Construction employment declined by 7,000 between May and June as the industry still employs 238,000 fewer people than before the pandemic, according to an analysis by the Associated General Contractors of America of government data released today. Association officials said that job losses in the nonresidential construction sector offset modest monthly gains in residential construction as many firms struggle with worker shortages, supply chain disruptions and rising materials prices.

“It is hard for the industry to expand when it can’t find qualified workers, key building materials are scarce, and the prices for them keep climbing,” said Stephen E. Sandherr, the association’s chief executive officer. “June’s job declines seem less about a lack of demand for projects and a lot more about a lack of supplies to use and workers to employ.”

Construction employment in June totaled 7,410,000, dropping 7,000 from the revised May total. The total in June remained 238,000 or 3.1% below February 2020, the high point before the pandemic drove construction employment down. The number of former construction workers who were unemployed in June, 730,000, dropped a quarter from a year ago and the sector’s unemployment rate fell from 10.1% in June 2020 to 7.5% this June.

Residential and nonresidential construction sectors have differed sharply in their recovery since the pre-pandemic peak in February 2020. Residential construction firms—contractors working on new housing, additions, and remodeling—gained 15,200 employees during the month and have added 51,000 workers or 1.7% over 16 months. The nonresidential sector—comprising nonresidential building, specialty trades, and heavy and civil engineering contractors—shed 22,600 jobs in June and employed 289,000 fewer workers or 6.2% less than in February 2020.

Sandherr noted that many firms report key materials are backlogged or rationed, while also reporting frequent increases in the amount they pay for those materials. In addition, many firms report they are having a hard time finding workers to hire despite the relatively high number of people currently out of work. He added these factors are contributing to rising costs for many contractors, which are details in the association’s updated Construction Inflation Alert.

Association officials said they were taking steps to recruit more people into the construction industry. They noted the association launched its “Construction is Essential” recruiting campaign earlier this year. They said Washington officials could help the industry by taking steps to ease supply chain backups. They also continued to call on the President to remove tariffs on key construction materials, including steel.

“The good news is there are large numbers of qualified workers available to hire who are on the sidelines until schools reopen and the federal unemployment supplements expire,” said Stephen E. Sandherr, the association’s chief executive officer. “Our message to these workers is clear, there are high-paying construction careers available when they are ready.”

Related Stories

Market Data | Oct 14, 2021

Prices for construction materials continue to outstrip bid prices over 12 months

Construction officials renew push for immediate removal of tariffs on key construction materials.

Market Data | Oct 11, 2021

No decline in construction costs in sight

Construction cost gains are occurring at a time when nonresidential construction spending was down by 9.5 percent for the 12 months through July 2021.

Market Data | Oct 11, 2021

Nonresidential construction sector posts first job gain since March

Has yet to hit pre-pandemic levels amid supply chain disruptions and delays.

Market Data | Oct 4, 2021

Construction spending stalls between July and August

A decrease in nonresidential projects negates ongoing growth in residential work.

Market Data | Oct 1, 2021

Nonresidential construction spending dips in August

Spending declined on a monthly basis in 10 of the 16 nonresidential subcategories.

Market Data | Sep 29, 2021

One-third of metro areas lost construction jobs between August 2020 and 2021

Lawrence-Methuen Town-Salem, Mass. and San Diego-Carlsbad, Calif. top lists of metros with year-over-year employment increases.

Market Data | Sep 28, 2021

Design-Build projects should continue to take bigger shares of construction spending pie over next five years

FMI’s new study finds collaboration and creativity are major reasons why owners and AEC firms prefer this delivery method.

Market Data | Sep 22, 2021

Architecture billings continue to increase

The ABI score for August was 55.6, up from July’s score of 54.6.

Market Data | Sep 20, 2021

August construction employment lags pre-pandemic peak in 39 states

The coronavirus delta variant and supply problems hold back recovery.

Market Data | Sep 15, 2021

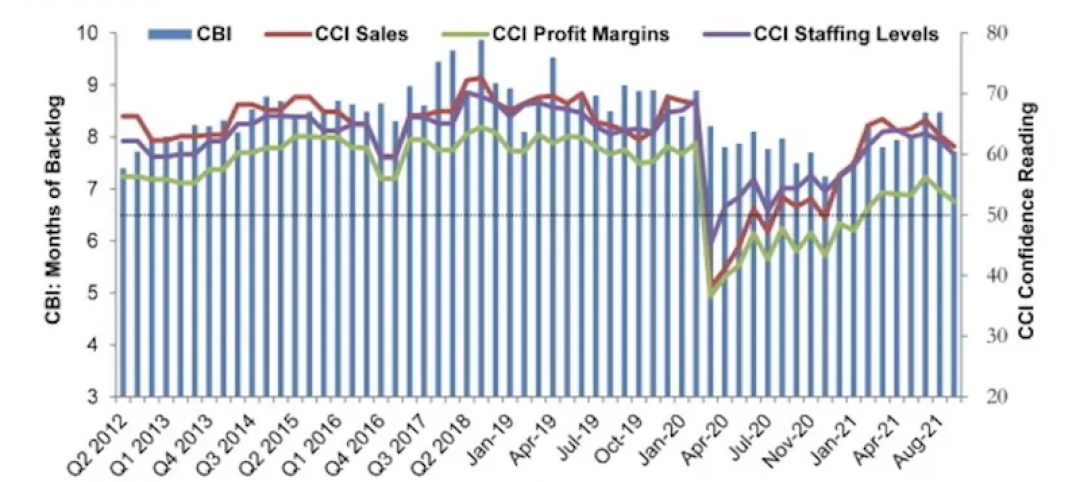

ABC’s Construction Backlog Indicator plummets in August; Contractor Confidence down

ABC’s Construction Confidence Index readings for sales, profit margins and staffing levels all fell modestly in August.