Related Stories

MFPRO+ New Projects | Jun 27, 2024

Chicago’s long-vacant Spire site will be home to a two-tower residential development

In downtown Chicago, the site of the planned Chicago Spire, at the confluence of Lake Michigan and the Chicago River, has sat vacant since construction ceased in the wake of the Great Recession. In the next few years, the site will be home to a new two-tower residential development, 400 Lake Shore.

Codes and Standards | Jun 27, 2024

Berkeley, Calif., voters will decide whether to tax large buildings with gas hookups

After a court struck down a first-in-the-nation ban on gas hookups in new buildings last year, voters in Berkeley, Calif., will have their say in November on a measure to tax large buildings that use natural gas.

Mass Timber | Jun 26, 2024

Oregon State University builds a first-of-its-kind mass timber research lab

In Corvallis, Oreg., the Jen-Hsun Huang and Lori Mills Huang Collaborative Innovation Complex at Oregon State University aims to achieve a distinction among the world’s experimental research labs: It will be the first all-mass-timber lab meeting rigorous vibration criteria (2000 micro-inches per second, or MIPS).

Sustainability | Jun 26, 2024

5 ways ESG can influence design and create opportunities

Gensler sustainability leaders Stacey Olson, Anthony Brower, and Audrey Handelman share five ways they're rethinking designing for ESG, using a science-based approach that can impact the ESG value chain.

Student Housing | Jun 25, 2024

P3 student housing project with 176 units slated for Purdue University Fort Wayne

A public/private partnership will fund a four-story, 213,000 sf apartment complex on Purdue University Fort Wayne’s (PFW’s) North Campus in Fort Wayne, Indiana. The P3 entity was formed exclusively for this property.

Sustainability | Jun 24, 2024

CBRE to use Climate X platform to help clients calculate climate-related risks

CBRE will use risk analysis platform Climate X to provide climate risk data to commercial renters and property owners. The agreement will help clients calculate climate-related risks and return on investments for retrofits or acquisitions that can boost resiliency.

MFPRO+ News | Jun 24, 2024

‘Yes in God’s Backyard’ movement could create more affordable housing

The so-called “Yes in God’s Backyard” (YIGBY) movement, where houses of worship convert their properties to housing, could help alleviate the serious housing crisis affecting many communities around the country.

Student Housing | Jun 20, 2024

How student housing developments are evolving to meet new expectations

The days of uninspired dorm rooms with little more than a bed and a communal bathroom down the hall are long gone. Students increasingly seek inclusive design, communities to enhance learning and living, and a focus on wellness that encompasses everything from meditation spaces to mental health resources.

Museums | Jun 20, 2024

Connecticut’s Bruce Museum more than doubles its size with a 42,000-sf, three-floor addition

In Greenwich, Conn., the Bruce Museum, a multidisciplinary institution highlighting art, science, and history, has undergone a campus revitalization and expansion that more than doubles the museum’s size. Designed by EskewDumezRipple and built by Turner Construction, the project includes a 42,000-sf, three-floor addition as well as a comprehensive renovation of the 32,500-sf museum, which was originally built as a private home in the mid-19th century and expanded in the early 1990s.

Building Technology | Jun 18, 2024

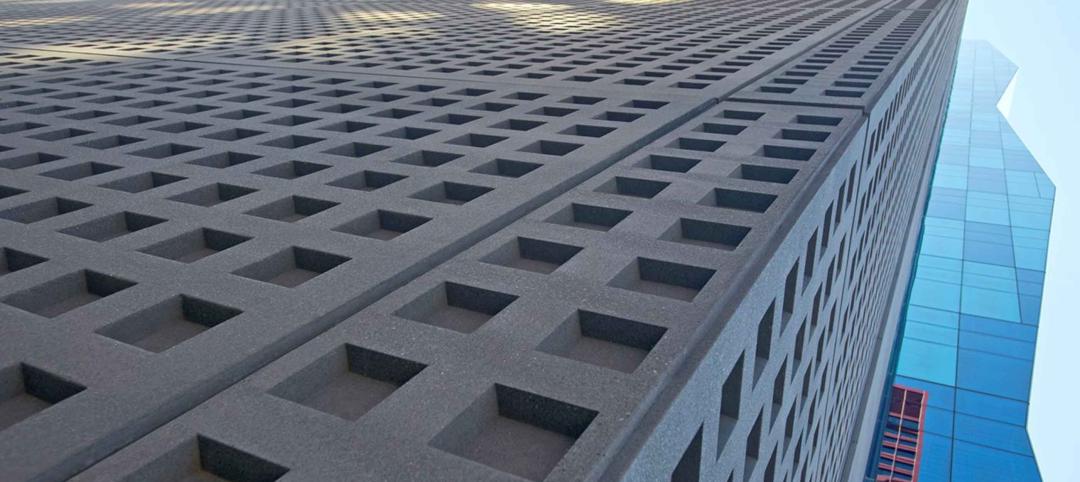

Could ‘smart’ building facades heat and cool buildings?

A promising research project looks at the possibilities for thermoelectric systems to thermally condition buildings, writes Mahsa Farid Mohajer, Sustainable Building Analyst with Stantec.