationwide in April, but the gains may be short-lived, according to an analysis by the Associated General Contractors of America of government data released today and a survey the association released on Thursday. Association officials urged officials in Washington to promptly enact measures to fund infrastructure projects and plug looming state and local budget deficits to avoid a “second wave” of job losses.

“The widespread uptick in construction employment in May is welcome news following a month in which industry employment shrank in all but one state,” said Ken Simonson, the association’s chief economist. “Our association’s latest survey shows many firms have been recalling or adding employees in recent weeks, thanks in part to rapid receipt of Paycheck Protection Program loans. But only about one-fifth of firms report winning new or expanded projects, while almost one-third of firms say an upcoming project has been canceled.”

Simonson noted that the association’s latest survey found that nearly one-fourth of contractors reported a project that was scheduled to start in June or later had been canceled. He added that with most states and localities starting a new fiscal year on July 1, even more public construction is likely to be canceled unless the federal government makes up for some of their lost revenue and unbudgeted expenses.

Of the 45 states with construction job gains over the month, Pennsylvania had the largest increase (77,400 jobs or 48.9%). Michigan had the largest percentage increase (51.4%, 50,500 construction jobs). Construction employment declined from April to May in five states. Hawaii lost the largest number and highest percentage of construction jobs (-700 jobs, -1.9%).

From May 2019 to May 2020, 12 states added construction jobs while 38 states and D.C lost jobs. Utah added the most construction jobs over the year (8,200 jobs, 7.6%). South Dakota—the only state to add construction jobs in April—had the largest year-over-year percentage increase (10.3%, 2,400 jobs). Both states set new highs for construction employment, in a series dating to 1990. New York lost the most construction jobs over the year (105,300 jobs, -25.9%). The largest percentage decline occurred in Vermont (-26.1%, -4,000 jobs).

Association officials cautioned that even as the immediate impacts of the coronavirus appear to be easing, the industry is just beginning to appreciate the longer-term impacts of the pandemic. They warned that without new federal recovery measures, the industry was likely to experience a second wave of job losses. They urged Congress and the Trump administration to enact liability reform, pass new infrastructure funding measures, and find a way to incentivize laid-off employees to return to work.

“The economic boost that comes with lifting economic lockdowns will not be enough to sustain long-term growth for the industry,” said Stephen E. Sandherr, the association’s chief executive officer. “Boosting infrastructure spending, protecting firms that are operating safely and encouraging people to return to work will help convert short-term gains into longer-term growth.”

View the state employment data, rankings, map and high and lows. Click here for the association’s survey results and here for a video summary of the survey responses.

Related Stories

Market Data | Nov 9, 2021

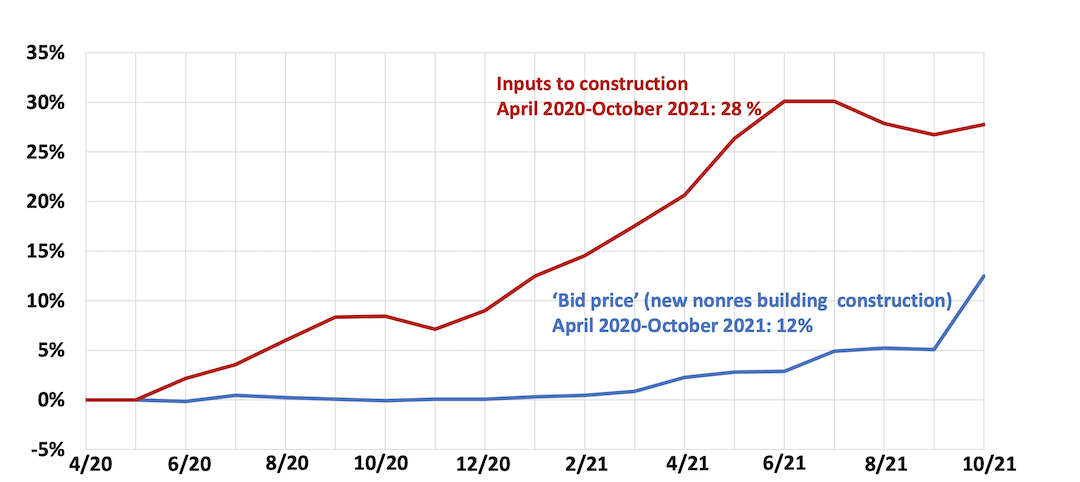

Continued increases in construction materials prices starting to drive up price of construction projects

Supply chain and labor woes continue.

