The commercial real estate development industry grew at the strongest pace since the economic recovery began in 2011, according to an annual report on the state of the industry released today by the NAIOP Research Foundation.

The report, entitled “The Economic Impacts of Commercial Real Estate,” determined that the economic impact realized by the development process rose a significant 24.06% over the previous year, the largest gain since the market began to recover in 2011.

Direct expenditures for 2013 totaled $124 billion, up from $100 billion the year before, and resulted in the following economic contributions to the U.S. economy:

- Total contribution to U.S. GDP reached $376.35 billion, up from $303.36 billion in 2012;

- Personal earnings (or wages and salaries paid) totaled $120.02 billion, up from $96.75 billion in 2012; and

- Jobs supported (a measure of both new and existing jobs) reached 2.81 million in 2013, up from 2.27 million the year before.

The report says that the outlook for the remainder of 2014 and into 2015 is that the figures will continue to rise, with year-over-year growth expected in the range of 8-15%.

Commercial real estate development has an immense ripple effect in the economy, providing wages and jobs that quickly roll over into increased consumer spending.

“Commercial development’s economic impact is tremendous; simply put, a healthy development industry is critical to a prosperous U.S. economy,” said Thomas J. Bisacquino, NAIOP president and CEO. “As the uneven pace of the nation's economic recovery continues, the industry seeks public policy certainty that bolsters investors’ and developers’ confidence. Despite this lack of assurance, we see positive indicators of a rebounding industry, but believe the industry could be more robust.”

Industrial, Warehousing, Office and Retail Show Strong Gains:

- Industrial development posted a year-over-year gain of 48.5 percent due mainly to groundbreaking of energy-processing facilities.

- Warehouse construction registered a third strong year of increased expenditures in 2013, gaining 38.1 percent in 2013. This is on top of 2012 growth of 28.4 percent and 2011 growth of 17.8 percent, showing a sustained increase in demand for warehousing space.

- Office construction expenditures rose for a second year in 2013, up 23.3 percent from 2012.

- Retail construction expenditures rose modestly for a third year in 2013, up 4.8 percent from 2012.

Operations and Maintenance Surge Even As Building Owners Cut Costs With Energy Efficiencies and New Technologies

Through increased energy efficiency and advanced technology, building owners cut the average per-square-foot cost of operating building space in the U.S. by 14 cents, from $3.20/square foot to $3.06/square foot. Still, maintaining and operating the existing 43.9 billion square feet of commercial real estate space resulted in $134.3 billion of direct expenditures, and resulted in the following economic contributions to the U.S economy:

- Total contribution to GDP in 2013 $370.9 billion;

- Personal earnings (wages and salaries) totaled $116.8 billion; and

- Jobs supported, 2.9 million.

Top 10 States by Construction Value for Office, Industrial, Warehouse and Retail:

1. Texas

2. Louisiana

3. New York

4. California

5. Iowa

6. Florida

7. Maryland

8. Georgia

9. West Virginia

10. Oregon

Four new states joined the list: Louisiana, Maryland, West Virginia, and Georgia. These states made the top ten list due predominantly to development of highly specialized and expensive energy-related processing facilities. Illinois, Ohio, Massachusetts, and North Carolina dropped off the top 10 list, slipping to Nos. 11, 14, 15 and 18 respectively.

The report includes detailed data on commercial real estate development activity in all 50 states, and also ranks the top 10 states specifically according to office, industrial, warehouse and retail categories.

The report is authored by Dr. Stephen S. Fuller, director of the Center for Regional Analysis at George Mason University, and funded by the NAIOP Research Foundation.

