Construction employment declined by 7,000 between May and June as the industry still employs 238,000 fewer people than before the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said that job losses in the nonresidential construction sector offset modest monthly gains in residential construction as many firms struggle with worker shortages, supply chain disruptions and rising materials prices.

“It is hard for the industry to expand when it can’t find qualified workers, key building materials are scarce, and the prices for them keep climbing,” said Stephen E. Sandherr, the association’s chief executive officer. “June’s job declines seem less about a lack of demand for projects and a lot more about a lack of supplies to use and workers to employ.”

Construction employment in June totaled 7,410,000, dropping 7,000 from the revised May total. The total in June remained 238,000 or 3.1% below February 2020, the high point before the pandemic drove construction employment down. The number of former construction workers who were unemployed in June, 730,000, dropped a quarter from a year ago and the sector’s unemployment rate fell from 10.1% in June 2020 to 7.5% this June.

Residential and nonresidential construction sectors have differed sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 15,200 employees during the month and have added 51,000 workers or 1.7% over 16 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 22,600 jobs in June and employed 289,000 fewer workers or 6.2% less than in February 2020.

Sandherr noted that many firms report key materials are backlogged or rationed, while also reporting frequent increases in the amount they pay for those materials. In addition, many firms report they are having a hard time finding workers to hire despite the relatively high number of people currently out of work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Association officials said they were taking steps to recruit more people into the construction industry. They noted the association launched its “Construction is Essential” recruiting campaign earlier this year. They said Washington officials could help the industry by taking steps to ease supply chain backups. They also continued to call on the President to remove tariffs on key construction materials, including steel.

“The good news is there are large numbers of qualified workers available to hire who are on the sidelines until schools reopen and the federal unemployment supplements expire,” said Stephen E. Sandherr, the association’s chief executive officer. “Our message to these workers is clear, there are high-paying construction careers available when they are ready.”

Related Stories

Market Data | Sep 6, 2023

Far slower construction activity forecast in JLL’s Midyear update

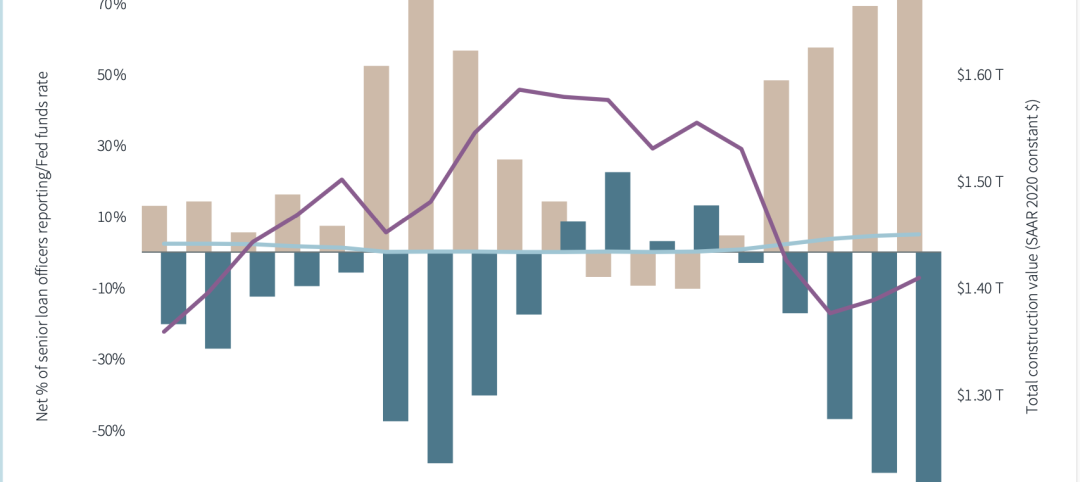

The good news is that market data indicate total construction costs are leveling off.

Giants 400 | Sep 5, 2023

Top 80 Construction Management Firms for 2023

Alfa Tech, CBRE Group, Skyline Construction, Hill International, and JLL top the rankings of the nation's largest construction management (as agent) and program/project management firms for nonresidential buildings and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Sep 5, 2023

Top 150 Contractors for 2023

Turner Construction, STO Building Group, DPR Construction, Whiting-Turner Contracting Co., and Clark Group head the ranking of the nation's largest general contractors, CM at risk firms, and design-builders for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Market Data | Sep 5, 2023

Nonresidential construction spending increased 0.1% in July 2023

National nonresidential construction spending grew 0.1% in July, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.08 trillion and is up 16.5% year over year.

