Earlier this week the Small Business Administration and U.S. Treasury Department released a list of recipients from the government’s Paycheck Protection Program (PPP), which so far has allocated $521 billion of the $670 billion approved by Congress under the CARES Act to nearly 659,000 borrowers. The Trump Administration claims that this program has supported 51 million jobs, roughly 84% of whom work for small businesses.

At presstime, SBA hadn't released exactly how much each entity was approved to borrow. And some recipients—like retail and fast-food chains, millionaire rock bands, and a business venture led by NFL quarterback Tom Brady, who earned $23 million last year—have raised questions about the program’s purpose and vetting process.

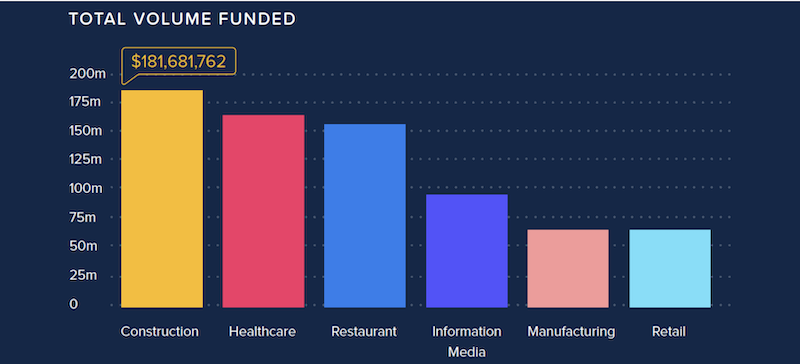

But according to Lendio, a small business marketplace, construction led all industries in total volume among the 100,000 PPP loans totaling $8 billion that Lendio facilitated in partnership with 300 lenders between April 3 and June 30.

FIRST LOAN ROUND LEFT SMALL BUSINESSES STRANDED

The PPP program allowed businesses in many sectors to keep their workers employed even if they were shut down by the coronavirus.

Lendio and its partners tapped into the $350 billion in relief lending that Congress approved in early May, which went primarily to small businesses and small proprietorships.

When Congress approved the first round of PPP loans, its intention was to provide a life raft to businesses forced to close because of the coronavirus pandemic. Borrowers could receive up to 2.5 times their companies’ monthly payrolls, much of which would be forgiven if they keep their workers employed.

However, small businesses struggled to access the first round of PPP loans, totaling $349 billion, which lasted only two weeks and was gobbled up by relatively few businesses. For the second round, Congress earmarked $30 billion specifically for community banks so they wouldn’t have to compete with larger lenders.

The demand was certainly pressing. Lendio points out that prior to participating in the PPP, it had facilitated $2 billion in business loans since its inception in 2011.

The average PPP loan on the Lendio platform is $73,000, versus the national average of $107,000. During the PPP, 30% of the loans that Lendio facilitated went to businesses in urban areas, 28% in the suburbs, and 39% in rural communities. The Pacific and South Atlantic regions of the country accounted for 45% of Lendio’s PPP loans.

LENDIO FACILITATES $182 MILLION IN LOANS TO CONSTRUCTION BORROWERS

About 45% of the PPP loans that Lendio facilitated were to businesses in the Pacific and South Atlantic regions of the U.S.

Of the loans facilitated by Lendio, just under $181.7 million went to businesses in the construction industry, the highest total volume for any sector. Construction was followed by healthcare, restaurants, information media, manufacturing, and retail.

The average loan for construction borrowers was just under $100,000, which ranked fourth by sector, with manufacturing topping this list at $145,568 per loan average.

Lendio estimates that construction borrowers saved 17,500 jobs as a result of the PPP, behind restaurants (31,501 jobs saved), healthcare, and automotive.

ARE MORE LOANS IMMINENT?

Right now, Congress and the White House are debating whether more stimulus is needed, as the coronavirus continues to spread in several areas of the country, with nearly 3.1 confirmed cases of COVID-19 and 133,000 deaths in the U.S., and with hospitalizations rising in 22 states. Some states, cities and towns are reconsidering their plans for reopening their economies.

“Unfortunately, the challenges for small business owners do not end when they receive a PPP loan and great economic uncertainty remains,” writes Lendio. It notes that business owners are now navigating the loan forgiveness process, and others continue to seek financial assistance while operating on thin margins. “As demonstrated throughout the program to date, the need for relief funding is unprecedented and will likely continue as small business owners seek to reopen and rebuild in the coming months.”

Related Stories

Green | Apr 26, 2022

Climate justice is the design challenge of our lives

As climate change accelerates, poor nations and disadvantaged communities are suffering the first and worst impacts.

Multifamily Housing | Apr 26, 2022

Fitness centers for multifamily housing: Advice from 'Dr. Fitness,' Karl Smith

In this episode for HorizonTV, Cortland's Karl Smith shares best practices for designing, siting, and operating fitness centers in apartment communities.

Mixed-Use | Apr 26, 2022

Downtown Phoenix to get hundreds of residential and student housing units

In fast-growing Phoenix, Arizona, a transit-oriented development called Central Station will sit adjacent to Arizona State University’s Downtown Phoenix campus.

Hotel Facilities | Apr 25, 2022

U.S. hotel construction pipeline up 2%, with 5,090 projects in the works

The total U.S. hotel construction pipeline stands at 5,090 projects and 606,302 rooms at the end of the first quarter of 2022, up 2% by projects, but down 3% by rooms, according to the Q1 2022 Construction Pipeline Trend Report for the United States from Lodging Econometrics (LE).

Codes and Standards | Apr 25, 2022

Supply chain constraints, shifting consumer demands adding cost pressures to office fit-outs

Cushman & Wakefield’s 2022 Americas Office Fit-Out Cost Guide found supply chain constraints and shifting consumer demands will continue to add pressure to costs, both in materials and labor.

Sports and Recreational Facilities | Apr 25, 2022

Iowa's Field of Dreams to get boutique hotel, new baseball fields

A decade ago, Go the Distance Baseball formed to preserve the Iowa farm site where the 1989 movie Field of Dreams was filmed.

Building Team | Apr 22, 2022

EarthCam Adds Senior Leadership Roles to Facilitate Rapid Growth

EarthCam today announced several new leadership positions as it scales up to accommodate increasing demand for its webcam technology and services.

Architects | Apr 22, 2022

Top 10 green building projects for 2022

The American Institute of Architects' Committee on the Environment (COTE) has announced its COTE Top Ten Awards for significant achievements in advancing climate action.

Mixed-Use | Apr 22, 2022

San Francisco replaces a waterfront parking lot with a new neighborhood

A parking lot on San Francisco’s waterfront is transforming into Mission Rock—a new neighborhood featuring rental units, offices, parks, open spaces, retail, and parking.

Legislation | Apr 21, 2022

NIMBYism in the Sunbelt stymies new apartment development

Population growth in Sunbelt metro areas is driving demand for new apartment development, but resistance is growing against these projects.