Building revenue and demand for new commercial construction may be rising fast—but so are costs. Profitability for new commercial building projects will be tricky in 2015, as soaring demand may not lead to soaring profits.

“Leasing momentum is boosting construction demand across multiple commercial property sectors—but raw material and labor costs are making it more expensive to get out of the ground than ever before,” said Todd Burns, President, JLL Project and Development Services, Americas. “Demand is exploding, but demand isn’t everything. You have to consider the bottom line of every project to make sure it makes economic sense short- and long-term.”

Affirming rising demand, the American Institute of Architects’ Consensus Construction Forecast projects that spending on non-residential construction is expected to rise 7.7% in every commercial property sector this year. Likewise, the Construction Backlog Indicator, which tracks non-residential construction, hit a post-downturn high of 8.8 months in the third quarter of 2014.

A new JLL report on U.S. non-residential construction activity highlights several trends to watch in 2015:

- The construction industry remains 22% below peak (2007) levels. According to Gilbane, it may take seven to eight more years to retain previous levels.

- Recovery Continues, Backlog Builds. The overall value of buildings constructed has continued to grow since bottoming-out in 2010. The Construction Backlog Index has grown in all but the Southeast Region, indicating that 2015 will be a big year for construction. Office vacancy rates across the country have declined from 14.1% in 2012 to 10.9% in the fourth quarter of 2014, further strengthening demand. That said, cities with high labor costs and limited land, like New York and New Jersey, may see construction activity slow.

- Costs Climbing Higher. Although raw material costs are expected to stabilize in 2015, rising labor costs will force construction costs continue to grow. Cities such as New York and Chicago will feel the pain of cost hikes and so will Minneapolis where a massive downtown refurbishment is underway. Even Atlanta, one of the lowest-cost markets, saw a bump up in overall prices for the first time since 2008. This could be troublesome for the education sector, which reported the highest level of spending on construction in 2014 at $78.7 billion.

- The Construction Unemployment Paradox. Construction unemployment rates remain high, indicating a large potential employment pool for new construction. However, overall unemployment will drop quickly as building continues to grow. Though unemployment will drop, costs will continue to rise due to productivity issues; there is a lack of construction workers with the right skills and training, frustrating employers and driving up overall labor costs. Costs are also growing more quickly in union-centric markets. According to the U.S. Bureau of Labor Statistics, the lack of available workers with the right training will worsen even as 1.1 million construction jobs are added to the market by 2020. The construction industry has grown every month of 2014, gaining 48,000 jobs in December to reach 290,000 total in 2014. However, overall construction employment is still 1.5 million lower than its peak in 2007.

- Cheaper to Build Than to Lease. With more demand for new construction in some markets like Chicago, West L.A. and Seattle, replacement costs have become lower than purchase prices so constructing new space is more cost-effective than leasing existing space.

While the overall market is recovering, it’s not an even recovery. Construction of distribution facilities supporting e-commerce and retail supply chains will continue to expand, particularly in markets like Dallas and Miami, where new facilities are needed to support sophisticated logistics strategies. Conversely, due to a high volume of office projects started in 2014, more than 16 million sf of new office development is under construction in Houston; 44% of that space remains unleased, which may cause vacancy issues for the city down the road, especially if oil prices remain low.

“Vacancy rates for industrial properties have dropped in the last two years, and competition for big distribution centers has increased dramatically,” said Dana Westgren, research analyst with JLL. “Particularly in locations near ports and other key supply chain locations, new construction can replace older, now-obsolete facilities.”

Download a copy of the JLL U.S. Construction Perspective for Q4 2014 report here.

Related Stories

Great Solutions | Aug 23, 2016

11 great solutions for the commercial construction market

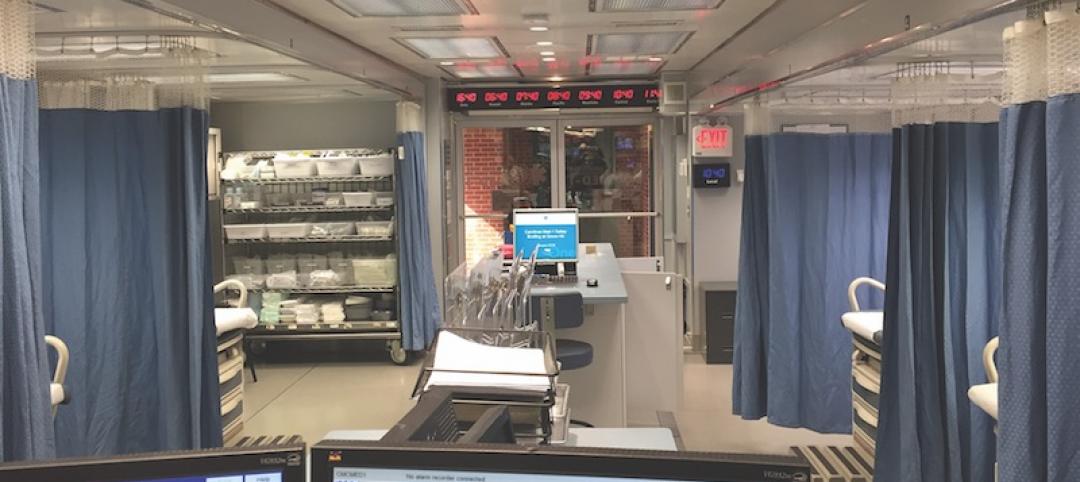

A roll-up emergency department, next-gen telemedicine center, and biophilic cooling pods are among the AEC industry’s clever ideas and novel innovations for 2016.

Building Team | Aug 4, 2016

Thought leaders from architecture, engineering and construction to meet at 2016 Bluebeam eXtreme Conference

Bluebeam users inspire technological change through shared insights and training at three-day event.

Building Team | Jul 11, 2016

Design-assist: The way to really fly [AIA course]

Experts explain the benefits of DA, a process where the subcontractors are retained to assist other Building Team members in the development of a design. Earn 1.0 AIA CES learning units by reading and taking the exam.

Building Team | Jul 11, 2016

Addressing client concerns about design-assist

Common concerns about DA include lack of familiarity, obtaining competitive pricing, and design liability.

Sponsored | Building Team | Jul 11, 2016

Construction Disruption at AECX: Technology, hackathons and the promise of change in LA

The lead up to AECX featured a discussion providing insight into the current state of the AEC technological revolution by exploring opportunities, challenges and choices AEC pros face.

Codes and Standards | Jun 17, 2016

Feds publish framework for evaluating public-private partnerships

No single factor determines whether a project yields stronger benefit as a P3.

Movers+Shapers | Jun 14, 2016

VERTICAL INTEGRATOR: How Brooklyn’s Alloy LLC evolved from an architecture firm into a full-fledged development company

Led by an ambitious President and a CEO with deep pockets, Alloy LLC's six entities control the entire development process: real estate development, design, construction, brokerage, property management, and community development.

Office Buildings | Jun 14, 2016

Let's not forget introverts when it comes to workplace design

Recent design trends favor extroverts who enjoy collaboration. HDR's Lynn Mignola says that designers need to accommodate introverts, people who recharge with solitude, as well.

Building Team | Jun 13, 2016

BD+C launches Women in Design+Construction Conference

Inaugural 2.5-day event will convene 125+ leading AEC women in Dana Point, Calif., November 9-11, for professional development, networking, and career training.

Building Team | Jun 2, 2016

Managing risk when building in challenging locations

AEC firms recognize the upsides of exploring new, emerging markets. Whitehorn Financial's Steve Whitehorn offers four principles that can help guide you to success.