Earlier this week the Small Business Administration and U.S. Treasury Department released a list of recipients from the government’s Paycheck Protection Program (PPP), which so far has allocated $521 billion of the $670 billion approved by Congress under the CARES Act to nearly 659,000 borrowers. The Trump Administration claims that this program has supported 51 million jobs, roughly 84% of whom work for small businesses.

At presstime, SBA hadn't released exactly how much each entity was approved to borrow. And some recipients—like retail and fast-food chains, millionaire rock bands, and a business venture led by NFL quarterback Tom Brady, who earned $23 million last year—have raised questions about the program’s purpose and vetting process.

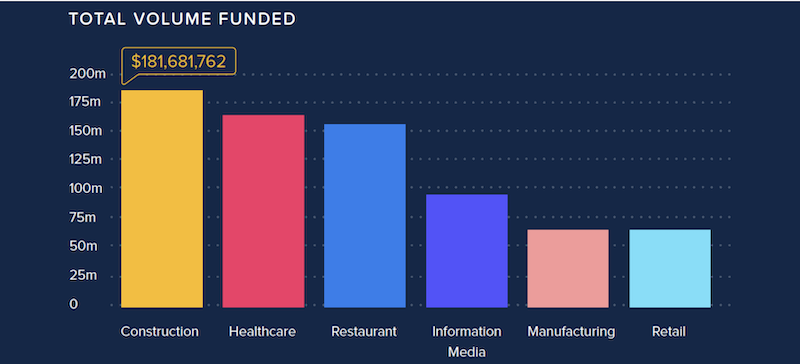

But according to Lendio, a small business marketplace, construction led all industries in total volume among the 100,000 PPP loans totaling $8 billion that Lendio facilitated in partnership with 300 lenders between April 3 and June 30.

FIRST LOAN ROUND LEFT SMALL BUSINESSES STRANDED

The PPP program allowed businesses in many sectors to keep their workers employed even if they were shut down by the coronavirus.

Lendio and its partners tapped into the $350 billion in relief lending that Congress approved in early May, which went primarily to small businesses and small proprietorships.

When Congress approved the first round of PPP loans, its intention was to provide a life raft to businesses forced to close because of the coronavirus pandemic. Borrowers could receive up to 2.5 times their companies’ monthly payrolls, much of which would be forgiven if they keep their workers employed.

However, small businesses struggled to access the first round of PPP loans, totaling $349 billion, which lasted only two weeks and was gobbled up by relatively few businesses. For the second round, Congress earmarked $30 billion specifically for community banks so they wouldn’t have to compete with larger lenders.

The demand was certainly pressing. Lendio points out that prior to participating in the PPP, it had facilitated $2 billion in business loans since its inception in 2011.

The average PPP loan on the Lendio platform is $73,000, versus the national average of $107,000. During the PPP, 30% of the loans that Lendio facilitated went to businesses in urban areas, 28% in the suburbs, and 39% in rural communities. The Pacific and South Atlantic regions of the country accounted for 45% of Lendio’s PPP loans.

LENDIO FACILITATES $182 MILLION IN LOANS TO CONSTRUCTION BORROWERS

About 45% of the PPP loans that Lendio facilitated were to businesses in the Pacific and South Atlantic regions of the U.S.

Of the loans facilitated by Lendio, just under $181.7 million went to businesses in the construction industry, the highest total volume for any sector. Construction was followed by healthcare, restaurants, information media, manufacturing, and retail.

The average loan for construction borrowers was just under $100,000, which ranked fourth by sector, with manufacturing topping this list at $145,568 per loan average.

Lendio estimates that construction borrowers saved 17,500 jobs as a result of the PPP, behind restaurants (31,501 jobs saved), healthcare, and automotive.

ARE MORE LOANS IMMINENT?

Right now, Congress and the White House are debating whether more stimulus is needed, as the coronavirus continues to spread in several areas of the country, with nearly 3.1 confirmed cases of COVID-19 and 133,000 deaths in the U.S., and with hospitalizations rising in 22 states. Some states, cities and towns are reconsidering their plans for reopening their economies.

“Unfortunately, the challenges for small business owners do not end when they receive a PPP loan and great economic uncertainty remains,” writes Lendio. It notes that business owners are now navigating the loan forgiveness process, and others continue to seek financial assistance while operating on thin margins. “As demonstrated throughout the program to date, the need for relief funding is unprecedented and will likely continue as small business owners seek to reopen and rebuild in the coming months.”

Related Stories

| May 3, 2012

Rudolph and Sletten, Inc. wins CMAA award

Firm recognized for the renovation of Grossmont-Cuyamaca Community College’s Student Administrative & Griffin Student Center.

| May 2, 2012

Trimble acquires SketchUp 3D modeling platform

The transaction is expected to close in the second quarter of 2012.

| May 2, 2012

Building Team completes two additions at UCLA

New student housing buildings are part of UCLA’s Northwest Campus Student Housing In-Fill Project.

| May 2, 2012

Public housing can incorporate sustainable design

Sustainable design achievable without having to add significant cost; owner and residents reap benefits

| May 2, 2012

SMPS Foundation accepting applications for Garikes Scholarship

One outstanding scholar will be selected this year to receive a $1,500 scholarship award, to be used toward academic expenses, such as tuition and fees, books, supplies, and other similar expenses.

| May 2, 2012

Sasaki selected for 2012 National Planning Firm Award

The award recognizes a firm for its body of distinguished work influencing the planning profession.

| May 1, 2012

White paper discusses benefits of diaphragm and piston flushometer valves

The white paper highlights considerations that impact which type of technology is most appropriate for various restroom environments.

| May 1, 2012

Time-lapse video: World Trade Center, New York

One World Trade Center, being built at the site of the fallen twin towers, surpassed the Empire State Building on Monday as the tallest building in New York.

| May 1, 2012

Bruce E. Brooks Associates announces new commissioning subsidiary

Brooks + Wright Commissioning to be led by Will Wright.