Construction employment declined in 91 metro areas and was stagnant in another 24 between February 2020, the last month before the pandemic, and May 2021, according to an analysis by the Associated General Contractors of America of government employment data released today. They said the high number of metro areas losing construction jobs during that time frame reflected the impacts of early pandemic shutdowns and more recent challenges procuring construction materials and finding qualified workers to hire.

“The devastating job losses of early 2020 and more recent materials and labor challenges since then have kept industry employment stagnant or lower this May than in February 2020 in nearly one-third of metros,” said Ken Simonson, the association’s chief economist. “Extreme lead times for producing and delivering materials, along with record prices for many items, has led to project delays and cancellations that have chilled hiring.”

Of the 91 metro areas with lower construction employment in May 2021 than in February 2020, Houston-The Woodlands-Sugar Land, Texas lost the most jobs: 30,500 or 13%. Major losses also occurred in New York City (-21,200 jobs, -13%); Midland, Texas (-9,600 jobs, -25%) and Odessa, Texas (-8,300 jobs, -40%). Odessa had the largest percentage decline, followed by Lake Charles, La. (-36%, -7,200 jobs); Midland; Laredo, Texas (-23%, -900 jobs) and Longview, Texas (-22%, -3,300 jobs).

Construction employment increased in 243 metro areas compared to the February 2020 level—far fewer than the 320 metros that typically add construction jobs between February and May, Simonson noted. Minneapolis-St. Paul-Bloomington, Minn.-Wis. added the most construction jobs over 15 months (11,100 jobs, 14%), followed by Indianapolis-Carmel-Anderson, Ind. (10,900 jobs, 21%); Chicago-Naperville-Arlington Heights, Ill. (10,300 jobs, 9%); Seattle-Bellevue-Everett, Wash. (6,900 jobs, 7%); and Pittsburgh, Pa. (6,900 jobs, 12%). Fargo, N.D.-Minn. had the highest percentage increase (45%, 3,300 jobs), followed by Sierra Vista-Douglas, Ariz. (44%, 1,100 jobs); and Bay City, Mich. (36%, 400 jobs).

Association officials said that many construction firms report challenges with rising materials prices, supply chain problems that are leading to delivery delays for key components and challenges finding qualified labor to hire. They urged the Biden administration and Congress to work together to remove tariffs on key construction materials, ease supply chain shortages and boost investments in career and technical education. They added that the association posted an updated Construction Inflation Alert to inform owners and officials about the worsening problems with rising materials costs, shipping delays and labor shortages.

“It is hard for the construction industry to grow while firms struggle to pay for and source key materials and have a hard time finding qualified workers to hire,” said Stephen E. Sandherr, the association’s chief executive officer. “Federal officials can help the industry and boost the economy by removing tariffs, easing supply chain backups and investing in workforce development.”

View the metro employment data, rankings, top 10, multi-division metros, and map. View the Alert.

Related Stories

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

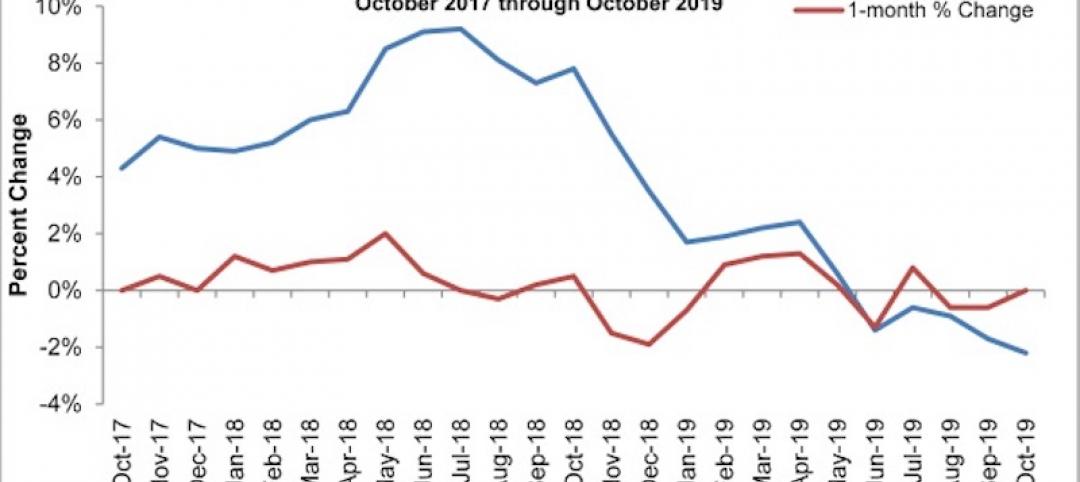

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.

Market Data | Nov 5, 2019

Construction and real estate industry deals in September 2019 total $21.7bn globally

In terms of number of deals, the sector saw a drop of 4.4% over the last 12-month average.

Market Data | Nov 4, 2019

Nonresidential construction spending rebounds slightly in September

Private nonresidential spending fell 0.3% on a monthly basis and is down 5.7% compared to the same time last year.

Market Data | Nov 1, 2019

GDP growth expands despite reduction in nonresident investment

The annual rate for nonresidential fixed investment in structures declined 15.3% in the third quarter.

Market Data | Oct 24, 2019

Architecture Billings Index downturn moderates as challenging conditions continue

The Architecture Billings Index (ABI) score in September is 49.7.

Market Data | Oct 23, 2019

ABC’s Construction Backlog Indicator rebounds in August

The primary issue for most contractors is not a lack of demand, but an ongoing and worsening shortage of skilled workers available to meet contractual requirements.

Multifamily Housing | Oct 16, 2019

A new study wonders how many retiring adults will be able to afford housing

Harvard’s Joint Center for Housing Studies focuses on growing income disparities among people 50 or older.