Market Data | Nov 5, 2021

Construction firms add 44,000 jobs in October

Gain occurs even as firms struggle with supply chain challenges.

Market Data | Nov 3, 2021

One-fifth of metro areas lost construction jobs between September 2020 and 2021

Beaumont-Port Arthur, Texas and Sacramento--Roseville--Arden-Arcade Calif. top lists of gainers.

Market Data | Nov 2, 2021

Construction spending slumps in September

A drop in residential work projects adds to ongoing downturn in private and public nonresidential.

Hotel Facilities | Oct 28, 2021

Marriott leads with the largest U.S. hotel construction pipeline at Q3 2021 close

In the third quarter alone, Marriott opened 60 new hotels/7,882 rooms accounting for 30% of all new hotel rooms that opened in the U.S.

Hotel Facilities | Oct 28, 2021

At the end of Q3 2021, Dallas tops the U.S. hotel construction pipeline

The top 25 U.S. markets account for 33% of all pipeline projects and 37% of all rooms in the U.S. hotel construction pipeline.

Market Data | Oct 27, 2021

Only 14 states and D.C. added construction jobs since the pandemic began

Supply problems, lack of infrastructure bill undermine recovery.

Market Data | Oct 26, 2021

U.S. construction pipeline experiences highs and lows in the third quarter

Renovation and conversion pipeline activity remains steady at the end of Q3 ‘21, with conversion projects hitting a cyclical peak, and ending the quarter at 752 projects/79,024 rooms.

Market Data | Oct 19, 2021

Demand for design services continues to increase

The Architecture Billings Index (ABI) score for September was 56.6.

Market Data | Oct 14, 2021

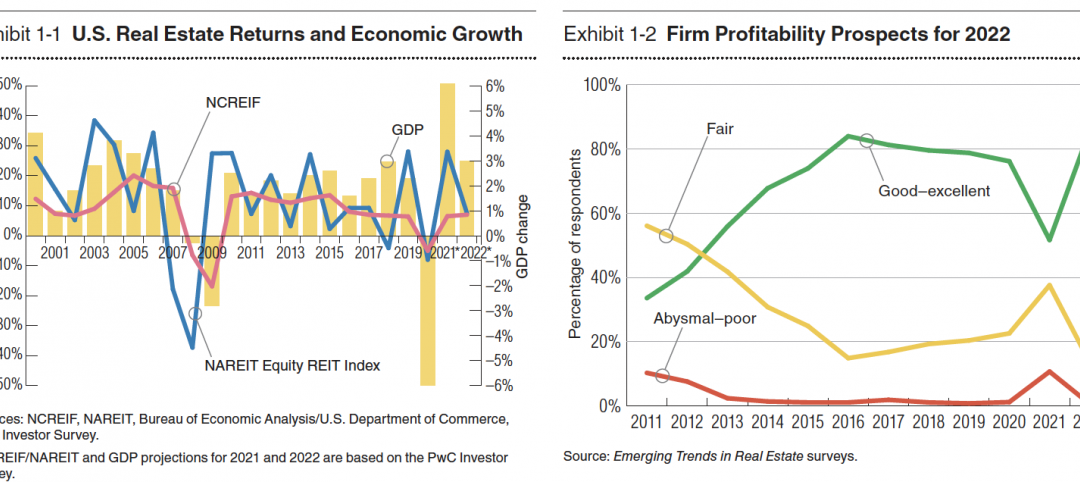

Climate-related risk could be a major headwind for real estate investment

A new trends report from PwC and ULI picks Nashville as the top metro for CRE prospects.