Giants 400 | Aug 31, 2023

Top 35 Engineering Architecture Firms for 2023

Jacobs, AECOM, Alfa Tech, Burns & McDonnell, and Ramboll top the rankings of the nation's largest engineering architecture (EA) firms for nonresidential buildings and multifamily buildings work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

Top 115 Architecture Engineering Firms for 2023

Stantec, HDR, Page, HOK, and Arcadis North America top the rankings of the nation's largest architecture engineering (AE) firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Giants 400 | Aug 22, 2023

2023 Giants 400 Report: Ranking the nation's largest architecture, engineering, and construction firms

A record 552 AEC firms submitted data for BD+C's 2023 Giants 400 Report. The final report includes 137 rankings across 25 building sectors and specialty categories.

Giants 400 | Aug 22, 2023

Top 175 Architecture Firms for 2023

Gensler, HKS, Perkins&Will, Corgan, and Perkins Eastman top the rankings of the nation's largest architecture firms for nonresidential building and multifamily housing work, as reported in Building Design+Construction's 2023 Giants 400 Report.

Apartments | Aug 22, 2023

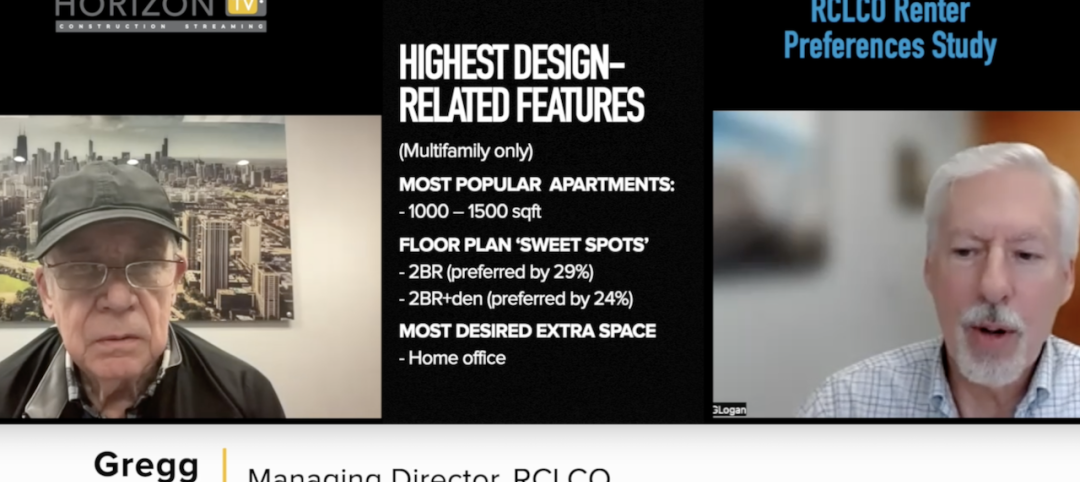

Key takeaways from RCLCO's 2023 apartment renter preferences study

Gregg Logan, Managing Director of real estate consulting firm RCLCO, reveals the highlights of RCLCO's new research study, “2023 Rental Consumer Preferences Report.” Logan speaks with BD+C's Robert Cassidy.

Market Data | Aug 18, 2023

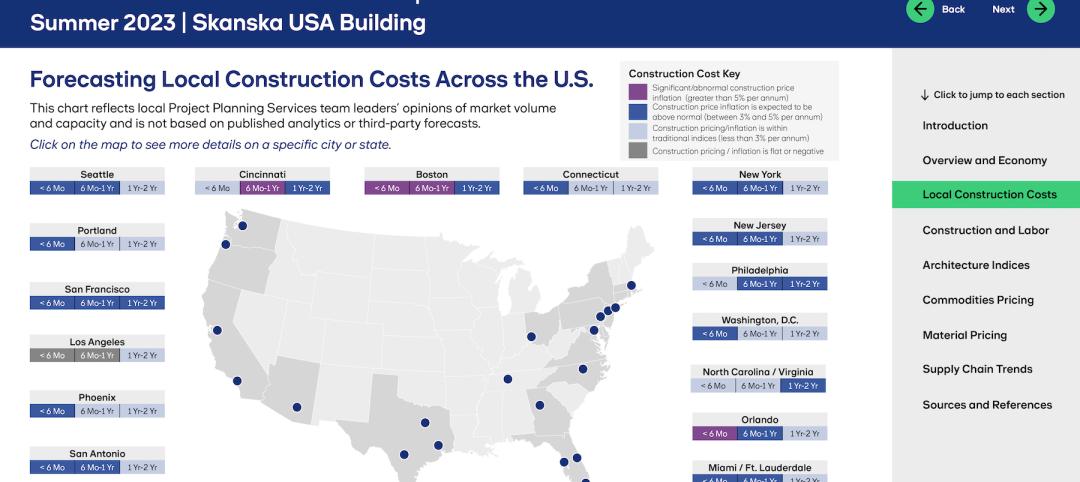

Construction soldiers on, despite rising materials and labor costs

Quarterly analyses from Skanska, Mortenson, and Gordian show nonresidential building still subject to materials and labor volatility, and regional disparities.