Earlier this week the Small Business Administration and U.S. Treasury Department released a list of recipients from the government’s Paycheck Protection Program (PPP), which so far has allocated $521 billion of the $670 billion approved by Congress under the CARES Act to nearly 659,000 borrowers. The Trump Administration claims that this program has supported 51 million jobs, roughly 84% of whom work for small businesses.

At presstime, SBA hadn't released exactly how much each entity was approved to borrow. And some recipients—like retail and fast-food chains, millionaire rock bands, and a business venture led by NFL quarterback Tom Brady, who earned $23 million last year—have raised questions about the program’s purpose and vetting process.

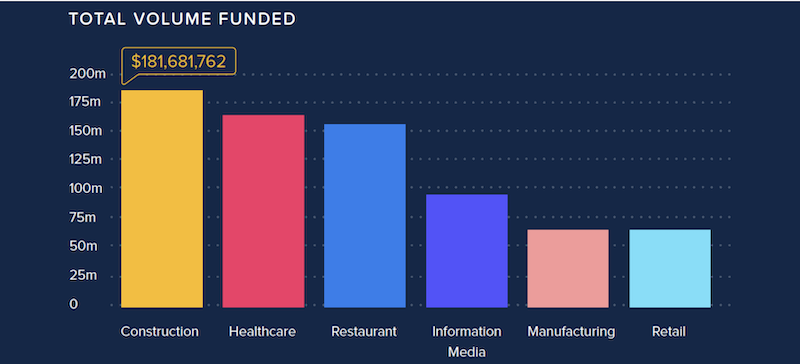

But according to Lendio, a small business marketplace, construction led all industries in total volume among the 100,000 PPP loans totaling $8 billion that Lendio facilitated in partnership with 300 lenders between April 3 and June 30.

FIRST LOAN ROUND LEFT SMALL BUSINESSES STRANDED

The PPP program allowed businesses in many sectors to keep their workers employed even if they were shut down by the coronavirus.

Lendio and its partners tapped into the $350 billion in relief lending that Congress approved in early May, which went primarily to small businesses and small proprietorships.

When Congress approved the first round of PPP loans, its intention was to provide a life raft to businesses forced to close because of the coronavirus pandemic. Borrowers could receive up to 2.5 times their companies’ monthly payrolls, much of which would be forgiven if they keep their workers employed.

However, small businesses struggled to access the first round of PPP loans, totaling $349 billion, which lasted only two weeks and was gobbled up by relatively few businesses. For the second round, Congress earmarked $30 billion specifically for community banks so they wouldn’t have to compete with larger lenders.

The demand was certainly pressing. Lendio points out that prior to participating in the PPP, it had facilitated $2 billion in business loans since its inception in 2011.

The average PPP loan on the Lendio platform is $73,000, versus the national average of $107,000. During the PPP, 30% of the loans that Lendio facilitated went to businesses in urban areas, 28% in the suburbs, and 39% in rural communities. The Pacific and South Atlantic regions of the country accounted for 45% of Lendio’s PPP loans.

LENDIO FACILITATES $182 MILLION IN LOANS TO CONSTRUCTION BORROWERS

About 45% of the PPP loans that Lendio facilitated were to businesses in the Pacific and South Atlantic regions of the U.S.

Of the loans facilitated by Lendio, just under $181.7 million went to businesses in the construction industry, the highest total volume for any sector. Construction was followed by healthcare, restaurants, information media, manufacturing, and retail.

The average loan for construction borrowers was just under $100,000, which ranked fourth by sector, with manufacturing topping this list at $145,568 per loan average.

Lendio estimates that construction borrowers saved 17,500 jobs as a result of the PPP, behind restaurants (31,501 jobs saved), healthcare, and automotive.

ARE MORE LOANS IMMINENT?

Right now, Congress and the White House are debating whether more stimulus is needed, as the coronavirus continues to spread in several areas of the country, with nearly 3.1 confirmed cases of COVID-19 and 133,000 deaths in the U.S., and with hospitalizations rising in 22 states. Some states, cities and towns are reconsidering their plans for reopening their economies.

“Unfortunately, the challenges for small business owners do not end when they receive a PPP loan and great economic uncertainty remains,” writes Lendio. It notes that business owners are now navigating the loan forgiveness process, and others continue to seek financial assistance while operating on thin margins. “As demonstrated throughout the program to date, the need for relief funding is unprecedented and will likely continue as small business owners seek to reopen and rebuild in the coming months.”

Related Stories

| Apr 5, 2011

What do Chengdu, Lagos, and Chicago have in common?

They’re all “world middleweight cities” that are likely to become regional megacities (10 million people) by 2025—along with Dongguan, Guangzhou, Hangzhou, Shenzhen, Tianjin, and Wuhan (China); Kinshasa (Democratic Republic of the Congo); Jakarta (Indonesia); Lahore (Pakistan); and Chennai (India), according to a new report from McKinsey Global Institute: “Urban World: Mapping the economic power of cities”.

| Mar 22, 2011

San Francisco ready to test hiring law

San Francisco's new construction law, billed as the nation’s toughest local hiring ordinance, establishes strict requirements for how many work hours on city-financed projects must be completed by city residents, starting with 20% this year. It also requires that a set percentage of hours be performed by low-income workers. The requirements apply to municipal construction projects worth more than $400,000 within 70 miles of the city.

| Mar 15, 2011

Passive Strategies for Building Healthy Schools, An AIA/CES Discovery Course

With the downturn in the economy and the crash in residential property values, school districts across the country that depend primarily on property tax revenue are struggling to make ends meet, while fulfilling the demand for classrooms and other facilities.

| Mar 11, 2011

University of Oregon scores with new $227 million basketball arena

The University of Oregon’s Matthew Knight Arena opened January 13 with a men’s basketball game against USC where the Ducks beat the Trojans, 68-62. The $227 million arena, which replaces the school’s 84-year-old McArthur Court, has a seating bowl pitched at 36 degrees to replicate the close-to-the-action feel of the smaller arena it replaced, although this new one accommodates 12,364 fans.

| Mar 11, 2011

Temporary modular building at Harvard targets sustainability

Anderson Anderson Architecture of San Francisco designed the Harvard Yard childcare facility, a modular building manufactured by Triumph Modular of Littleton, Mass., that was installed at Harvard University. The 5,700-sf facility will remain on the university’s Cambridge, Mass., campus for 18 months while the Harvard Yard Child Care Center and the Oxford Street Daycare Coop are being renovated.

| Mar 11, 2011

Renovation energizes retirement community in Massachusetts

The 12-year-old Edgewood Retirement Community in Andover, Mass., underwent a major 40,000-sf expansion and renovation that added 60 patient care beds in the long-term care unit, a new 17,000-sf, 40-bed cognitive impairment unit, and an 80-seat informal dining bistro.

| Mar 11, 2011

Research facility added to Texas Medical Center

Situated on the Texas Medical Center’s North Campus in Houston, the new Methodist Hospital Research Institute is a 12-story, 440,000-sf facility dedicated to translational research. Designed by New York City-based Kohn Pedersen Fox, with healthcare, science, and technology firm WHR Architects, Houston, the building has open, flexible labs, offices, and amenities for use by 90 principal investigators and 800 post-doc trainees and staff.

| Mar 11, 2011

Blockbuster remodel transforms Omaha video store into a bank

A former Hollywood Video store in Omaha, Neb., was renovated and repurposed as the SAC Federal Credit Union, Ames Branch. Architects at Leo A Daly transformed the outdated 5,000-sf retail space into a modern facility by wrapping the exterior in poplar siding and adding a new glass storefront that floods the interior with natural light.