Overcapacity in global iron ore production was a major factor in keeping construction costs low through the first four months of 2015. And for the first time in years, subcontractor labor costs showed signs of softening.

Those are two key findings in the latest assessment of current and future pricing from IHS, the Englewood, Colo.-based market analysis firm.

IHS derives its monthly Cost Index from information it receives from member procurement executives working for several of the world’s largest construction and engineering companies, including AECOM and Bechtel. It breaks down those data into current pricing trends and projections for six months forward.

In April, its Cost Index was 46.2, a bit higher than 44.7 in March, but still below what IHS would consider a “neutral” reading. Its sub index for Materials/Equipment costs in April was 44.9 compared to 43.0 in March. And the April sub index for Subcontractor Labor costs stood at 49.1, compared to 48.7 in March.

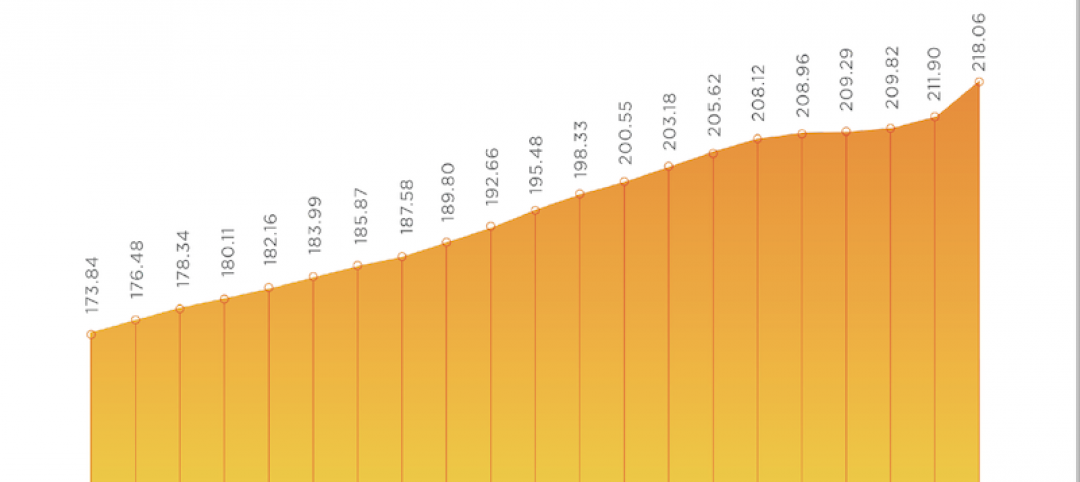

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

Procurement execs from some of the world's largest construction and engineering firms report that costs for materials and labor are still falling, and are unlikely to see much inflation for the next six months. Chart: IHS

IHS notes that eight of 12 construction components it tracks registered falling prices in April, led by carbon steel pipe and fabricated structural steel. Both are victims of “bloated capacity, weak profit growth, and lackluster demand,” explains John Anton, IHS’s Director of Steel Services. Iron ore companies that, in response to demand from China’s steel industry, have initiated massive projects whose capacity, so far, “is far ahead of demand,” and is holding prices down.

Anton adds that while the iron ore market may have some ostensible similarities to the recent decline of crude oil prices, what’s different is that iron ore producers have shown no inclinations toward cutting production to match demand. (IHS points out that three quarters of China’s mines are losing money.)

IHS also notes that several global construction and engineering firms, particularly those in the oil and gas sectors, have been taking a “wait and see” approach to investing in larger capital projects. “The capex environment has yet to thaw,” asserts Mark Eisinger, IHS’s senior economist.

While some markets, like the U.S. South, are still experiencing shortages in skilled subcontractor labor, manpower costs have been receding. For the third consecutive month, the U.S. did not register higher month-to-month labor costs in April. And for the first time in this survey’s history, projections about labor costs over the next six months are below the neutral mark. The six-month cost index for subcontractor labor fell to 47.4 in April, compared to 55.2 in March.

The forward-looking index for materials and equipment, at 43.4 April, rose from March’s record low of 41.9, even as 10 of 12 components showed falling price expectations.

Related Stories

Resiliency | Aug 19, 2021

White paper outlines cost-effective flood protection approaches for building owners

A new white paper from Walter P Moore offers an in-depth review of the flood protection process and proven approaches.