An executive summary and the full report is online: www.naiop.org/

Related Stories

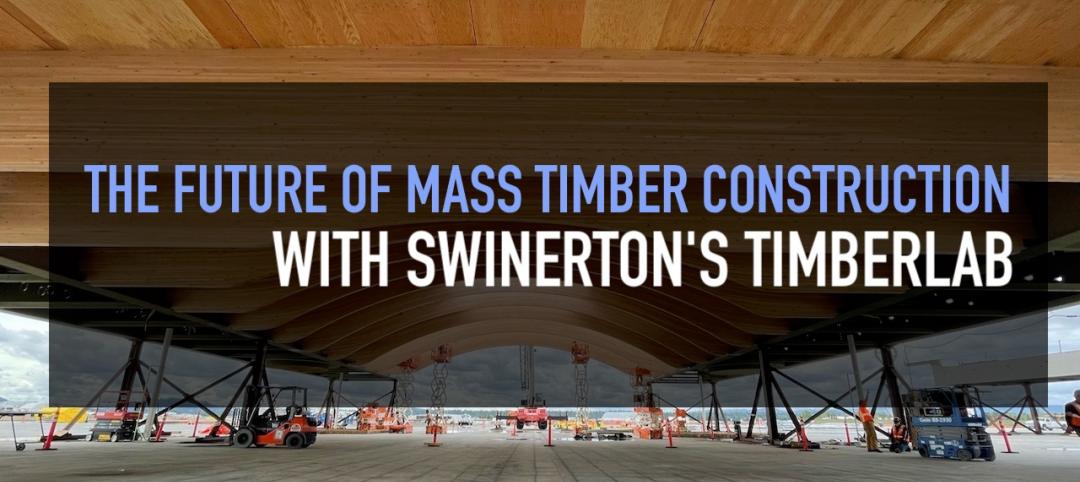

Wood | Jul 16, 2021

The future of mass timber construction, with Swinerton's Timberlab

In this exclusive for HorizonTV, BD+C's John Caulfield sat down with three Timberlab leaders to discuss the launch of the firm and what factors will lead to greater mass timber demand.

Multifamily Housing | Jul 15, 2021

Economic rebound leads to record increase in multifamily asking rents

Across the country, multifamily rents have skyrocketed. Year-over-year rents are up by double digits in nine of the top 30 markets, while national YoY rent growth is up 6.3%. Emerging from the pandemic, a perfect storm of migration, enhanced government stimulus and a hot housing market, among other factors, has enabled this extremely strong growth.

AEC Business Innovation | Jul 11, 2021

Staffing, office changes at SCB, SmithGroup, RKTB, Ryan Cos., Jacobsen, Boldt, and Adolfson & Peterson

AEC firms take strategic action as construction picks up steam with Covid openings.

K-12 Schools | Jul 9, 2021

LPA Architects' STEM high school post-occupancy evaluation

LPA Architects conducted a post-occupancy evaluation, or POE, of the eSTEM Academy, a new high school specializing in health/medical and design/engineering Career Technical Education, in Eastvale, Calif. The POE helped LPA, the Riverside County Office of Education, and the Corona-Norco Unified School District gain a better understanding of which design innovations—such as movable walls, flex furniture, collaborative spaces, indoor-outdoor activity areas, and a student union—enhanced the education program, and how well students and teachers used these innovations.

Multifamily Housing | Jul 7, 2021

Make sure to get your multifamily amenities mix right

One of the hardest decisions multifamily developers and their design teams have to make is what mix of amenities they’re going to put into each project. A lot of squiggly factors go into that decision: the type of community, the geographic market, local recreation preferences, climate/weather conditions, physical parameters, and of course the budget. The permutations are mind-boggling.

Industrial Facilities | Jul 2, 2021

A new approach to cold storage buildings

Cameron Trefry and Kate Lyle of Ware Malcomb talk about their firm's cold storage building prototype that is serving a market that is rapidly expanding across the supply chain.

Multifamily Housing | Jun 30, 2021

A post-pandemic ‘new normal’ for apartment buildings

Grimm + Parker’s vision foresees buildings with rentable offices and refrigerated package storage.

Architects | Jun 30, 2021

Perkins Eastman joins forces with MEIS

MEIS’ work on stadiums and entertainment centers spans the globe with state-of-the-art designs in the U.S., Europe, Asia, and the Middle East.

Architects | Jun 25, 2021

AIA announces Small Project Award recipients

Now in its 18th year, the AIA Small Project Awards program recognizes small-project practitioners for the high quality of their work.

Architects | Jun 24, 2021

Post-pandemic, architects need to advocate harder for project sustainability

An AIA-Oldcastle report looks closer at the coronavirus’s impact on design and construction