Construction employment in April remained below the pre-pandemic high set in February 2020 in 36 states and the District of Columbia, despite increases from March to April in 26 states, according to an analysis by the Associated General Contractors of America of government employment data released today. Association officials said that the sector’s recovery was being undermined by increases in materials prices, delays in receiving key construction supplies and labor shortages.

“Today’s numbers show that construction has yet to fully recover from the effects of the pandemic in most parts of the country,” said Ken Simonson, the association’s chief economist. “Even where employment has topped pre-pandemic levels, the gains are likely due mainly to feverish homebuilding and remodeling, not to widespread resumption of nonresidential building and infrastructure projects.”

Seasonally adjusted construction employment in April exceeded the February 2020 level in only 14 states. Utah added the most jobs (5,100 jobs or 4.5%), trailed by Idaho (4,400 jobs, 8.0%), Washington (3,800 jobs, 1.7%), and South Carolina (1,900 jobs, 1.8%). Idaho added the highest percentage, followed by South Dakota (6.3%, 1,500 jobs), Utah, and Rhode Island (3.5%, 700 jobs).

Employment declined from the February 2020 level in 36 states and D.C. Texas lost the most construction jobs over the period (-44,800 jobs or -5.7%), followed by New York (-29,300 jobs, -9.1%), California (-27,600 jobs, -3.0%), Louisiana (-19,600 jobs, -14.3%), and New Jersey (-15,600 jobs, -9.5%). Louisiana recorded the largest percentage loss, followed by Wyoming (-13.5%, -3,100 jobs), New Jersey, New York, and West Virginia (-8.7%, -2,900 jobs).

For the month, construction employment increased in 26 states, decreased in 21, and held steady in three states and D.C. Illinois added the most construction jobs (4,000 jobs, 1.8%), followed by Pennsylvania (3,400 jobs, 1.4%), Wisconsin (2,900 jobs, 2.4%), Kentucky (1,900 jobs, 2.4%) and North Carolina (1,600 jobs, 0.7%). New Hampshire had the largest percentage gain (3.2%, 900 jobs), followed by Rhode Island (2.4%, 500 jobs), Kentucky, and Wisconsin. Texas lost the most construction jobs for the month (-13,600 jobs, -1.8%), followed by New York, (-3,900 jobs, -1.0%) and Iowa (-3,100 jobs, -3.9%). Iowa had the largest percentage loss, followed by Alabama (-2.4%, -2,200 jobs), and Texas.

Association officials noted that rapid increases in the cost of many construction materials are hammering firms still trying to recover from the pandemic. Deliveries of many materials are often delayed because of manufacturing and shipping backups. In addition, many firms report having trouble finding workers to hire amid continued school closures, lingering worries about the pandemic and elevated unemployment benefits.

“Federal officials can give the industry a needed boost by removing tariffs on key construction materials such as lumber, steel, and aluminum, and taking steps to ease supply-chain backups,” said Stephen E. Sandherr, the association’s chief executive officer. “It is also time to end barriers keeping workers home, including reopening schools and ending the unemployment supplements.”

View state February 2020-April 2021 data, 12-month rankings, 1-month rankings and map.

Related Stories

AEC Tech | Jan 16, 2020

EC firms with a clear ‘digital roadmap’ should excel in 2020

Deloitte, in new report, lays out a risk mitigation strategy that relies on tech.

Market Data | Jan 13, 2020

Construction employment increases by 20,000 in December and 151,000 in 2019

Survey finds optimism about 2020 along with even tighter labor supply as construction unemployment sets record December low.

Market Data | Jan 10, 2020

North America’s office market should enjoy continued expansion in 2020

Brokers and analysts at two major CRE firms observe that tenants are taking longer to make lease decisions.

Market Data | Dec 17, 2019

Architecture Billings Index continues to show modest growth

AIA’s Architecture Billings Index (ABI) score of 51.9 for November reflects an increase in design services provided by U.S. architecture firms.

Market Data | Dec 12, 2019

2019 sets new record for supertall building completion

Overall, the number of completed buildings of at least 200 meters in 2019 declined by 13.7%.

Market Data | Dec 4, 2019

Nonresidential construction spending falls in October

Private nonresidential spending fell 1.2% on a monthly basis and is down 4.3% from October 2018.

Market Data | Nov 25, 2019

Office construction lifts U.S. asking rental rate, but slowing absorption in Q3 raises concerns

12-month net absorption decelerates by one-third from 2018 total.

Market Data | Nov 22, 2019

Architecture Billings Index rebounds after two down months

The Architecture Billings Index (ABI) score in October is 52.0.

Market Data | Nov 14, 2019

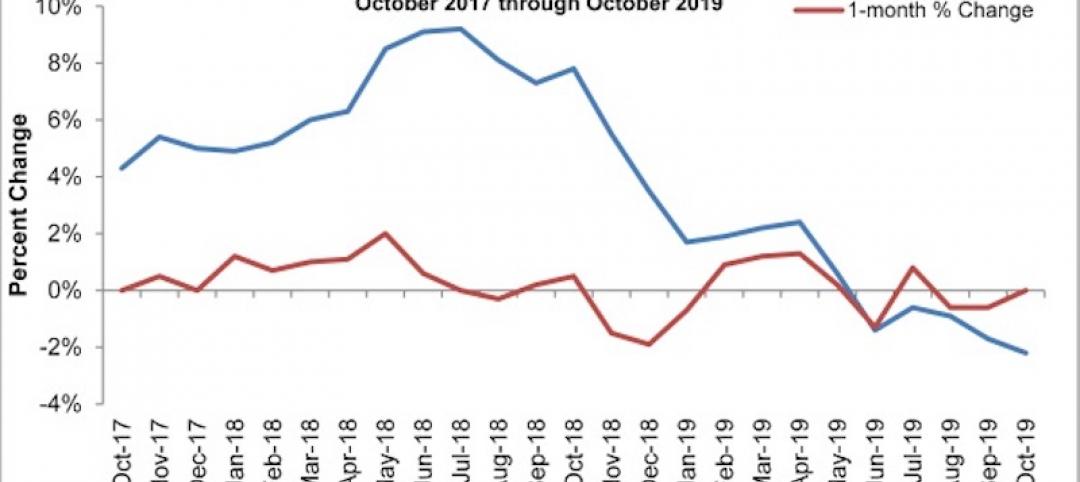

Construction input prices unchanged in October

Nonresidential construction input prices fell 0.1% for the month and are down 2.0% compared to the same time last year.

Multifamily Housing | Nov 7, 2019

Multifamily construction market remains strong heading into 2020

Fewer than one in 10 AEC firms doing multifamily work reported a decrease in proposal activity in Q3 2019, according to a PSMJ report.