Contractors | Aug 10, 2021

McShane Construction Company opens new regional office in Nashville

Jason Breden, Vice President & Director of Nashville Operations, will lead the new office.

Contractors | Jul 23, 2021

The aggressive growth of Salas O'Brien, with CEO Darin Anderson

Engineering firm Salas O'Brien has made multiple acquisitions over the past two years to achieve its Be Local Everywhere business model. In this exclusive interview for HorizonTV, BD+C's John Caulfield sits down with the firm's Chairman and CEO, Darin Anderson, to discuss its business model.

Coronavirus | Jul 20, 2021

5 leadership lessons for a post-pandemic world from Shawmut CEO Les Hiscoe

Les Hiscoe, PE, CEO of Shawmut, a $1.5 billion construction management company headquartered in Boston, offers a 5-point plan for dealing with the Covid pandemic.

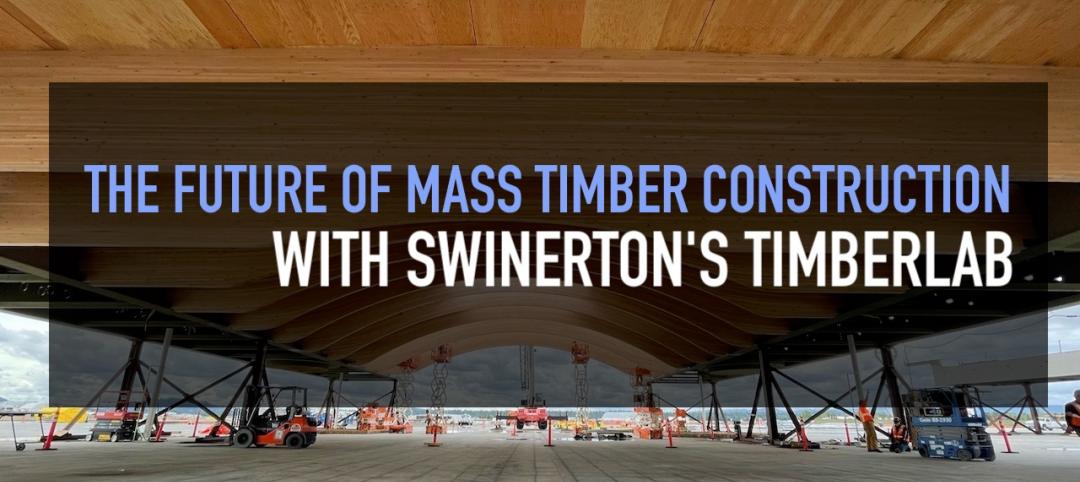

Wood | Jul 16, 2021

The future of mass timber construction, with Swinerton's Timberlab

In this exclusive for HorizonTV, BD+C's John Caulfield sat down with three Timberlab leaders to discuss the launch of the firm and what factors will lead to greater mass timber demand.

Multifamily Housing | Jul 15, 2021

Economic rebound leads to record increase in multifamily asking rents

Across the country, multifamily rents have skyrocketed. Year-over-year rents are up by double digits in nine of the top 30 markets, while national YoY rent growth is up 6.3%. Emerging from the pandemic, a perfect storm of migration, enhanced government stimulus and a hot housing market, among other factors, has enabled this extremely strong growth.

AEC Business Innovation | Jul 11, 2021

Staffing, office changes at SCB, SmithGroup, RKTB, Ryan Cos., Jacobsen, Boldt, and Adolfson & Peterson

AEC firms take strategic action as construction picks up steam with Covid openings.

K-12 Schools | Jul 9, 2021

LPA Architects' STEM high school post-occupancy evaluation

LPA Architects conducted a post-occupancy evaluation, or POE, of the eSTEM Academy, a new high school specializing in health/medical and design/engineering Career Technical Education, in Eastvale, Calif. The POE helped LPA, the Riverside County Office of Education, and the Corona-Norco Unified School District gain a better understanding of which design innovations—such as movable walls, flex furniture, collaborative spaces, indoor-outdoor activity areas, and a student union—enhanced the education program, and how well students and teachers used these innovations.

Market Data | Jul 8, 2021

Encouraging construction cost trends are emerging

In its latest quarterly report, Rider Levett Bucknall states that contractors’ most critical choice will be selecting which building sectors to target.